Friday Paper Charts

November 10, 2023

I am travelling today. I will be on holiday for most of November and back into full action upon my return. Fear not, as I will still be publishing and opining on markets as usual. I have also queued up some great articles for you all to enjoy. I like planning ahead. Also, please check out this week’s free education post on Cross Currency Basis Swaps if you haven’t already.

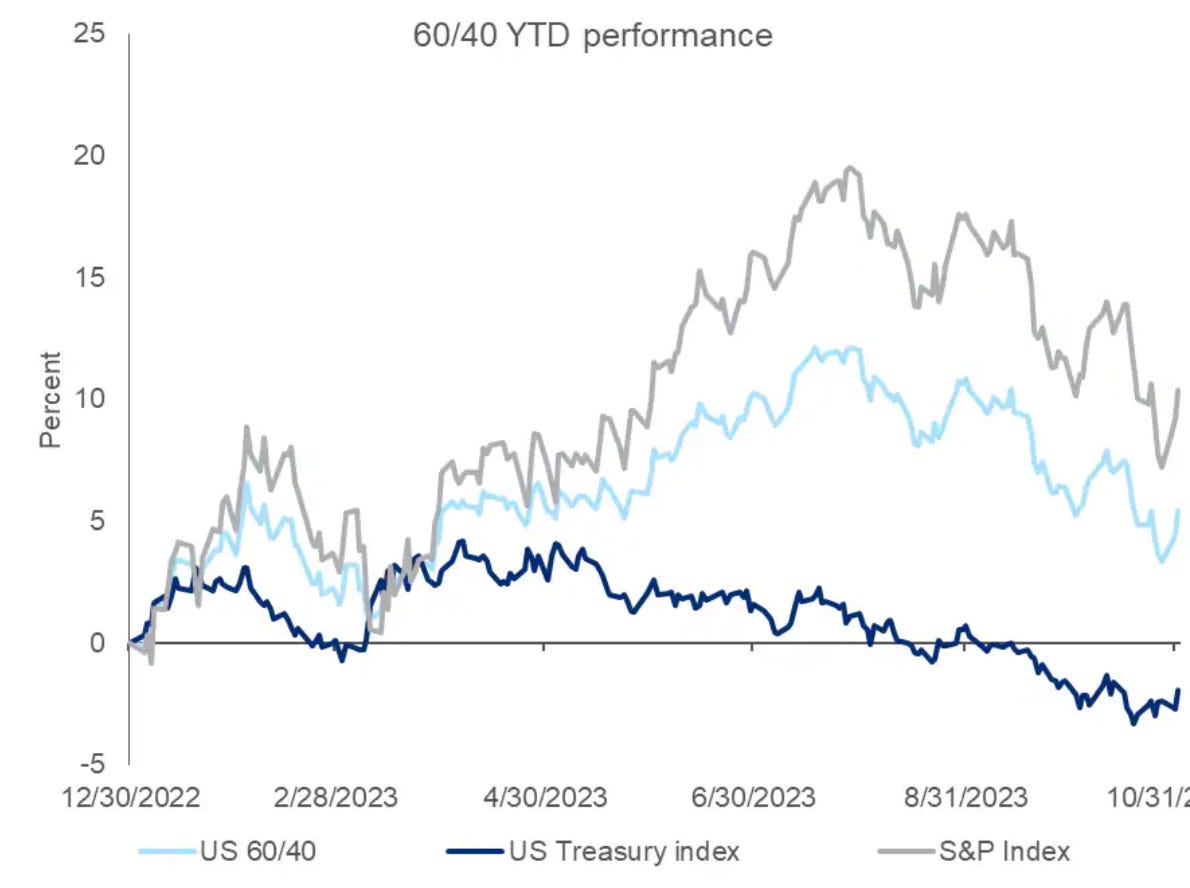

The refunding announcement has cooled supply risks and take a bite out of the recent run-up in the term premium. Fed was dovish in downplaying the September "dots" (which implied another hike) while ISM softened and unit labour costs fell for the first time since late 2022. Yields falling and rates vol under pressure means that US financial conditions are easing from this year’s tightest reading. Unsurprisingly, the 60/40 portfolio had one of the best weeks last week.

