Mid-Week Update

Nothing but Boredom?

There seems to be little going on, as I can tell from the number of broker trade ideas I am receiving. It’s all about carry for the summer and structuring short volatility trades. That’s not my cup of tea, although I can perfectly see the rationale. These quieter times are not meant for one to be disengaged, much to the contrary. This is the perfect time to study, sharpen your mind and prepare for what’s to come.

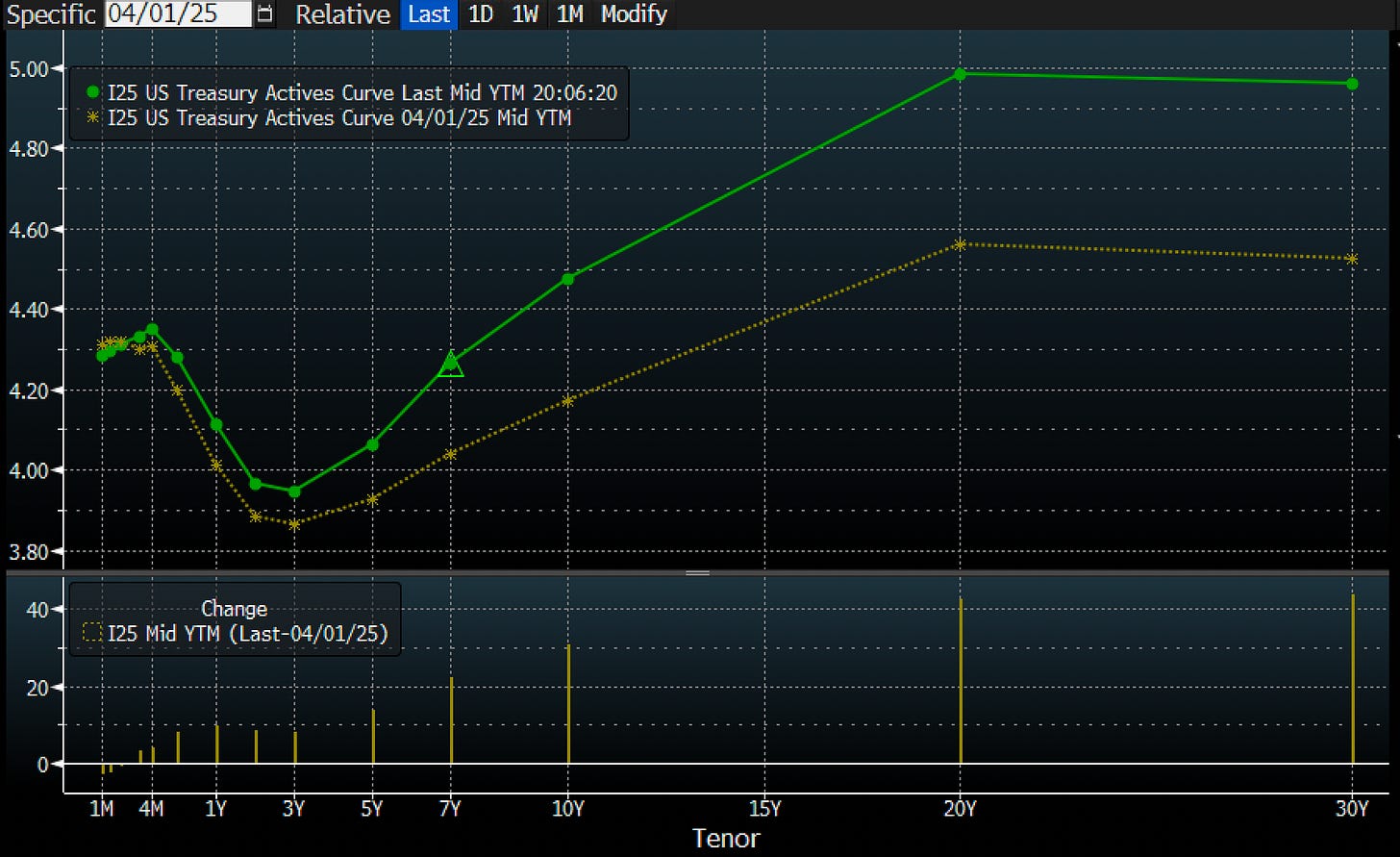

I am mapping various scenarios, although I am still firmly holding onto my macro roadmap, which I laid out a few months back, but have added a few nuances. Most notably, I am now firmly focused on how markets might price in the upcoming bill and the fiscal impetus it might give. The US yield curve has steepened markedly since “liberation day”, with the 30-year yield jumping more than 40 bps over that horizon.

A lacklustre JGB auction did little to help the overall steepening trend, which has sent 30-year Japanese government bond yields to their highest level in this millennium.

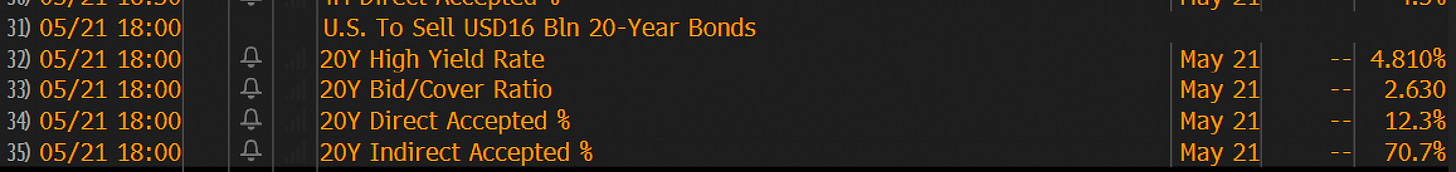

Wednesday’s US 20-year auction will have the markets trade nervously into the event. With all the fanfare and worry, I wouldn’t be surprised if this auction clears well.

The real question is, when does the 30-year yield become a problem? Mortgage rates are already close to 7%. Will housing activity massively slow down at 7.5%? I doubt it. I was reading a few commentaries where strategists were thinking that Bessent and co could get vocal or even threaten buy-backs or twist operations to support the long end if it were to reach 5.25%. I would think that such an action would be rather premature. I’d think 6% would cause headaches all around.

Until then, let’s wait, see and have a bit of a laugh.

Let’s now dig into some interesting FX thoughts from Macro D and some updated charts.