Inverse Optimal Control Monetary Policy

Re-calibrating Yellen's lower for longer playbook

When Janet Yellen was the Fed Chair from 2014 to 2018, some of her mostly dovish concepts came to the forefront when anticipating future monetary policy stances. I studied her academic views regarding rules-based monetary policy strategies in detail, as it showed me how far they will likely go in keeping rates lower for longer. It was one part of my long-held long bond thesis back then.

Especially her speech in 2012, when she was vice-chair, was one that set the tone for much of the dovish policy stance even as they started lifting rates in December 2015. I remember the exact moment back then I was wearing the below t-shirt for lift-off.

As much as taking rates finally higher from the zero floor, the Fed’s reaction function meant only good things for bonds. A slow and steady, overly cautious approach to monetary policy. This was mostly related to Yellen’s “Optimal Control” policy which she outlined in her above-mentioned speech in 2012. You can find the link here. It is very theoretical but worth exploring, especially as we are currently facing the opposite mix. High nominal growth and inflation. What would “Inverse Optimal Control” look like? Let’s dig in …

In her speech, she goes through the economy at the time and outlines the reasons why the Fed would need to be more accommodative, given the benign inflation outlook and slack in the labour force.

As a theoretical concept, she takes the well-known Taylor rule from 1993 and adjusts it to the now-known 1999 Taylor rule. As a refresher, here are the two formulas.

