Mid-Week Update

June 26, 2024

The market takes no prisoners. We are gyrating in the midst of a regime flux, mixing reflationary themes with those of stagflation and expansionary hope. Those environments are never easy to navigate as we must wait for clues to give us directions. While the models have guided us very well in anticipating broader moves, the chop and churn environment is here to reflect and prepare for the next phase to unfold. We are ready at Paper Alfa.

I hope you read ATW’s Trade Corner piece dissecting some AUD crosses. Macro D gives a deep analysis of why he thinks those trades work. He seems to have nailed the move, as an August RBA rate hike is now firmly back on the table after an upside surprise in May headline inflation and sticky services. Markets are pricing a 50% chance of hikes for the next two meetings.

Upcoming French and UK elections are keeping markets and pundits busy. Please see my comment in my ATW Sunday thoughts. Political markets are notoriously difficult, and the markets usually get them very wrong. I am briefly explaining this weekend’s first round and the general French election system further below.

First, let’s hear Macro D’s latest thoughts before we update a few charts that have changed since we last looked at them.

Macro D Thoughts

This week, the financial world will focus on U.S. inflation data. On Friday, we will finally see the May PCE deflator data. We must remember that the PCE index has historically been the Fed's preferred measure for monitoring inflation's ups and downs.

We essentially have two notable observations in the first half of the week. 1) Fed Governor Michelle Bowman once again highlights the upside risks to inflation and gives the market her classic view: "It's not time to cut rates yet." Bowman is one of the Fed's most vocal hawks, and for months now, she has been telling us that she thinks the Fed's monetary policy will diverge from that of other central banks between now and the end of the year. 2) Something went wrong in Canada, or rather, something in Canada did not go as expected.

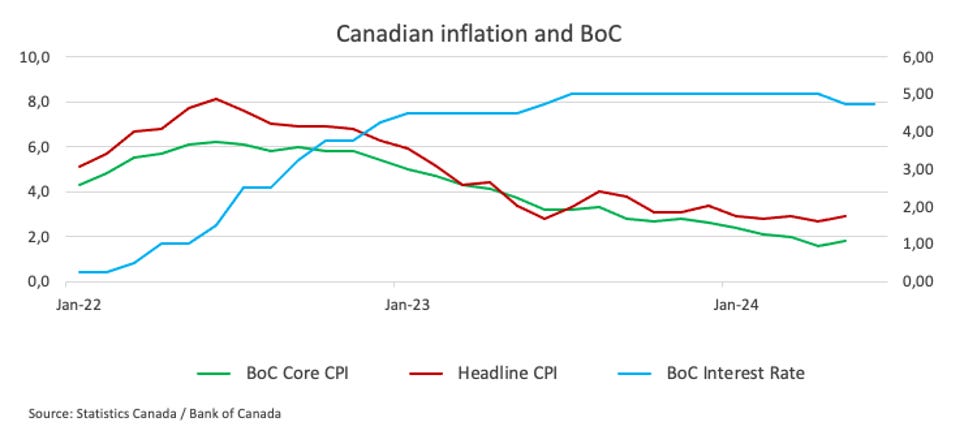

On Tuesday, Canadian consumer price index (CPI) inflation rose in May, hitting 2.9% year-on-year (y/y), above expectations.

Even the BoC's favourite measure, CPIX, jumped from 0.8% q/q to 2.1%. We have to admit that these numbers, while surprising, are not outside the Canadian central bank's target range, so there is no alarm, but it is still data that goes in a direction diametrically opposite to the desired one.

What remains of the market idea that predicted a rate cut in July? Before raising the white flag, I would at least wait for the upcoming employment data.

Currently, the central banks I am watching with particular attention are the Fed, the ECB, the BoE and the SNB.

Here, we will sniff the wind at each of these latitudes.

Before getting on the market carousel, let's look at a picture the markets left us with last week. The S&P 500 surpassed the 5,500 mark for the first time on Thursday, and with that, the index is up more than 16% this year. This is no small feat.

And now, a broader view. Macron to call early elections in France; this event materialized in the form of a bomb whose timer nobody knows: The spread between French bonds and German 10-year Bunds has practically doubled, going from 45 basis points to 80 in the space of a few days. We haven't seen such a movement since the sovereign debt crisis terrorized Europe.

As for the US macro data, the apparent heterogeneity regarding the labour market data is perplexing. The nonfarm payroll data released in early June showed the creation of 272,000 jobs, while the Household Survey report (also published on the same day) showed the loss of 408,800 jobs in the same period.

Should the non-farm payroll data be considered "inflated" by immigrant employment?

Is it up to Powell to handle this hot potato? Apparently, his first openings favour an awareness whose consequences aim to convince the non-farm payroll data to take a bath of humility and recognize that it does not possess the voice of the oracle of Delphi: no one is perfect.

In the US, Jay was surprised by more persistent than expected inflation in the first quarter, but he responded boldly: He stood still. Someone else would have given in to panic and behaved like that wealthy father who answers every request of his son (legitimate and illegitimate) first and foremost to himself.

But I'm so rich, why shouldn't I give my son everything he wants?

Jay is a wealthy father, but he has shown his son that he can respond with a resounding and dry NO.

And now, let's try to delve into the internal mechanisms. The S&P 500 index flies like Icarus, but if you look closely, not all the feathers on these wings have the same capabilities and show the same talent as they soar through the air. The index can count on only three dozen stocks that shine like diamonds; the rest of the group shines with reflected light. Is this a condition that can last? I don’t think so.

And now we have come to the United Kingdom. So says Bailey.

"We need to be sure that inflation will remain low, which is why we have decided to keep rates at 5.25% for now."

This statement by the Governor differed from his previous one, in which he declared himself "optimistic" that the data was trending in a direction conducive to cutting rates.

In Switzerland, the SNB has proceeded with the second cut of interest rates of 0.25%. The cost of money has been lowered to 1.25%. Thomas Jordan, who will leave the governor's seat in September, seems to have decided to go with the trumpet blasts and the stamina that has always distinguished him: decisive and imperturbable moves, regardless of the expectations of the context regarding the currency that is under his protective wing. Jordan has been smelling the air for a while now, and his move is not long coming. If there is a banker for whom history makes sense and deserves to be constantly considered, this banker is exactly him. Also, please read my guest piece on the SNB and the CHF below.

The governor smelled the French air; evidently, it did not go well with him. He imagined that the French political tensions had yet to arrive and stay for a weekend, but he intended to pitch their tents for at least a long time. Jordan, after all, saw what we all see, but he made a decision, and we? France is going to early elections at the end of the month, and the market is waiting for the victory of Marine Le Pen's right wing. Macron's move, worthy of a hardened Las Vegas gambler, has immediately given wings to the Swiss franc, which, as a safe asset, is the currency everyone turns to when the going gets tough and the air becomes unbreathable. Jordan did some calculations and was in a hurry, too. A "giant" version of the Swiss franc lowers the cost of imported goods and causes both deflation and a slowdown in economic growth due to lower exports. In the past, the SNB has passed over an "alien" version of the franc because it allowed it to counter inflation. Now, the line has been drawn, but will those who come after Jordan be able to make him not regret it?

Let’s now have a brief overview of the French election dynamics and process for the upcoming weekend before diving into a few updated charts that have caught my eye.

On y va!