Friday Comments / Market Update

April 11, 2025

A very good morning to all my existing and new subscribers. Seems my macro blueprint framework has brought many new people to the pack, and I am grateful for that. Remember to recommend my work to others, as I don’t do any marketing. A good product sells itself, so a bit of word of mouth would be much appreciated. Thank you.

With that, let’s jump straight into the market sphere, where astonishing developments are taking place. Two decades of experience, but there are still things that I haven’t seen in that time. The US Treasury bond market being decimated being one of them. This is not a taper tantrum or any other of the episodes which our risk officers have in their stress test book. This is an outright new test to the biggest financial market in the world.

As James Carville famously said, “I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now, I would want to come back as the bond market. You can intimidate everybody.”

And intimidating it is. What’s going on? Since Monday morning, the tide has turned, and US Treasuries have been taken to the woodshed. We have basically seen a 50 bps turnaround, causing havoc for people holding “balanced” portfolios or loaded up on “safe” Treasuries to offset the risk in their equity books. Whack! These are crazy times when Bitcoin outperforms US treasuries on a risk-off event!

Not only was the de-correlation causing havoc, but suddenly equity margin calls came knocking, and people were forced to liquidate bonds to pay the bills. Normally, that is not a problem, but not when pretty significant amounts have to be accounted for while the collateral value of your bond holdings goes down.

Much has been written about the bond basis and related hedge funds being responsible for what is occurring. I think that’s a bit off the mark. The confusion around the bond basis trade stems from its dramatic unwind during the March 2020 crisis, which has led to it being blamed for any unusual market movements since then. The basis trade, while large, is fundamentally limited in risk due to the futures delivery mechanism. Real money investors prefer yield from spread products over off-the-run Treasuries, using futures to manage duration risk. Hedge funds take the opposite side by selling futures and buying cash Treasuries, often choosing the Cheapest-To-Deliver (CTD) or similar alternatives. These positions are exited either by rolling futures contracts or by delivering the CTD at expiry, capping losses at a basis of zero if held to delivery. The current market volatility appears driven more by strained dealer balance sheets and margin-driven selling than by problems in the basis trade itself. Also, read my free educational pieces on the subject below if you are unfamiliar with it.

There is also speculation that this is a flight out of US treasuries by reserve holders, mostly China. I don’t know about that. This week’s auctions, especially the 10 and 30-year ones, went rather smoothly, with strong foreign participation. What’s more concerning is the rapid rise in real yields, which also suggests liquidity constraints in the system as well as capital shortfall. This all happens while the USD is relentlessly sold - a typical emerging market phenomenon. If that is really at work, real yields would need to rise substantially higher to attract capital and stabilise the Dollar. Ironically, in that scenario, the Fed’s hands would be tied as they wouldn’t be able to cut rates aggressively as it would send real yields and the long-end term premium much higher.

Curves are steepening aggressively, but this is still rather small compared to longer history frames. Below is the US 2-30s yield curve and a term premium proxy. If there are fiscal and stagflationary worries building, there is still a long way to go.

What can the Fed do? If this continues, they will have to step in and provide liquidity and relief to dealers to hold treasuries and fund their positions. I think that move is imminent (I’m writing this on Friday morning, London time). Their job is to ensure the functioning of the biggest financial market in the world, so they can’t sit on their hands, even if most moves are politically induced. Powell and Co should be on top of this.