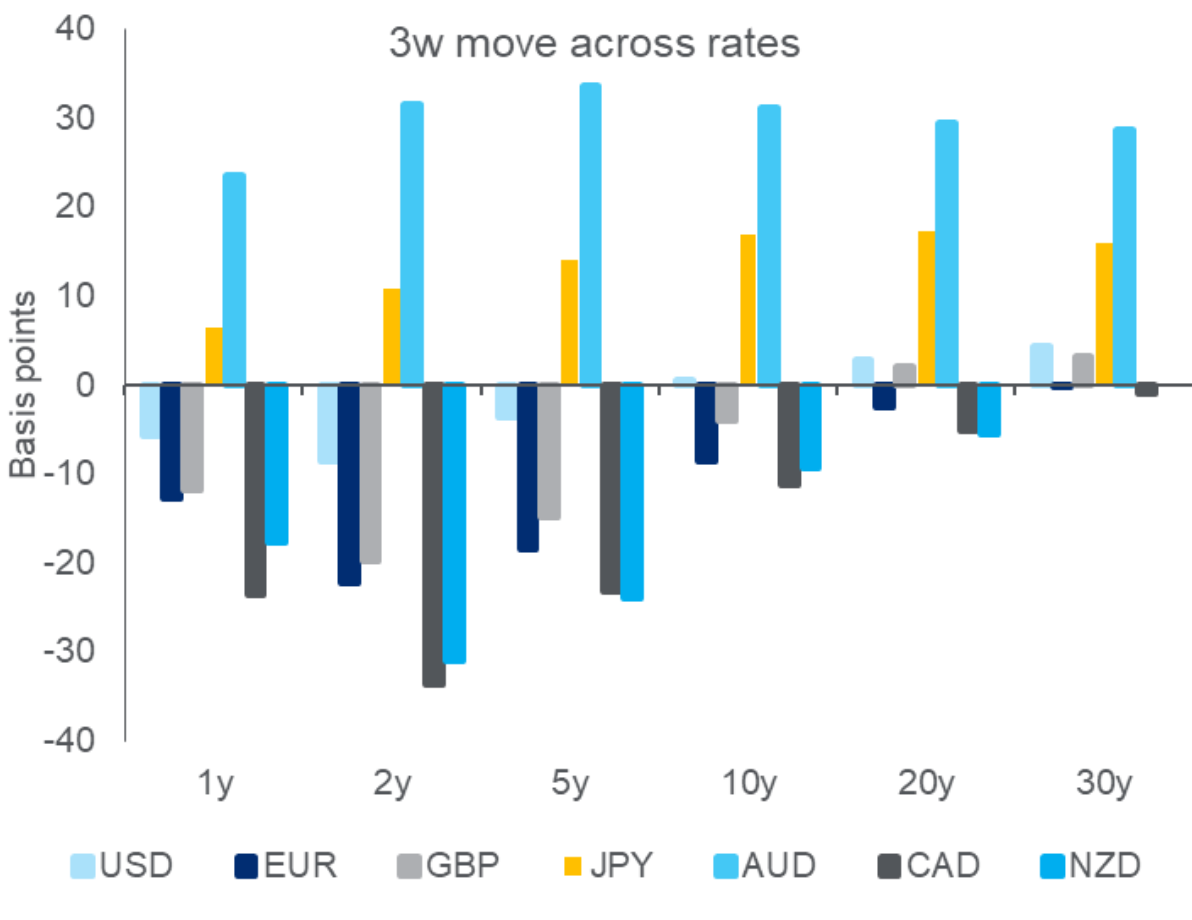

There are some pretty decent bond moves in Europe and the UK compared to other markets.

S&P 500 saw the largest 1-day rally in 6 months. Seasonals are strong (and everyone knows it), and recent selling pressure fueled by CTA selling and risk-control deleveraging is now gone and about to turn into support.

CTA’s are already maximum short and will start to reduce on a break above 4,342, suggesting around USD 17bn of buying according to bank desk estimates, while risk-control exposure is already at the lowest since July, leaving plenty of room to add when VIX drops and cross-asset vols compress.

After posting the best week since May, the seven mega-caps are up well over 50% YTD. The other 493 stocks have risen by single figures this year.

Let’s now dive straight into the charts and see what set-ups are opening up for us this time around. I counted a new record of 106 charts that I have on offer here for you. There are plenty of signals firing, so I wanted you all to have a full picture. Please note the prices are from Thursday.

We cover Equities, Sectors, Single Stocks, Rates, Curves, FX, Commodities and crypto.

Let’s go!

Equities

ES, overall, the models worked very well, catching the move lower on the momentum model, as well as the recent bounce by the reversal model. Now, momentum is again in buy mode, with the future trading above the 50 ema line.

NQ also bounced off nicely from the reversal buy signal, now also switching to a momentum buy as we trade north of the 50 ema and back to the early October highs.

RTY saw a nice bounce back to tagging the 50 ema before consolidating lower and now trading below the 20 ema. Momentum is still short, and stochastics are also rolling over.

