FX Options

Educational Primer

Currency markets have provided decisive support to the global use of options in financial markets. The unstoppable expansion of the derivatives market has undoubtedly been aided by the significant increase in volatility in exchange rates. We can frame the beginning of this scenario in that time frame that began in the seventies of the last century when there was the transition from a fixed exchange rate regime to a variable exchange rate regime. In this context, the insurance provided by options has shown, initially to large institutional players and then to all international players, that they could effectively reduce the overall risk associated with their currency activity.

Exchange rate options can be used for speculative purposes, to exploit the volatility of exchange rates, and, above all, for precautionary purposes, to cover the risk of foreign currency positions.

That said:

FX Options give the buyer the right, but not the obligation, to buy or sell a currency at a specified exchange rate on or before a specified date. The buyer of an FX option pays a Premium to the seller, who is referred to as the "Option Writer".

Key points:

Over-the-Counter Trading: Forex options are not traded on exchanges, providing flexibility in contract customization.

Limited Downside Risk: Traders in long positions can lose only the premium paid, while profit potential is unlimited.

Hedging Tool: It can be used to hedge existing forex positions.

Risks: Factors like interest rate differentials, market volatility, time value, and premium costs influence option pricing and risk.

Advantages of FX Options

One of the main advantages of FX options is that they provide flexibility in managing currency risk. FX options limit the downside risk when purchasing an option at the cost of the premium while also allowing unlimited upside potential.

FX options are widely used in the interbank foreign exchange market to maximize profits and protect against potential losses. FX options allow currency traders to realize potential earnings without taking on the risks of physical delivery, ownership and currency settlement.

Forex options can be used as a hedging product, complementing other trading strategies, using Spot and Forward contracts. Taking FX options as part of an investment portfolio can offer numerous diversification benefits. Given that currencies often move independently of other asset classes, the supplement provided by FX options can help spread risk and, as a result, improve the overall performance of the portfolio.

Forex Spot vs. Option

In spot forex trading, currencies are traded in pairs, which means that the trader simultaneously buys and sells a currency. For example, if you buy EUR/YEN, you buy Euros while selling the Japanese currency. This exchange happens instantly, and the profit or loss is determined by the exchange rate movement immediately after the exchange. In contrast, FX options are financial derivatives. This means the trader does not own the underlying currency pair when trading options. In this case, the trader merely speculates how the price will move.

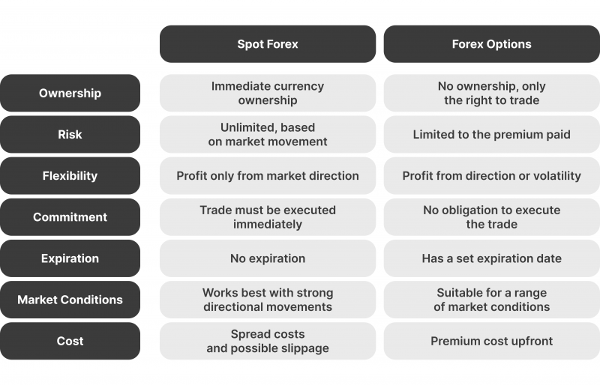

Here are the differences between spot and options trading:

Let’s compare EUR/YEN spot trading and Forex options.

• In spot trading, if EUR/YEN trades at 1.10 and you believe the euro will appreciate, you buy EUR/YEN. If the price rises to 1.12, you profit from the 200 pip move.

• With Forex options, you could buy a call option with a strike price of 1.10, giving you the right to buy EUR/YEN before the option expires. If the market moves to 1.12, you can exercise the option and potentially profit. However, if the price does not reach or exceed 1.10, your only loss is the premium you paid for the option.

Why Trade FX Options?

Forex options are primarily used for short-term hedging foreign stock market positions or spot Forex. For example, if the trader buys EUR/USD but believes there may be a short-term decline in the price, the trader could also buy a Euro put option to profit from the decline while maintaining the purchase. Consider selling EUR/USD short at the same time as the purchase.

Options contracts allow for many bullish, bearish, and even neutral strategies, depending on the trading environment the trader is exposed to.

A Forex option can be bought or sold. Option prices are derived from the base currency, which is the first currency in the currency pair (for example, the euro in EUR/USD). If the trader is bullish on the base currency, he should buy calls or sell puts, while if he is bearish, he should buy puts or sell calls.

