When to Buy Bonds 4

A Few Things to Consider

This is the fourth instalment of the series. You can find them all in the freely accessible educational section of Paper Alfa. You can easily conclude that bonds haven’t been a buy yet, given that I have written a fourth post on the same subject since late last year.

I have also given subscribers two very solid bond allocation models, which have been stellar performers over the past decades and over the recent years as they exclusively allocated to cash (T-Bills) during the most recent period. Unsurprisingly, they are still in cash for the time being.

This is another exploration into the elements I mentioned in the previous 3 instalments and ponders again the question of when it is time to buy bonds. Recession incoming? Yes, that might be the case, but how confident are we that our monetary operators will appropriately ease policy? I am not overly hopeful. Their reaction function is clearly lagging, and once again, I would see their policy stance as more hindrance than beneficial for asset market returns going forward. In the Macro Book series, we have explored the dynamics of finding a dominant trade for a given thesis. The recent performance of Gold relative to Treasuries should give anyone pause for thought.

Maybe Gold is the dominant trade, although its market breadth and depth are incomparable to Treasuries.

Below will be a collection of a few charts and thoughts which will hopefully give you enough information to answer the question of whether it is time or not for yourself. As always, it’s up to anyone’s personal circumstances, time horizons and portfolio composition to consider it. So, let’s explore some facts.

The chart below shows a long history of previous Fed tightening cycles (grey-shaded areas), indicating that yields (10-year, blue) usually peak at the end of the rate hiking cycle. So, if you are convinced we are there, the chart should give you enough clues to ponder.

As usual, the recent carnage in bond markets has also left quite a bad sentiment, which needs exploring. Bad or good sentiment readings are usually good reversal indicators. Below is a Treasury bond futures sentiment, which is currently in excessive pessimism territory (orange line), which is unsurprising. History since 1984 would indicate that such a negative reading usually gives you an almost 5% return for the coming 12 months. Don’t get overly excited, however, as you can get the same return and more on 1-year Treasuries risk-free.

Most economists are struggling with their models to explain why the fast tightening process hasn’t left a mark on economic momentum yet. Monetary policy obviously works with massive lags, and I have given my thoughts as to why this peculiar occurrence might be different to previous cycles, as we had unprecedented rounds of QE, which is still in the system.

The chart below shows global manufacturing PMIs in blue, overlaid with the % of global central banks that are in easing mode. There is a strong correlation at times, but I would also focus on the 2004-2007 period when growth was relatively strong despite a general monetary tightening environment. We, of course, now know how this ended, but it’s still important to remember.

The fiscal side of things is what caused the recent re-steeping of the yield curve amid a higher-than-anticipated wall of supply coming to our shores. Fiscal thrust is still in full force, which is obviously supporting growth running 12 months ahead of an important US presidential election

This, however, should diminish its impact going into 2024, according to current estimates, although an election year could be still expansionary for obvious reasons.

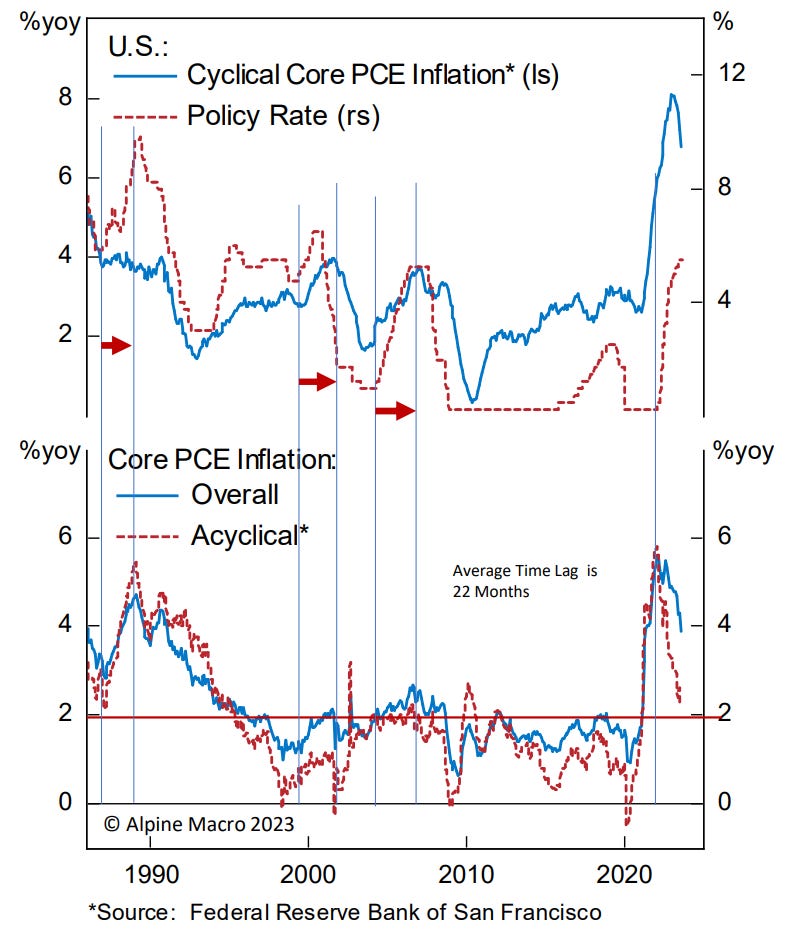

As we know, inflation is on a downward trajectory but still very sticky for the bond market’s liking. The chart below shows the YoY % change in the policy rate and core inflation. According to this research, a policy lag of 22 months is the average, typical timeframe for a tightening policy to be in place to return inflation to 2%. This would mean the end of this year.

