Macroscope

Edition 2.0: Paper Alfa Allocation Model (PAAM)

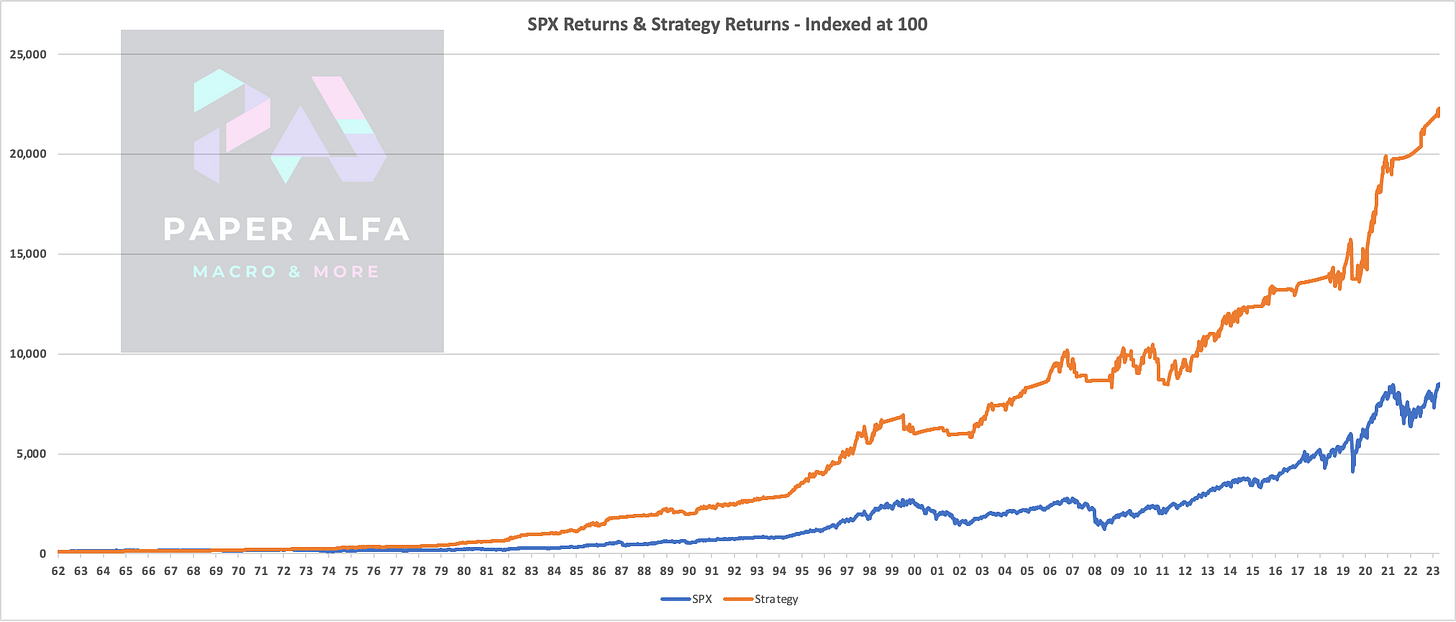

This is the second instalment of the Macroscope series. I will present an allocation model based on SPX and 10-year US Treasuries in the below section. As a quick refresher, edition 1 featured a liquidity model, which essentially provided entry and exit points for equities, in this case, the S&P 500. We analyzed weekly data going back to the early 1960s to test for robustness in varying macro regimes. As the long-term trend of equities for the observed period was overall up, a buy-and-hold strategy, of course, would have yielded the best results.

The most important thing for long-term compounding, however, is to avoid large drawdowns. And that’s exactly what this model was able to show.

Following a hypothesis of system liquidity flows (see chart below), I ran a market-based strategy, which gives us an indication of when either forward liquidity is ample or tight and what its impact is on equity prices.

The hypothesis I shared resulted in the following strategy output, with the orange line showcasing the strategy vs the blue line which is the SPX performance.

How is it possible, you ask? Simple. By side-stepping major market downturns. Again, easier said than done, right? The below drawdown profile, however, shows that the strategy exhibits less of a left-tail by limiting (so far) the max drawdown to roughly 20% rather than more than double that for a buy-and-hold strategy. Remember, compounding is powerful.

As a result, we can more than double the risk-adjusted return (Sharpe) of the strategy and at worst need to rebalance between cash and the SPX on a weekly basis.

Now, what if there is a bond & equity-based allocation strategy that gives you even better risk-adjusted returns? This is precisely what this new edition of Macroscope is trying to explore. By combining the above strategy with an active bond strategy, I stipulated the hypothesis of a stable and drawdown-oriented approach, which gives me confidence in participating in enough equity and bond upside but limiting drawdowns and maximizing my risk-adjusted return.

Before we go into the details, I have to stress that this is purely an educational run-through and is by no means intended to act as financial advice in any shape or form. Please conduct your own research. I might have made mistakes in my modelling and assumptions. Always seek professional financial advice before putting your hard-earned money to work.

So, without further ado, let’s dive straight into it. For all paying subscribers, I will update the output of this strategy on a weekly basis and include it in ATW (Attack the Week).

There are basically 2 simple levers:

Long SPX or T-Bills

Long 10-year Treasuries or T-Bills

So, we are either both long equities and bonds, just long T-Bills or long either bonds or equities at any given point on a weekly basis.

As for the analysis, we go back to 1977 given data availability, and run it weekly. That’s 48 years’ worth of data, which have shown to be profitable in 45 years on a calendar year basis. I am assuming no transaction costs and as our signals are provided on Fridays after close, I am also not taking weekend price slippage into consideration.

Some of the highlights of the strategy are:

Annualized Return: 8.38%

Sharpe Ratio: 1.78

Max Drawdown: -5.91%

Best Year: +36.57% (1982)

Worst Year: -2.22% (2011)

If you are just a free subscriber, I would urge you to join the pack as prices will be adjusted higher soon. This is a fun and educational place, where broader macro concepts are clearly laid out to you. Educational pieces are for free, which will always be the case. In-detail chart set-ups (weekly) and thought pieces are charged at reasonable rates to compensate for my time and energy running this place.

In addition, I have my loyal friend Macro D at hand, who is providing thought-provoking Macro ideas and observations on a regular basis. We are doing well, given the success and steady reader growth we’ve been experiencing. I don’t like to blow my own trumpet too much as I believe a good product to be selling itself. Hopefully, you are here and reading this because someone somewhere recommended that you do so. So why wait?