DJI bounced nicely back above the 50 ema but now struggling to break the 200 ema barrier. Momentum has switched to a long.

FTSE-100 is still confined to the recent ranges, trading below the 50 ema, while momentum is still pointing to a short,

DAX, hallo? Momentum model is buying it just below the 50 ema. We haven’t seen a buy since July.

Cac-40 alo alo? is also seeing a momentum model buy, trading above the 50 ema.

Euro-Stoxx is also seeing the momentum model switching to a long, now trading north of the 50/200 ema.

Nikkei is still seeing a momentum buy, although its within the recent ranges.

Hang-Seng is also seeing the momentum model signal switching to a buy, trading just. at the 20 ema line.

China A-50 also has the momentum model buying it, holding just north of the 20 ema line.

Bovespa saw a big bounce, which caused the model to switch back into a long.

ASX-200 is also back in buying momentum mode, now trading north of the 50 ema.

NIFTY is trading off a nice bounce, now holding just above the 200 ema, while momentum is still short for now.

KOSPI had an outsized rally, tagging the 200 ema then consolidating lower, with momentum still short.

OMSX saw a nice reversal from the reversal signal, tagging the 50 ema twice with momentum still pointing to a short.

TSX also see the momentum model switching to a buy, trading just north of the 50 ema, with the 200 ema just above it acting as a resistance.

Sectors

If you are unfamiliar with the sectoral ETF codes used, please see here.

XLE is seeing another momentum signal flaring up. Now trading below the 200 ema.

XLF is now just at the 200 ema with momentum switching to a long.

XLB sees another momentum short flashing, sitting just below the 50 ema.

XLI is seeing a momentum buy signal triggered today. Now trading just north of 50 ema with 200 ema just above it.

XLC is also in momentum buy mode, close to recent highs.

XLP also saw a momentum buy signal triggered, but it failed to capture the 50 ema line.

XLRE is holding around the 50 ema with a momentum buy signal now in play.

XLU has also seen momentum shift to a buy, now holding just north of the 20 ema.

XLK is now also in buy momentum mode, now back at the previous September highs.

XLV struggled to touch the 50 ema, then reversed sharply lower, now trading below the 20 ema.

XLY also saw a switch to a momentum buy, now trading just above the 50 ema.

XOP sees a nice setup. Back at the mirror-image of a setup from September/October. Again, the momentum model is short, and we are trading below the 200 ema. And again, we have a reversal window in play, which could trigger a reversal buy. Will we do it again?

XHB is still holding north of the 50 ema, with a buy momentum signal still in play.

ITB also sees a momentum buy signal triggered, while there is also a reversal signal now in play. Stochastics are rolling over as well, so I’d expect a further consolidation.

KRE also saw the momentum model switching to long. Meanwhile, a reversal signal caused a consolidation back to the 50-ema line.

Stocks

AAPL has bounced nicely off the reversal signal and has now also turned bullish on momentum again.

AMZN also saw a nice bounce off the 200 ema and is now back to the YTD highs, with a reversal zone now in play.

NDVA also sees positive momentum, as we are trading north of the 50 ema, now above the highs of October.

SPROTT (U.U) is holding just under the 20 ema as the consolidation continues.

MSFT had a big bounce off the momentum buy signal and is now back at the YTD highs. We now have a reversal signal short in play.

GOOG had a textbook bounce off the 200 ema, which came with a reversal buy signal, and is now trading just below the 50 ema while momentum is still short.

TSLA saw a bounce off the reversal signal, now struggling to break north of the 20 ema with momentum still pointing short.

META saw a momentum buy signal triggered. Now trading close to October highs.

ORCL also saw the momentum model switch to long as we traded through the 50-ema resistance.

JPM is also seeing a buy momentum signal triggered as we are trading above the 50 ema. We failed twice in recent attempts. Let’s see whether it holds this time around.

WMT is seeing a small consolidation from the recent highs, as the reversal indicated. 20 ema support below.

PG is holding just at the 20/50/200 juncture, with momentum still pointing higher.

AMD is also seeing the momentum model in buy mode, while the reversal model is currently flashing for an overbought condition.

PLD had a bounce and tried holding north of the 20 ema but is now trading below as momentum is still short.

Rates

US 2s (ZT) is cooling off the recent rally and saw a reversal sell triggered. Now holding the 50 ema with momentum still long.

US 5s (ZF) is showing similar consolidation patterns, with momentum also still long.

US 10s (TN) saw its first buy momentum triggered in 6 months. Now trading above the 50 ema.

US 30s (UB) is also joining the rally momentum trade. Now trading above the 50 ema.