With forex options, you always trade a currency pair.

To reiterate: when you trade forex options, you buy the right to trade a currency pair at a specified price on a specific date. This means you want to buy one currency (the base currency) and sell another (the quote currency) because you believe one will strengthen against the other. FX options contracts are typically traded through the OTC (over-the-counter) market, so they are completely customizable and can expire anytime.

Types of Forex Options

There are two types of currency options to trade: puts and calls.

1. Call Options

A call option gives the trader the right to buy a pair at a pre-determined strike price before expiration. The trader buys the call option when he expects the base currency to strengthen against the quote currency.

Example:

If the trader believes that EUR/YEN will rise from 1.1000 to 1.1200 next month, he could buy a EUR/YEN call option with a strike price of 1.1000. Suppose the EUR/YEN exchange rate reaches or exceeds 1.1200 before expiration. In that case, the trader’s choice will have intrinsic value, and he can profit by exercising the option or selling it in the market.

2. Put Options

A put option gives the right to sell a pair at a pre-determined price. The trader buys a put option when he expects the base currency to weaken against the quote currency.

Example:

If the trader believes that USD/JPY (US Dollar to Japanese Yen) will fall from 150 to 140, they could buy a put option with a strike price of 140. If the price drops below 140 before expiration, the trader will profit by selling the pair at the higher strike price.

Hedging is used with options to offset the risk of an existing trade, for example, an already open position on the spot forex. For example, it is not uncommon for a trader to rely on a forex put option to protect himself from the depreciation of a particular currency. In this case, the trader opens an option with a strike price lower than the current market level, and if the market moves below the cost of the put option, at this point, the trader can profit from the decline.

Buying forex put or call options presents less risk than spot forex trading; this results from losing the option's initial premium (the margin) only if the trade does not go well. However, it is necessary to keep in mind that 1) the premiums of the options can also be relatively high and 2) the risk is unlimited when selling options.

To recap: Forex options have several advantages:

Risk Management: Options protect traders' trades from adverse currency movements. By paying a premium upfront, the trader can limit his potential losses.

Flexibility: Options allow the trader to benefit from both upward and downward movements in exchange rates without committing to an entire market position.

Leverage: Options trading offers leverage. The trader can gain exposure to a more prominent position for an initial cost (the premium the trader pays).

Speculation: The trader can speculate on price movements in any direction, up, down, or sideways. With options, the trader benefits from both volatility and direction.

Types of FX Options

American Options:

American FX options differ from European options in that they can be exercised at any time before their expiration date. This gives traders more leeway and allows them to take advantage of favourable market conditions (should such conditions arise). Advantages and Disadvantages of American Options.

American options are beneficial because traders do not have to wait to exercise the option when the asset price rises above the strike price. At the same time, American-style options involve a premium, an initial cost, that traders pay and must, of course, be factored into the overall profitability of the trade.

Advantages:

• Allows exercise at any time

• Allows exercise before an ex-dividend date

• Allows profits to be reinvested

Disadvantages:

• Charges a higher premium

European options:

A European option is a version of an options contract that limits execution to its expiration date. In other words, if the underlying security, such as a stock, has moved in price, an investor would not be able to exercise the option early and take delivery of or sell the shares. Instead, the call or put action will only take place on the date of option maturity.

Another version of the options contract is the American option, which can be exercised at any time up to and including the date of expiration. The names of these two versions should not be confused with the geographic location as the name only signifies the right of execution. It’s simple to remember the “A” for any time.

Advantages:

Lower premium cost

Allows trading index options

Can be resold before the expiration date

Disadvantages:

Settlement prices are delayed

Cannot be settled for underlying assets early

Exotic options:

Exotic FX options have customized features that differ from standard options. They often include complex payoff structures and specific conditions. An example of exotic options is barrier options. They are similar to Vanilla Put and Call options but are only activated or extinguished when the asset (e.g. currency) reaches a pre-set price level. Knock-In and Knock-Out are commonly used to describe the price level in question.

Vanilla Options vs. Exotic Options

In addition to puts and calls, options can be divided into:

Vanilla Options: These are standard call-and-pull options where you bet on whether the price of a currency pair will rise or fall.

Exotic Options: These are more complex options with additional conditions. These "exotic" options result from the rapid development that the markets experienced in the 1990s. The surprising volatility of the time was the driving force for the generation/spread of increasingly sophisticated financial engineering products, which aimed to meet financial operators' increasingly specific and ambitious needs.