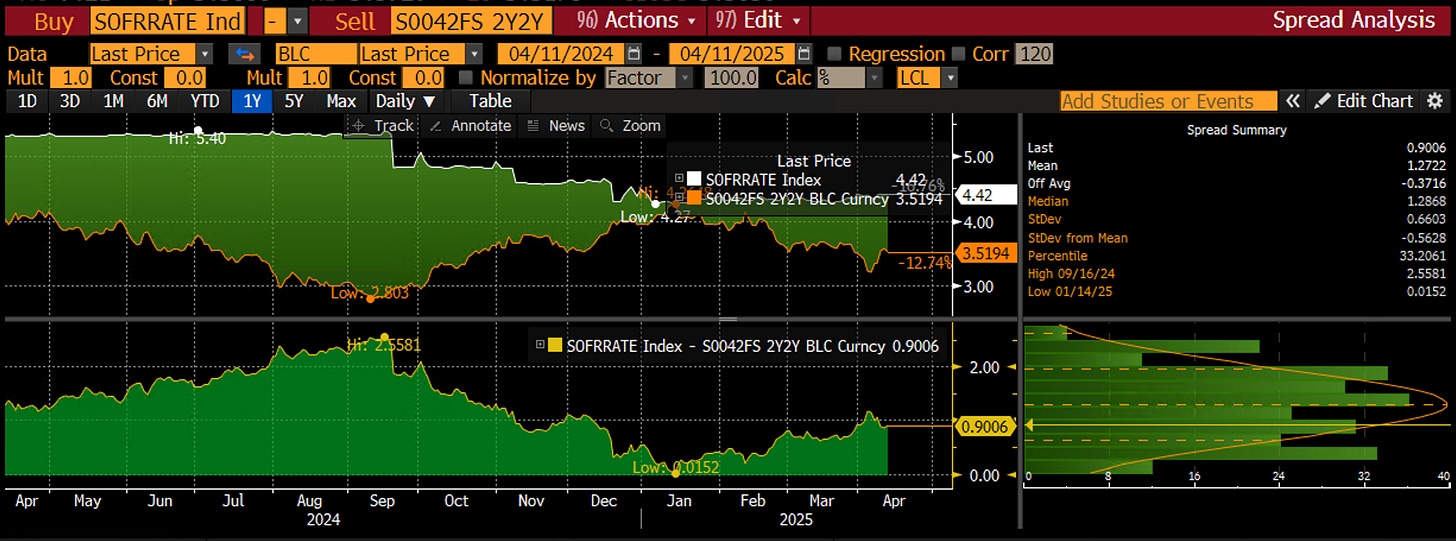

What about Fed cuts? That is the biggest question in town. Can they really go in circumstances where they won’t see the growth and inflation impact properly over the coming months, given all this volatility? Unsurprisingly, front-ends are not moving aggressively as the uncertainty is still too high to ascertain a proper monetary reaction function. 2y2y ois (terminal) vs SOFR ois is currently around 90 bps, which is in line with that’s priced for this year.

That is not outlandish and puts in a higher probability for a near-term reaction function into play rather than something that might come in 2026. This is also evidenced by the relatively stable SOFR Z5 - Z6 spread.

You know from my macro framework what I think about yield curves and the USD, and I have been nailing this move so far, although I certainly didn’t anticipate this sell-off in rates. I stare at the US 2-year and think, what gives? Why are we trading here? That’s the “safest” part of the curve, yet it trades at levels I wouldn’t expect, given everything that’s happening.

My mind keeps circling between what I know from experience and what is possible but not yet priced. There are questions like the following: Is the Fed not cutting at all? Sure, more capital flight accelerating, causing crowded front-end trades to be whacked? The positioning is certainly there, so do I want to add to a crowded trade? What if, in EM-style, the Fed is forced to hike to retain credibility and calm down the long-end? What if Trump fires Powell, and we go to even crazier levels? What if Trump wants to default on foreign treasury holdings? These are all small probability events in my book, but they are possible, given how fast things have moved. For these things, I would only engage in taking long front-end positions through options. Sure, they ain’t cheap, but I want to protect myself against unforeseen multi-sigma moves. I am looking at trade I like, which I will show behind the paywall.

As I opined in the Mid-Week Update, I was looking for a bounce in equities. Things were oversold, and my reversal model was flashing. I did a call spread on ES, expiring at the end of April 5300/5400, and it more than doubled. Annoyingly, I didn’t put enough risk on it, and given the move, the call spread was the wrong choice as, once in the money, I was short gamma at that point. Lesson learned. Crypto and Equities are trading well this morning, alongside a better bid in long-dated US Treasuries. The market is sniffing out or speculating that some intervention is coming in.

The models have been doing an incredible job, but even they are not equipped to do well in a whipsawing market. Be nimble, don’t panic, and run risk with reduced measures in these times. You can get taken out just by volatility swings themselves. Never go all-in on trades and stick to what you know or think you know. Keep an open mind, as this is a politically driven market. As you know, anything can change in politics, as we saw on Wednesday. And never ever underestimate the willingness of finance to save itself.

You can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now go into more detail and read what Macro D has to say. As this market requires my immediate attention and thoughts in your inboxes, I am leaving the charts for the weekend as I did last week. They will all speak for themselves, and it’s better to release them all with Friday’s closes, so expect them at some point on Saturday. Stay safe out there!