1993 Taylor:

1999 Taylor (Balanced Approach):

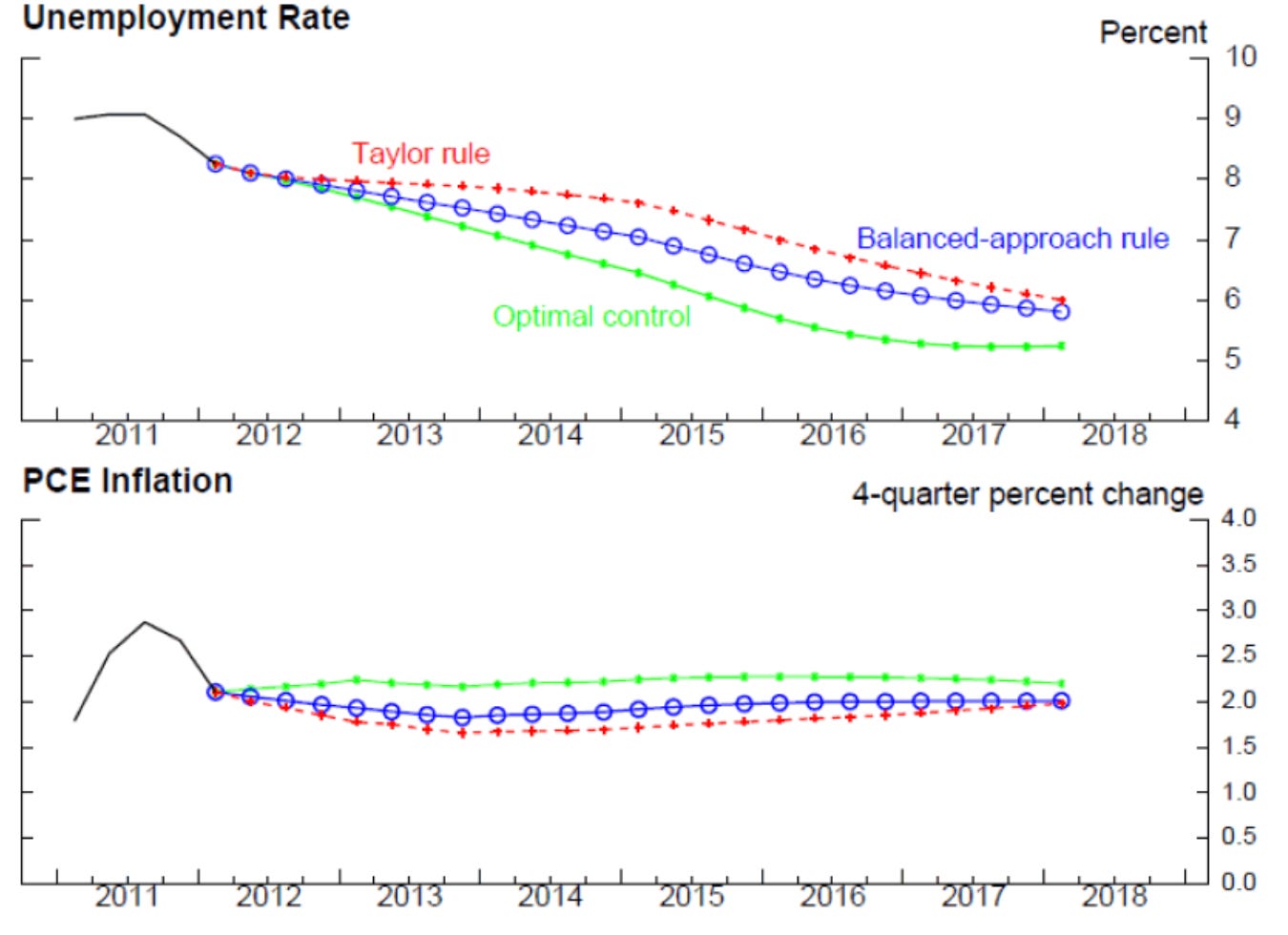

Plotting the lines looks as follows. The red line is the 1993 “old” Taylor rule, while the blue line is the “Balanced” or 1999 Taylor rule.

The green line with dots shows the "Optimal Control" path for the monetary policy rates. As she outlines in her speech, this monetary policy strategy involves keeping the fed funds rate close to zero until late 2015, four quarters longer than the balanced-approach rule prescription and several years longer than the Taylor rule.

“Importantly, optimal control calls for a later lift-off date even though this benchmark - unlike the simple policy rules - implicitly takes full account of the additional stimulus to real activity and inflation being provided over time by the Federal Reserve's other policy tool, the past and projected changes to the size and maturity of its securities holdings.”

“The above chart shows that, by keeping the federal funds rate at its current level for longer, monetary policy under the balanced-approach rule achieves a more rapid reduction of the unemployment rate than monetary policy under the Taylor (1993) rule does, while nonetheless keeping inflation near 2 per cent. But the improvement in labour market conditions is even more notable under the optimal control path, even as inflation remains close to the FOMC's long-run inflation objective.”

We have to keep in mind that the trade-off back then was to stimulate economic activity sufficiently in order to reduce the unemployment rate further while not unanchor inflation expectations. Today, this is obviously upside down, with the unemployment rate at a secular low while inflation is still far from the target.

Calibrating the Framework to Today

In the below chart, I have plotted the Fed Funds target (upper band) in blue and the 1999 Taylor Rule / Balanced approach as outlined in Yellen’s work in white. A balanced approach would still have Fed Funds at 9% at the current juncture, although it is notable that it’s already down 2.5% from its high of 11.5% precisely a year ago. Also notable is that the rule would have raised rates above zero pretty much a year earlier in spring 2021 than what actually transpired.

You can argue that a theoretical “Optimal Control” approach today would involve holding rates higher for longer in order to bring inflation back to target while ensuring nominal stability to markets in order to avoid a deep recession. For many, including me, an almost impossible task, but let’s stick with the theoretical approach for now.