Vanilla FX Options

Standard Vanilla options are:

a) Put Option (the right to sell one currency and buy another)

b) Call Option (the right to buy one currency and sell another),

for a specified currency pair exchange rate, called the strike price, within a specific period, it is called the expiration date.

If the exchange rate moves in favour of the option buyer, the option buyer can exercise the option and execute the transaction at the predetermined exchange rate. However, if the exchange rate is unfavourable, the option buyer can let the option expire, limiting his losses to the premium paid.

General Benefits:

Determine and budget your cash flows.

The opportunity to benefit from favourable foreign exchange movements.

Protection against the direct impact of unfavourable changes in foreign currency values.

It allows you to manage your foreign exchange risk and provides flexibility if circumstances change.

General Considerations:

A premium is payable.

When you buy the option, the strike rate may be less favourable than the prevailing spot rate.

Put Option

Benefits:

Protection against the direct impact of unfavourable changes in foreign currency values.

Determine and budget your cash flows.

The opportunity to benefit from favourable foreign exchange movements.

Points to consider:

A premium is payable

When you buy the option, the strike rate may be less favourable than the prevailing spot rate. A put option may be suitable when:

You are an Italian importer or a company that makes payments in foreign currency,

You want to protect yourself from future currency risk, but you are unsure about the likelihood of this risk materializing.

The strike price for put options is the price at which the holder can sell the asset. For put options to be profitable, the asset's cost must fall below the strike price.

For example, if a trader buys a put option with a strike price of $50 and a premium of $2, the option will be profitable if the asset's market price falls below $48. This allows the holder to sell the asset at a higher price than the market price and thus make a profit.

Call Option

The right, but not the obligation, to buy a specified amount of one currency in exchange for another currency at a rate agreed when the option is purchased (strike rate) on an agreed settlement date.

Offers complete protection against unfavourable changes in foreign currency values. You can benefit from a favourable exchange rate movement by transacting at the prevailing spot rate.

Benefits:

Protection against the direct impact of unfavourable changes in foreign currency values.

Determine and budget your cash flows.

The opportunity to benefit from favourable foreign exchange movements.

Points to consider:

A premium is payable.

Buying the option may make the strike rate less favourable than the prevailing spot rate. A call option may be suitable if:

You are an Italian exporter or a company with foreign currency income.

You want to protect yourself from future currency risk and are unsure about the likelihood of the risk materializing.

The strike price for call options is the price at which the holder can buy the asset. For call options to have a potentially positive outcome, the cost of the underlying asset must exceed the strike price by more than the premium paid.

For example, if a trader buys a call option with a strike price of $40 and a premium of $2, the asset's cost must exceed $42 to be considered profitable.

Exotic FX Options

The exchange rate derivatives market has also acted as a precursor for new types of options, particularly sophisticated and innovative "exotic options."

In this regard, we distinguish between:

Asian options (average strike and average price), whose pay-off depends on an average (arithmetic, geometric or weighted) of the price of the underlying in the reference period;

Options with a pay-off that is linked in a complex way to the price of the underlying, as it can depend on a minimum/maximum price during a specific period (lookback), on the achievement of a pre-established threshold for the cost of the underlying (ladder and barrier) or on a change in the exercise price (reset-strike, deferred-strike and instalment);

Options with a pay-off that is, in turn, a derivative contract or another option (forward-start, packages, chooser, compound, swaption and caption);

Options with a pay-off that is not linked to a strike price exercise but to an exercise region (digital or binary, asset-or-nothing, gap);

Options with a pay-off that depends on the price of multiple securities, as it is determined based on the highest price recorded in a certain period among a set of securities (exchange and rainbow);

Options with pay-off determined by the difference between the prices or yields of multiple financial assets, such as interest rates on two different currencies and interest rates on two different maturities (spread) or stock and bond indices (outperformance);

Options with a pay-off in a currency other than the one in which the option is denominated (Quanto and differential swap).

Here, we will deal with Binary Options and Barrier Options.

Binary Options

Binary options have a payoff structure closely tied to the occurrence or absence of a predetermined event, usually related to the movement of an underlying asset. They provide a set payout, attracting the attention of traders interested in sifting through the all-or-nothing options landscape.

Unlike traditional options, binary options generate fixed payouts. They pay a fixed amount if the asset price crosses above the strike for calls or below the strike for puts. If the asset fails to meet these criteria, the option expires worthless, and the trader is left with the premium paid.

