Friday Paper Charts

October 20, 2023

I can’t remember the last time I put together Friday’s thoughts and charts in an environment where stability was flavour du jour. Things seem to get angstier by the day if I just gauge Twitter sentiment. Musings about nearly daily cycle highs in US bonds appear everywhere I look. The clearing level for yields is still the hunting ground for markets as US economic resiliency and an overly loose fiscal policy continue to pressure bonds and term premia.

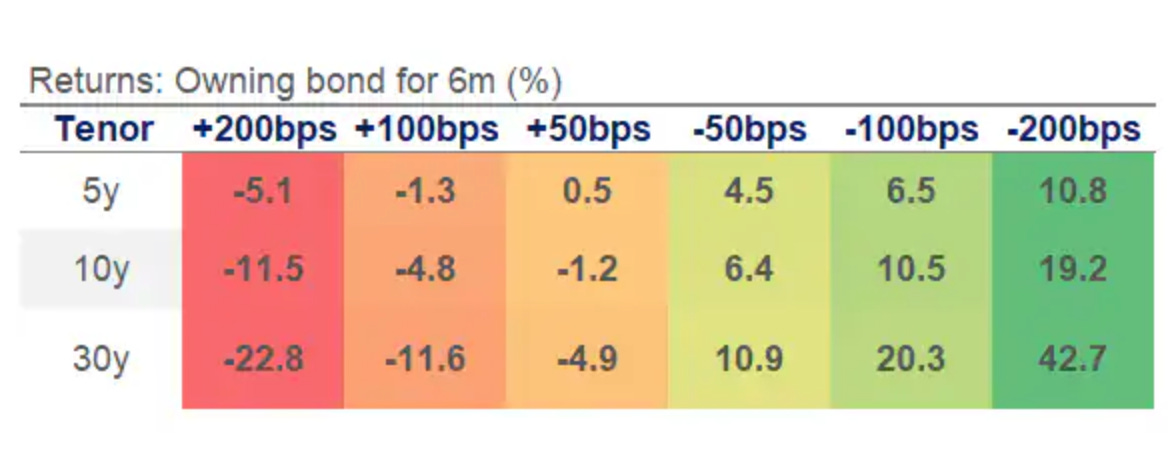

Why the heck buy bonds if you get a decent enough return on cash seems to be the prevailing question. As I am drafting another thought piece on “When to Buy Bonds”, it is worth reflecting on the convexity gained from owning longer-dated bonds. There were other tables floating around in Fintwit, but they didn’t consider the funding and convexity that certain yield moves would bring.

Alpine Macro had a good conference call regarding the current geopolitical playbook as the situation intensifies. I personally have trouble putting probabilities to any scenario, but the following chart could be useful in assessing where the consensus currently is. I don’t want to think about the consequences of 2.

As I opined in yesterday’s post, Powell’s balance was still firmly hawkish as it gives him and his fellow FOMC members the necessary optionality in light of a still very strong nominal economy.

His speech (prepared text) primarily emphasised the "higher for longer" mantra. However, there are also some cautiously hawkish undertones with a wait-and-see approach framing the current policy outlook with two main considerations.

Strong economic conditions pose upside risks to inflation. Powell's tone seems to show openness to a possibly higher neutral rate. He also said outright that "economic evidence is not showing that policy is too tight right now."

But, there are unpredictable risks, like geopolitics, that require patience. Whether higher bond yields continue feeding through to the economy - proof that policy is restrictive enough - also requires waiting-and-seeing or "higher for longer."

Below is a look at STIR pricing for all major central banks. Judge it for yourself with everything you know: how does the 2024 and 2025 pricing look? That will be part of the consideration for the upcoming bond piece.

Plenty of things to consider from a broader macro level, but for now, let’s dive straight into the charts, and we have plenty of them across Equities, Sectors, Rates, Curves, FX, Commodities and Crypto. I have stopped counting them.

It takes me a good few hours to compile, but it provides me every time with a few set-ups to go for. If you like what I am doing, I’d be grateful if you could recommend my work to whoever you think might be interested.