Reflections for the Year Ahead

The past is a closed book and the future is an unwritten page

I hope you celebrated a wonderful Christmas with your friends and loved ones. I personally had a quiet time, spending quality time with the family away from screens, although I had to marvel at the Silver ramp around Christmas. You can’t avoid markets entirely after all.

While the last few days of performance are trickling in, I am, as usual, reflecting on the year just gone by. And what a year it was. Once again, we are in positive territory across most asset classes as year-end approaches, which masks the volatility we experienced at key points during the year.

I entered 2025 with an open mind, yet a firm view on how the year could unfold as I set sail with the 2025 allocation, which I didn’t touch once during the year. We are closing around +24% on this buy-and-hold strategy, which I hope subscribers have benefited from. Much focus was spent on tariffs and their likely impact. Remember that the consensus on the effect would be a USD-positive story, which would counteract the macro forces from rising import costs, as in previous episodes. That turned out to be completely wrong as the USD depreciated.

In fact, according to Bloomberg, the USD didn’t appreciate against any currency this year on a total return basis, not even against the Yen. The best performer was the Ruble, which I bet you wouldn’t have guessed.

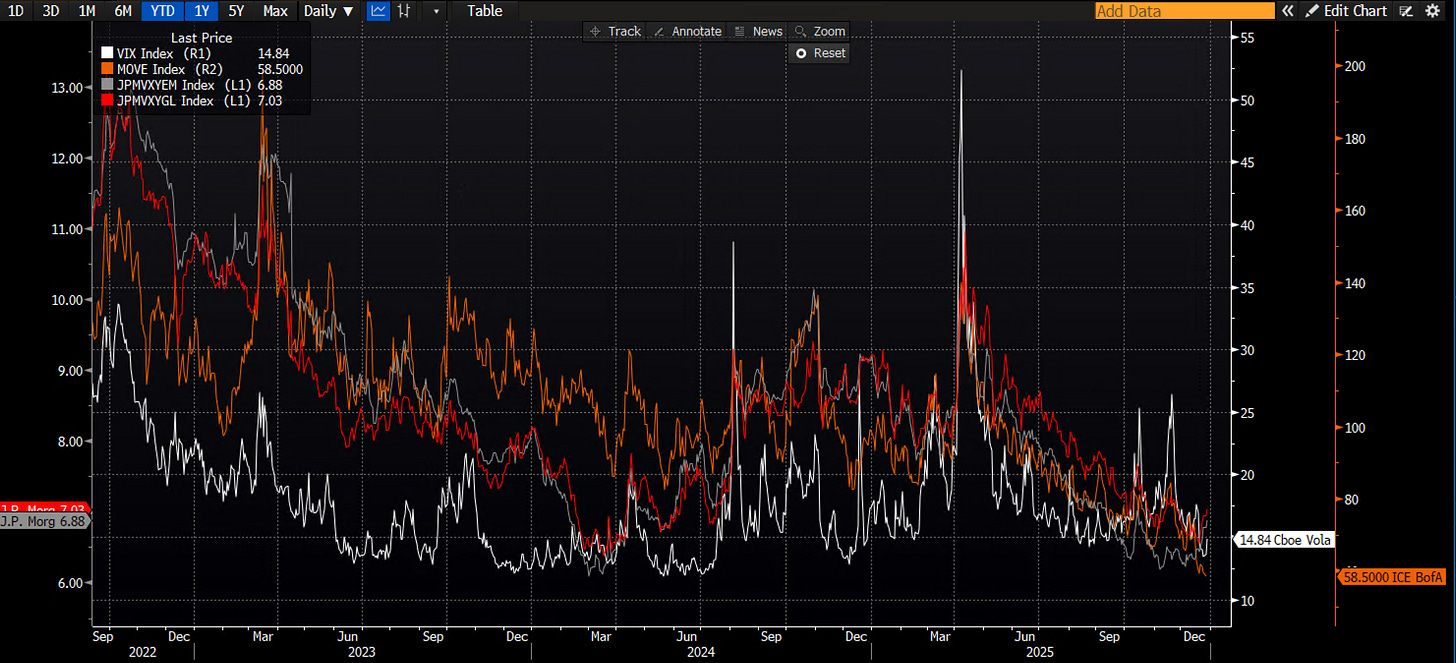

The most frustrating aspect of the year was how bonds performed, given that they are at the very pulse of macro. Correlations to equities often flipped in short order during the year, making portfolio construction more challenging to manoeuvre. This was particularly evident during the high-volatility period in April, when equities, bonds, and the USD started selling off in tandem.

Monetary policy impulses waned as the year progressed, as uncertainty around data, inflation forecasts, and uneven wealth distribution paralysed rather than provided a clear policy framework. This, I am pretty confident, won’t change in 2026 either.

Hindsight, as is always the case, is such a luxury, yet many might forget that April was the month of survival for many in a professional capacity.

A successful trading year usually comes down to survival and reacting with force and conviction in those moments that matter. This year was no different in this regard. The last two-thirds of the year were bliss for pretty much any strategy aside from crypto. That doesn’t take much skill.

Overall, all my strategies posted positive returns for the year. I am particularly proud of having performed well in April in my levered book, reacting to the correlation turns as they unfolded. I can tell you that even more than 2 decades of experience, the week after “liberation day” offered a new learning experience, and I am glad I was there to trade in those markets.