For example, suppose a trader selects a binary call option with a stated payout of $10 and a strike price of $50. If the asset price moves above this strike at expiration, the holder receives a payout of $10, regardless of the increased price. If the asset price remains below the strike, the option becomes worthless.

Binary options span multiple asset classes, supporting trading on foreign exchange, commodities, and even event outcomes, serving a wide range of market participants. They offer a simplified path to the markets, appealing to those who prefer clear risk parameters and simple trading propositions but require sophisticated knowledge of market dynamics and risk due to their binary payoff structure.

Barrier Options

The main feature of exotic barrier options is that contracts can only be activated if the price of the underlying asset reaches a certain pre-determined level.

A barrier option is a class of derivatives whose payoff depends on whether the underlying asset reaches or passes a predetermined price.

A barrier option can be a knock-out, meaning it expires worthless if the underlying asset rises above a specific price, limiting the holder's profits and the writer's losses. It can also be a knock-in, meaning it has no value until the underlying asset reaches a specific price.

Barrier options are considered exotic because they are more complicated than American or European options. Barrier options are also considered a class of path-dependent options because their value fluctuates as the underlying asset changes over the life of the option contract. The payoff of a barrier option is based on the path of the underlying asset's price. The option becomes worthless or can be activated when a price barrier is breached.

Let's reiterate the key points:

Barrier options are a type of exotic option where the payoff depends on whether the option hits or breaks a predetermined barrier price.

Barrier options offer cheaper premiums than standard options and are also used to hedge certain positions taken in the market.

There are mainly two types of barrier options: knock-out and knock-in barrier options.

The rights associated with a knock-in option come into existence when the underlying asset's price hits a specified barrier during the option's life.

On the other hand, a knock-out barrier option ceases to exist if the underlying asset hits a barrier during the option's life.

Barrier Option Examples

Let's look at two examples of barrier options in action:

Let's imagine a trader buying an up-and-in call option with a strike price of $40 and a barrier price of $50. The current price of the underlying asset is $50. The barrier option will not be valid until the underlying stock breaks above the $65 price.

The trader pays for the option, which means he will lose money if the barrier option expires worthless. The option will effectively expire worthless if the underlying asset's value does not reach and exceed $65 during the life of the option contract.

Now, imagine a trader holding an up-and-out put option. The put option's barrier is $30, and the strike price is $27. The underlying stock is trading at $23.

When the stock rises above $30, the option ceases to exist. Remember that the option becomes worthless even if it has only briefly crossed the $30 threshold.

Barrier options are usually classified as either knock-in or knock-out.

Knock-in Barrier Options:

A knock-in option is a type of barrier option in which the rights attached to it only arise when the price of the underlying asset reaches a specified barrier during the option's life. Once a barrier is reached or occurs, the option remains in effect until its expiration.

Knock-in options can also be classified as either up-and-in or down-and-in.

In an up-and-in barrier option, the option only occurs if the underlying asset's price rises above the predefined barrier, which is set above the asset's initial cost. In contrast, a down-and-in barrier option only occurs when the underlying asset's price falls below a predefined barrier, which is set below the asset's initial cost.

Imagine a trader who buys an up-and-in call option with a strike price of $600. The barrier level is set at $650 when the underlying asset is at $550. In such a case, the up-and-in option does not become active until the price of the underlying asset moves above $650. If it fails to reach the barrier, the option cannot be activated, and the buyer loses the price he paid.

Knock-out Barrier Options:

Unlike knock-in barrier options, knock-out options cease to exist when the underlying asset hits a barrier during the option's life. Knock-out barrier options can further be classified as either up-and-out or down-and-out.

An up-and-out option ceases to exist when the underlying asset moves above a barrier, which is, in turn, set above the underlying asset's initial price.

A down-and-out option ceases to exist if the underlying asset moves below a barrier set below its initial price.

If an underlying asset hits the barrier at any point during the option's life, it is eliminated or terminated.

Imagine a trader who buys an up-and-out put option with a strike price of $200. The barrier level is set at $250 when the underlying asset is at $180. If, in this particular case, the underlying asset's value goes above $250 during the option's life, then it will cease to exist. The option becomes worthless, even if it briefly touches the $250 barrier and falls below it again.

There are also other variations of the barrier options described above.

