Attack the Week (ATW)

EU trade deal / Hedge-Fund-Like Trade Ideas & More

Sunday Thoughts

We are probably looking at another great trade deal announcement this weekend with Ursula von der Leyen travelling to Scotland to meet Trump. I doubt the lady would go there just to negotiate. After all, summer holidays are much more important. I am expecting an announcement to be made, probably with the already mentioned 15% overall tariff rate, including auto and agriculture.

Meanwhile, much focus is given to the current monetary juncture for the Fed. The parody around the multi-billion-dollar Eccles building refurbishment continues, while the immediate firing of Powell seems to have been put on the back burner. The FOMC is this coming week, and while nothing is priced, the press conference and overall communication could make some waves. I am expecting some dissent to the hold could grow louder with Bowman and Waller having already opined that they’d favour a July rate cut. This could further call into question the Fed's independence. Pressure is certainly mounting, although they were right not to overreact over the past few months by holding a steady ship.

SFRZ5 is sitting at levels where we started the year, with 44 bps priced until year-end.

Most of the pricing and rate cut expectations are for 2026, with the SFRZ6 future up around 75 bps since the beginning of the year.

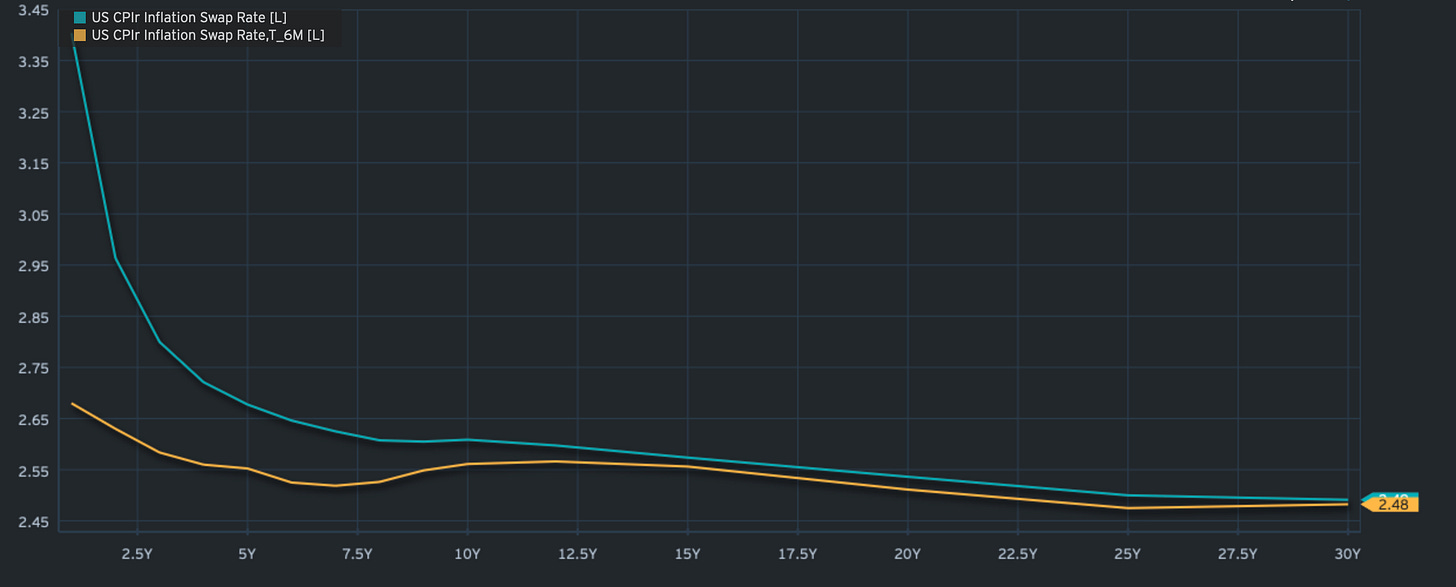

It is true that inflation expectations have recently increased, although much of it is tariff-related, as the chart below shows, where short-dated swaps are high, while longer-term expectations are basically where they were 6 months ago.

Tariffs are coming, and I explained in Friday’s Chart book how the simple economic accounting identities would indicate that growth will be negatively impacted. Read for details below.

I presented a trade idea that would benefit from a slowdown under such circumstances. This was the start of a new addition at Paper Alfa, where I’ll be sharing hedge fund-like trade ideas as part of a fictitious USD 100 million portfolio.

This will take you behind the curtain — into the mindset, structure, and risk management approach you'd see inside a professional macro setup.

Many of the details of a detailed investment process have been discussed in the Macro Book series, where I laid out several pieces going through the following elements.

Risk / Sizing (Article 1, Article 2, Article 3, Article 4)

Portfolio Construction (Article 1)

If you haven’t already, I would suggest you familiarise yourself with each of the above steps. In addition, I would also recommend people to re-read the options primer below (any educational post is free at Paper Alfa, cause that’s how I roll).

All this is in addition to the allocation model and tactical trading models, which are already fully integrated into what this place has to offer. Curious? Why not sign up for a free 7-day trial? Good Risk/Reward, without the risk.

Let’s now read some additional thoughts from Macro D on Stablecoins and where next for USD/JPY, before we scan the weekly macro calendar, check a few interesting chart setups, and update the weekly asset allocation model for its latest change and performance.

Have a great end to July!