Politics, of course, entered the trading rooms with full force this year, and this isn’t going to change anytime soon. While this force was always looming in the background, it very much became a staple in every macro manager’s arsenal. The unpredictability of it all made it frustrating, but markets and participants became accustomed to the nature of the beast as the year progressed. Nothing seems to be shocking us anymore.

The Socio-economic-political sphere is going to be the hardest to navigate. The very fabric of those dimensions is being stretched beyond what we have witnessed before. This is leading to many fundamental questions that remain unanswered. We saw flare-ups during the year as narratives were building. This is a different level of macro altogether, as it encompasses the very foundations of it all. What is a safe asset in this context? What are the true constraints of our monetary system? These questions are so profound that, when I think through various scenarios, such as a wealth-effect-driven recession, I start to visualise not only the trade itself, which is easier to envisage, but also what the trade is after that. That, my friends, will be the bigger question to answer.

Beneath all of this sits the psychology of our time, and it feels increasingly fragile. Money has become not just a means or a scorecard, but the moral high ground itself — the ultimate arbiter of worth, success, and even virtue. The uneven distribution toward capital remains firmly entrenched, while labour, once the social counterweight, grows ever more demoralised and disempowered. For many, the social contract no longer feels functional. Wages lag, costs compound, and the promise that effort alone leads to a good life rings hollow. It is therefore hardly surprising that a growing number see speculation as the only perceived escape route — taking on more risk not out of greed, but out of necessity, in the hope of securing a future that traditional paths no longer seem able to provide.

This is, of course, a dangerous equilibrium and a recipe for instability, yet I struggle to ignore the logic that for many it feels like the only play left in town. At the same time, corruption has moved from the shadows into plain sight. What was once dismissed as something that happened “over there” is now visible everywhere, and few are genuinely shocked anymore by the brazen abuse of systems as individuals and institutions enrich themselves in broad daylight. The erosion here is not just financial, but moral — and markets, as always, are merely reflecting the deeper fractures beneath the surface.

It is precisely against this backdrop that Paper Alfa exists and will continue to evolve. The task ahead is not to predict every twist and turn, but to disentangle signal from noise in a world that has become increasingly distorted — financially, politically, and socially.

“If the backdrop has changed this profoundly, then the way we prepare must change with it.”

As we prepare for 2026, the most valuable realisation may be that both attention and time are finite resources. In a world saturated with information, progress will come not from consuming more inputs, but from choosing fewer and sharpening conviction where it truly matters. This is the moment to refine the process — on both sides of the equation — not only how risk is taken, but how it is managed when regimes shift, and correlations break. Consensus will always be visible and often comfortable, and at times it may even be right, but genuine edge is rarely found there. It is extracted through second-level thinking, disciplined preparation, and a willingness to engage with multiple scenarios before they unfold. Continue learning relentlessly, not just to compound returns, but to compound your own framework and belief system. Patience, when curated deliberately, becomes a strategic advantage — and clarity, above all else, remains the rarest asset.

As we move into another year, my commitment remains unchanged: to think independently, challenge consensus, and frame markets within the broader forces that truly drive them, rather than the daily distractions that so often dominate attention. As usual, I will be guided by my asset allocation and technical models as a framework for what is likely to unfold. I am excited about what is coming, and so should you.

If you are interested in what this place is offering, consider becoming a subscriber. What’s on offer, you ask? You will get my and my friend Macro D's flagship weekly and ad hoc thoughts on markets, as well as outputs from all my models and chart updates, which encompass the entire global macro universe (250+ securities).

We have published 175 pieces this year alone. While our thoughts remain mostly behind the paywall, we occasionally publish educational content, which has been and always will be free. If you are looking for a closer interaction, the founding member option enables you to have periodic calls with me.

I am deeply grateful for the trust, engagement, and loyalty of my subscribers, many of whom have been part of this journey for years. Your support allows this work to remain focused, thoughtful, and uncompromised — and for that, I thank you sincerely as we step into the year ahead together.

I am wishing you all a tremendously successful and healthy year ahead. May you become wiser and a better version of yourself, far beyond what you have ever imagined.

I will publish my 2026 buy-and-hold portfolio in the coming days and update the latest outputs of the asset allocation model.

As we look ahead to the new year, below are a few key events to mark on your calendars.

Q1:

Ukraine peace talks continue or fail

January:

ACA healthcare subsidies expire (1st)

Chinese government imposes licensing for silver exports (1st)

Supreme Court begins Fed’s Cook hearing (21st)

Fed governor Miran’s temporary term ends (31st)

Supreme Court decision regarding the legality of tariffs

President Trump makes his pick for new Fed chair (probably in January)

February:

EU parliament to vote on EU/US trade deal

Thai parliamentary elections (8th)

Munich Security Conference (13th)

March:

UK’s OBR spring forecasts (3rd)

China 15th 5-year plan (5th)

April:

Brazilian election candidates must resign from positions (2nd)

May:

UK local elections (7th)

August:

Fed’s Jackson Hole conference (likely 20th)

October:

Brazilian elections (4th)

November:

US mid-terms (3rd)