UK 10s (Gilts) is now seeing a reversal sell signal just on top of the recent range. Momentum is still long. Can we hold close to the top this time around?

JP 10s (JGB) saw a bounce, now trading above the 20 ema, with momentum still short. 50 ema is the next upper resistance.

DE 2s (Schatz) is holding just above the 20-ema line. Momentum is still long.

DE 10s (Bund) is holding close to recent gains. Stochastics look overbought, so let’s see whether we consolidate first.

DE 30s (Buxl) is now in a reversal window, with stochastics also seemingly rolling over.

IT 10s (BTP) is seeing another momentum buy signal triggered, now sitting just below the 200 ema.

Greece 10y yield is rallying below the 200 ema. Momentum points lower.

Australia's 10y-yield is now holding the 50-ema after a decent rally. Momentum is still long, pointing to higher yields.

Brazil's 10-y yield has broken through the 50 ema, triggering a momentum sell (on yield, higher in prices).

Curves

US 2-10s, the momentum model is back into flattening mode. We are just at the 50 ema line.

US 5-30s is just holding the 50 ema. Momentum is still long.

US 10-30s just holding the 50 ema. Momentum is still long.

US 2-5s is interestingly also back in flattening momentum mode.

DE 2-10s also joins the flattening trend, now trading below the 20 ema.

JP 2-10s is holding the 50-ema line for now, with the momentum model still long (steeper).

SOFR 24-23 has settled just north of the 50 ema, with a reversal sell now back in play. Momentum is long.

SOFR 25-24 is in momentum buy mode, which means pricing in more rate cuts into 2025.

FX

EUR is just holding above the 50 ema, momentum is long, and a reversal has played out.

JPY, momentum model is now short and close to recent lows.

GBP reversed after tagging the 200 ema, now trading below the 50 ema line. Momentum is still long.

AUD reversed nicely from the reversal signal (red triangle), now trading just above the 20 ema, while momentum still points to a long.

CAD tagged the 50 ema line, then reversed lower, now trading below the 20 ema.

CHF is holding just at the 20 ema, with 50 ema being the first resistance. Momentum is short.

NZD momentum is still long, now holding above 20 ema and trying to break the 50 ema line.

MXN is showing some upside exhaustion with a reversal signal in play and stochastics rolling over. Momentum is still long.

BRL is tracking lower after the reversal signal was triggered. Momentum is still long, however.

ZAR is also reversing lower from the reversal signal trigger that was highlighted earlier this week. 200 ema as first support with momentum model still long.

NOK is tracking still closer to recent range lows. Momentum is still short.

SEK is seeing a momentum buy signal just as we are trading at recent range highs and above the 50 ema.

USDKRW is bouncing off a reversal buy signal, with momentum still short.

USDCNH is trading below the 50 ema, with the momentum model short. Reversal buy is in force with 50 ema as the first resistance.

Commodities

Gold has reversed after a reversal signal has been triggered. Now holding the 50 ema with momentum still pointing long.

Silver struggled to meaningfully break above the 200 ema, now below all ema lines, and the momentum model switched to a short again.