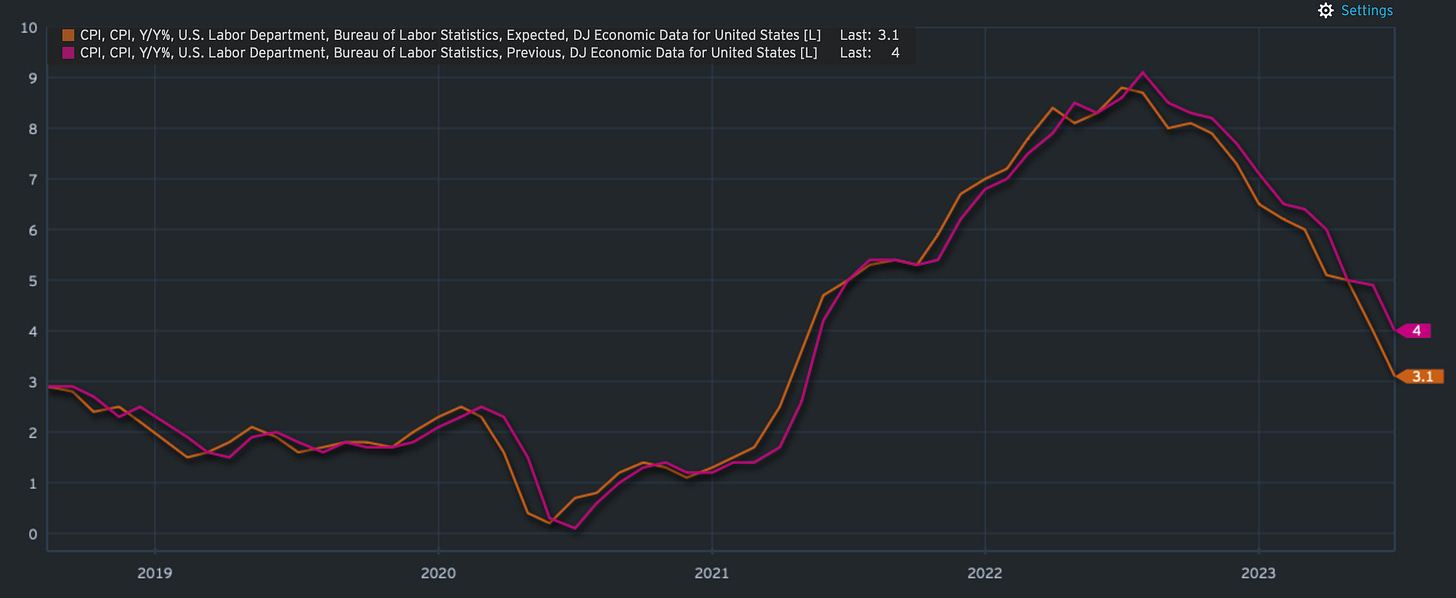

Given that we are now pretty much one year since the Taylor model started cutting rates, has optimal control, in fact, already materialized? Further, are we now on the brink of cutting rates in real life? Not so fast; after all, there is still a sizeable gap of nearly four percentage points from where rates “should be” according to the model and where they currently are.

Keeping the output gap element constant, it would take inflation to drop back to 2% in order for Taylor-rule implied rates to trade at 4%, which is pretty much what the market is expecting for the end of 2024.

At least looking at this model, which is admittedly theoretical, one could conclude that the market is already expecting a fall in inflation to 2%, which will get the Fed to cut by 100 bps over the next year. This, all things being equal, does not cater for any recession premium, at least not according to the rules-based monetary policy approach.

It would seem that the Fed is in a comfortable spot at the current juncture. They can indeed hike once or twice more before holding rates at a plateau and see how things pan out, especially on the inflation front. If inflation settles around 3% as the recent CPI is indicating (although Fed looks at PCE), then Fed funds would just be appropriate where they are, plus the 30 bps of hikes priced into next year.

Looking at PCE, however, would suggest that the next six monthly core PCE numbers will need to average around 0.25% just to get to the Fed's year-end 3.9% target – a level consistent with 50bps in additional rate hikes. It would take an average of around 0.2% to get to the previous 3.6% target from back in March when they were projecting end of 2023 funds at 5%.

Conclusion

First off, this is a theoretical concept and model. But it is used by policymakers, so it could be indicative of their thinking as it was under chair Yellen’s reign. Monetary policy works in lags, and it sure was behind the curve when it came to rising rates even though they had the same Taylor-inspired models at hand. The Fed has now regained credibility and is at a good enough policy setting which is anticipated to be reaching its plateau in due course. Whether that’s 5.5% or 5.75% doesn’t matter in the great scheme of things.

The reverse optimal control concept looks at keeping rates higher for longer, which, according to the theoretical model, has already been in place over the past year. While there is still a huge gap as to where rates should be and currently are, the Fed will be in no rush to adjust policy rates which are currently “in theory” in the perfect setting for a 3% inflation world. Should inflation really get back to 2% over the next year or so, front-ends are already anticipating an adjustment of around 100% back to around 4%, which is in line with p2% inflation over the next 12 months.

Implications, as usual, are in the eye of the beholder; I will leave you to your own conclusions. Hit me up with comments as to what they are.

Good Luck out there!

Your

Paper Alfa