Barrier options with a refund: Both knock-out and knock-in barrier options can include a clause to offer a refund to the holders if the option fails to reach the barrier price and becomes worthless. These options are known as barrier options with refunds. In this specific case, refunds are made in the form of a percentage of the premium paid by the holder for the option.

Barrier options Turbo Warrant: These are traded mainly in Europe and the Hong Kong financial centre. They are a type of down-and-out option that is highly leveraged and characterized by low volatility.

Parisian options: In this type of option, reaching the barrier price does not activate the contract. For the contract to come into force, the price of the underlying asset must spend a predefined period of time beyond the activation barrier price. In this type of option, the period that the underlying asset's price spends outside and inside the barrier price range is measured.

Reasons to Trade Barrier Options

Since barrier options have additional conditions built in, they offer cheaper premiums than comparable options without barriers. If a trader thinks the barrier is unlikely to be reached, he can buy a knock-out option, as it has a lower premium, and the barrier condition is unlikely to affect him. A trader who wants to hedge a position, but only if the underlying asset's price reaches a specific level, can choose to use knock-in options. The lower premium of the barrier option makes this option more attractive than using American or European options without barriers.

What are Option Greeks?

Option Greeks are financial measures of an option's price sensitivity to its underlying determinants, such as volatility or the underlying asset's price. Greeks are used in options portfolio analysis and sensitivity analysis of an option or portfolio of options. In short, Greeks refer to a set of calculations that can measure different factors that could affect the price of an options contract.

The various Greek letters are used in the options market to describe the risk parameters when taking an options position. Each letter is assigned to a specific situation where risk is present due to the relationship between the option and some other variable. With this information, the trader can make more informed decisions about which options to trade and when. In the options markets, each option has a number associated with it, giving traders an idea of the risk associated with the option or how it moves. However, this number is not fixed and changes over time. A trader can also calculate these values daily to determine if market changes have affected his portfolio to the extent that it needs to be rebalanced. Traders commonly use these different Greek values to assess and adequately manage their positions' risk parameters. Delta, Gamma, Vega, Theta and Rho are the key options for Greeks. However, there are many other Greek options that can be derived from the main ones just mentioned, which we will describe.

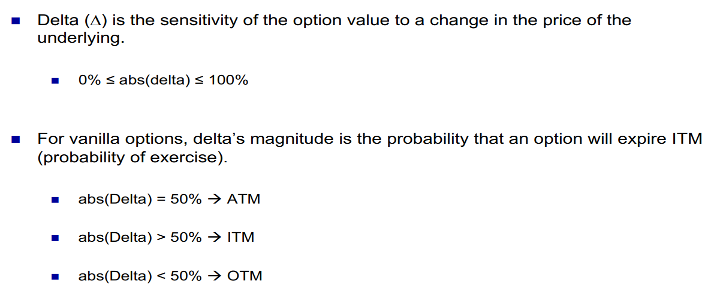

Delta

This indicates how much the option price will change in response to a 1-point change in the underlying stock price.

Gamma

This measures the change in the delta. Simply put, it measures how much the delta will change in response to a 1-point shift in the underlying stock price.

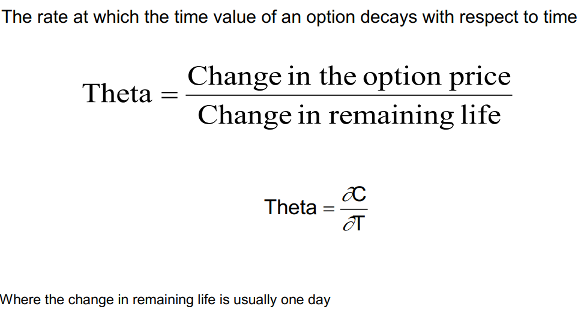

Theta

This shows us how much the option price loses value each day as time passes.

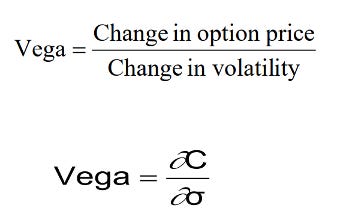

Vega

This measures the effect that a 1% change in volatility can have on the option price.

Rho

This indicates how much the option price will change in response to a 1% change in interest rates.

These measures guide how options respond to different factors, such as price movements, the passage of time, volatility, and interest rates.

Delta

Gamma

Gamma (Γ) : Adjustments to Delta