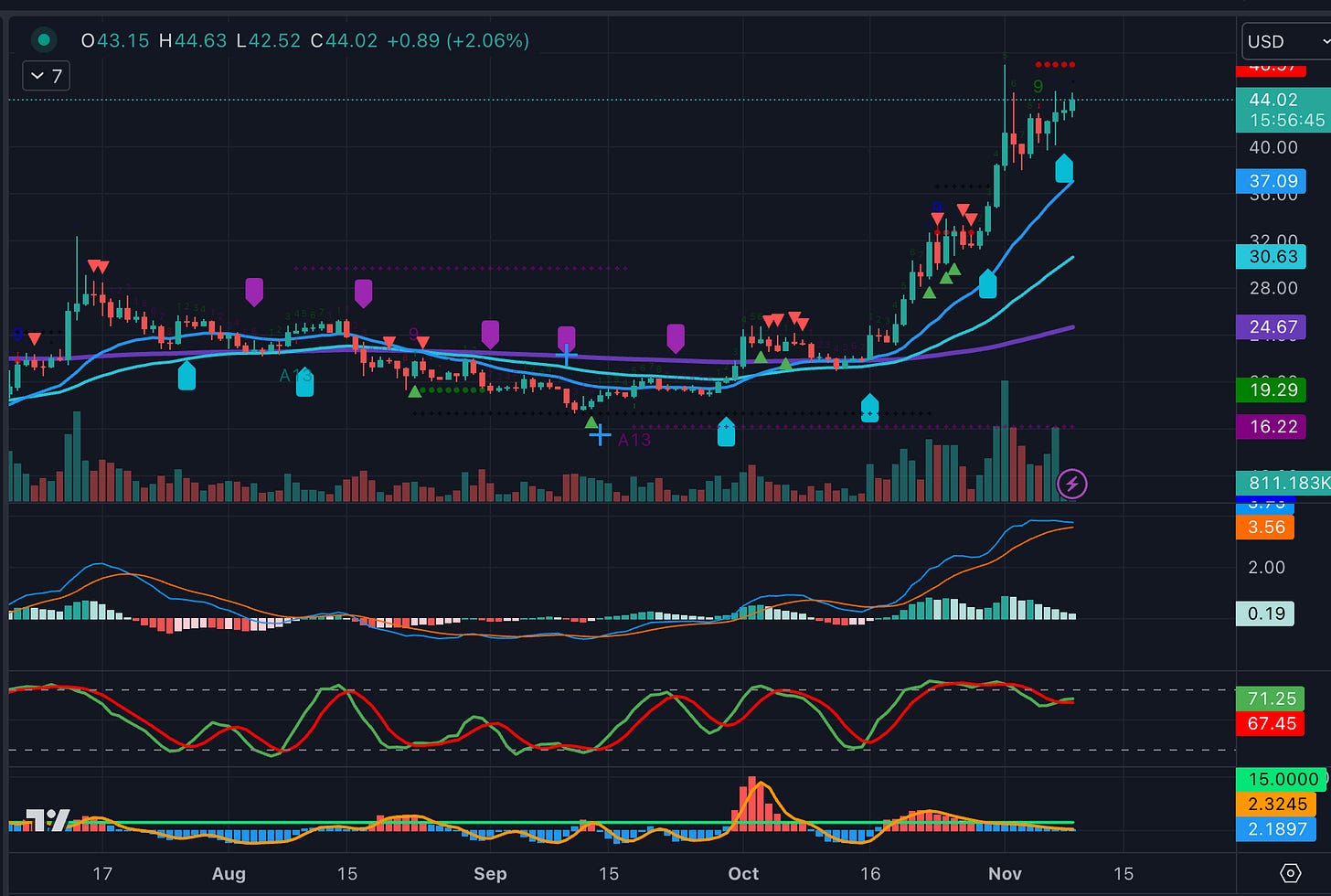

Crude, as highlighted yesterday, a reversal window is now opening up, and we have a 9-count on the TD marker, suggesting that pressing shorts from here possibly offers suboptimal risk/reward.

Copper is seeing another momentum short triggered. Now trading at the previous lows.

Natgas is back in the range it saw for most of the year. Momentum is now short again, although the signal is weak given the oscillating nature.

Platinum failed to stay above the 20/50 ema, now trading at the recent lows with momentum triggering another short. Meanwhile, a reversal window is opening up, which could bring a bounce back to the 20 ema.

Palladium is seeing new lows, the momentum model is short, and we have a reversal zone in play.

Wheat is in an interesting set-up, just holding the 50 ema with the momentum model going long here.

Corn is back on the lows of the range; momentum is short.

Cocoa is seeing another buy signal triggered at the recent highs.

Soybeans are struggling to break higher as we are in a reversal zone, but momentum is still pointing higher.

Cotton had quite a down move, with momentum short. Now, we have a reversal signal flashing (green close depending).

Live Cattle is in momentum short, trading below the 20/50 ema lines. We also have a reversal zone forming, and candle patterns look exhaustive to the downside.

Orange Juice is holding the 50 ema; momentum is short. Stochastics are turning from oversold conditions.

Crypto

BTC is resuming its ascent after a bit of a consolidation, triggering another momentum buy signal.

ETH is also back to the summer highs, with momentum supportive of a move higher.

SOL is also tracking higher, with another momentum triggered two sessions ago.

XMR consolidating just north of the 20 ema, with momentum still long. Preparing for another push higher.

XRP is consolidating as well with momentum also still in buy mode. Stochastics are a bit oversold and we have a 9 count TD reversal flashing.

DOGE is also in buy momentum mode with some exhaustion on the candle patterns appearing. We are now in a consolidation zone from August.

ADA is looking to surpass the summer highs, with momentum still long.

LTC is struggling at the 200 ema. With momentum still long, I am expecting a break soon. Waiting for reversal zone to pass first.

MATIC has passed the 200 ema comfortably. Now looking at the July highs as the next resistance.

DOT also holds north of the 200 ema, with the momentum model triggering another long.

HBAR is also seeing another buy signal triggered. Now looking to surpass the zone from August.

Best of Luck out there!