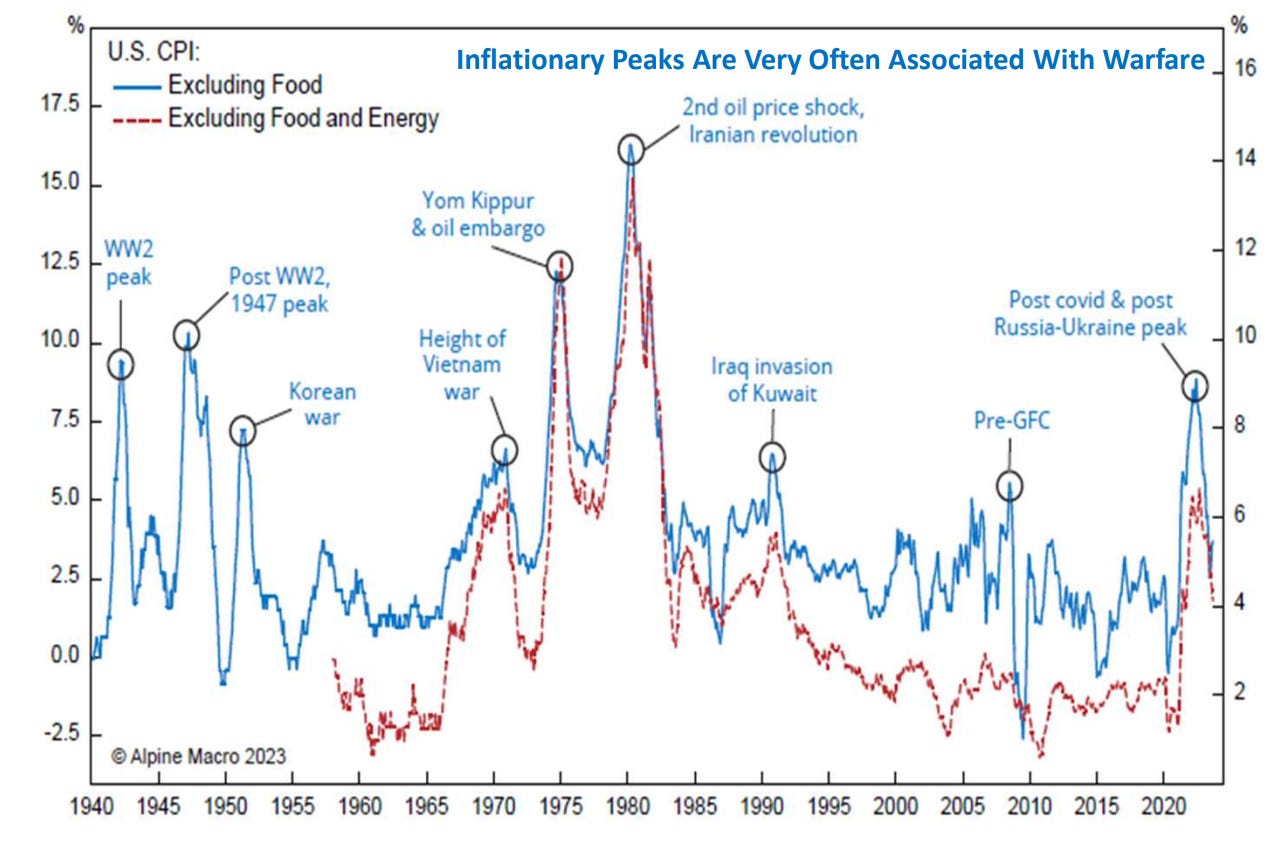

Wars, while abhorrent in every way, also leave a bad taste on inflationary impulses. This complicates the picture for inflation and, hence, monetary policy reaction functions going forward. If there is a glimmer of hope is that they also tend to coincide with inflationary peaks.

The conclusion, my dear reader, has to be done by you. I gave you enough information in this and the previous articles, which should give you enough food for thought.

In simple terms, we can look at various components highlighted above to form an opinion, i.e.:

What are the bond allocation models telling us?

What is sentiment, and how has it impacted forward-looking returns?

Are we at the end of the tightening cycle?

The lags of monetary policy are unknown, but we can monitor a variety of forward-looking indicators. I gave you enough indicators to consider in my “En Route to Recession” post.

Fiscal impulse still supports growth but will likely diminish into next year, although it’s an election year.

Inflation is still on a downward trajectory but is sticky. How long until we reach the target?

I hope you found enough information to form a view. For subscribers, there is more detail at hand, so consider becoming a full subscriber with all the benefits that come with it.

Best of Luck out there!

Thanks. Helpful overview for sure. My conclusion, for whatever it’s worth, is that it’s still too early for me to allocate anything to bonds.

So my question is, how correlated are the REITs to something like the five-year notes or the 10 year bonds?

Since I’m 65, and for the first time in my life, have begun a very slow DCA process into a couple of higher quality Reits that have excellent balance sheets and are not exposed to the Office sector. REITS are obviously down significantly and some of these high qualitys are now yielding more than any of the Treasuries.

Reading your post is giving me pause for thought about possibly pausing my process.

Any thoughts or suggestions would be appreciated.

Thank you for taking the time to answer my complex question. It's always good to read different thoughts; otherwise, there's a risk of waking up in an echo chamber where you only hear what you want to hear. I read your articles, but I have to admit that I don't understand everything. That's not because of you, but more due to the fact that my knowledge of macroeconomics is limited. The reason for my question is simple: I'm holding a larger short position on the DAX. :-)) Best regards, Daniel