Friday Chart Book

Tariff Math / Trade for a Slowdown / ECB & Japan

It’s all good news these days. Tariff “deals” are coming in, Japan is already done, and the FT is running a story that Europe is about to agree to a 15% rate, which is half of what was previously discussed in Trump’s copy/paste letters. First of all, there is very little substance to those agreements. A “pledge” doesn’t mean much in any line of business. Second, details matter. Europe appears to be aiming for a 15% overall figure in negotiations, similar to Japan, which seems to be a bit ambitious given the President was previously hardly comfortable with 17.5%.

Regardless of this micro, the macro picture seems somewhat misunderstood.

Tariffs are essentially taxes imposed by governments on imported goods and services. When the U.S. government places a 15-20% tariff on imports, the cost is not simply absorbed by foreign suppliers — it's typically passed on to American companies importing those goods and, ultimately, to consumers purchasing them. This means that both U.S. businesses and households bear the weight of tariffs in the form of higher input costs or retail prices.

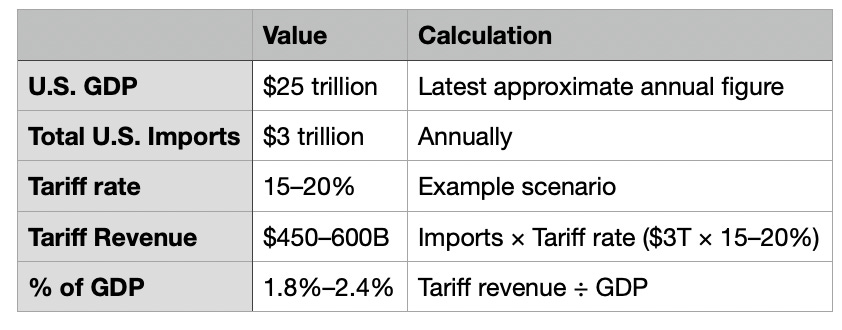

Here are some numbers to work with:

At a 15–20% tariff rate on all imports, the direct annual cost to the U.S. economy would be USD 450 – 600 billion, equating to about 1.8–2.4% of GDP. That’s a big figure.

A quick look at sectoral balances within the national accounting identity links income and spending across sectors as follows:

(I–S) + (G–T) + (X–M) = 0

I–S: Private sector investment minus savings

G–T: Government spending minus taxes (the budget deficit)

X–M: Exports minus imports (the trade balance)

Therefore, by raising the cost of imports, it tends to decrease imports, which raises (X–M). When (X–M) increases (the trade deficit narrows or a surplus grows), the accounting identity requires that the sum of the other sectors moves in the opposite direction to maintain balance.

Therefore, if (X–M) increases due to tariffs, at least one of the following must occur (assuming no other changes):

The government must spend less or tax more

(G−T) must decrease (budget deficit shrinks)Private investment must decrease, or private savings must increase

(I−S) must decrease (either through less investment or more savings)

Nothing in a complex system works in isolation. This sectoral approach does not account for the interactions and reflexive loops within the system. A levered economy within a credit cycle can extend the growth impulse but not alter reality. I think markets are solely focused on the inflationary dynamics for now. There is an opportunity in anticipating the market switching to growth worries. See my trade idea below.

Paper Alfa’s buy-and-hold 2025 portfolio is now up 15% YTD. No trading, just holding and a bit of good diversification.

I know some of my readers are more active and are looking for more trading opportunities. Macro D is kindly sharing his macro FX process, and his trades are presented in the “Trade Corner” publication. See the one from this week below.

I will start publishing my trade thoughts, structured in either options or delta one space. This will be through FX, Rates, and Equity Index positions, in addition to my asset allocation model and general beta thoughts. It’s what I would trade in a professional setup. You will find one of my trade ideas behind the paywall further below.

In addition, a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

If you are interested in exploring Paper Alfa’s full package, subscribe below.

Let’s now look at a trade idea, read some of Macro D’s latest thoughts on the ECB and Japan, before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

Enjoy a fantastic weekend!