When to Buy Bonds 5

Are we finally there?

Here we go again. With bonds pretty much range-bound at post-GFC highs in yield, I thought it would be great to think about when it might be good to ask the above question again.

I started the “When to Buy Bonds” series back in December 2022, when the US 10-year yield was trading with a 3-handle. Clearly, back then, the answer wasn’t a resounding “NOW!” but what has changed to give us more clues as to whether the ultimate buying opportunity is finally approaching?

As a refresher, here are the previous four instalments:

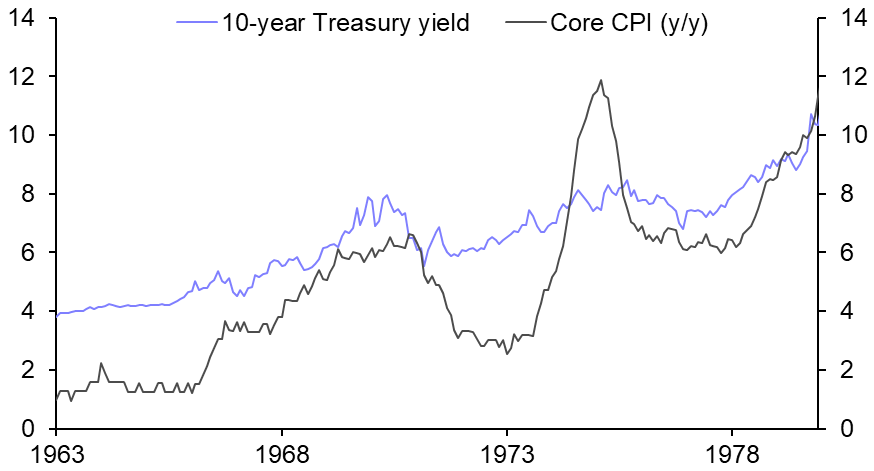

Looking at history, the US 10-year yield typically peaks ahead of the final rate hike and has only peaked afterwards in the early 80s and before. Naturally, that makes sense as we were in higher volatility and velocity inflationary regimes.

We are certainly in unusual waters in this cycle, where yields peaked after what we think is the final rate hike in the middle of last year (see chart below). This is indicative of an atypical cycle, which makes sense in the context of the different inflation regimes we find ourselves in compared to the last few decades.

The interesting bit, and relevant to today’s environment, is that in the '70s and '80s, the late peaking of the 10-year yield coincided with core inflation rising for some time after the tightening cycles concluded. You can see how today’s nervousness around sticky inflation is precisely following this script, although we have seen a more pronounced fall in core inflation readings in the current episode.

That’s, however, just one aspect of the story. The overall bond market and macro backdrop at this cycle's end are different from previous occurrences.

Let’s explore.