Friday Chart Book

Gold / Equity Momentum / 250+ Chart Updates

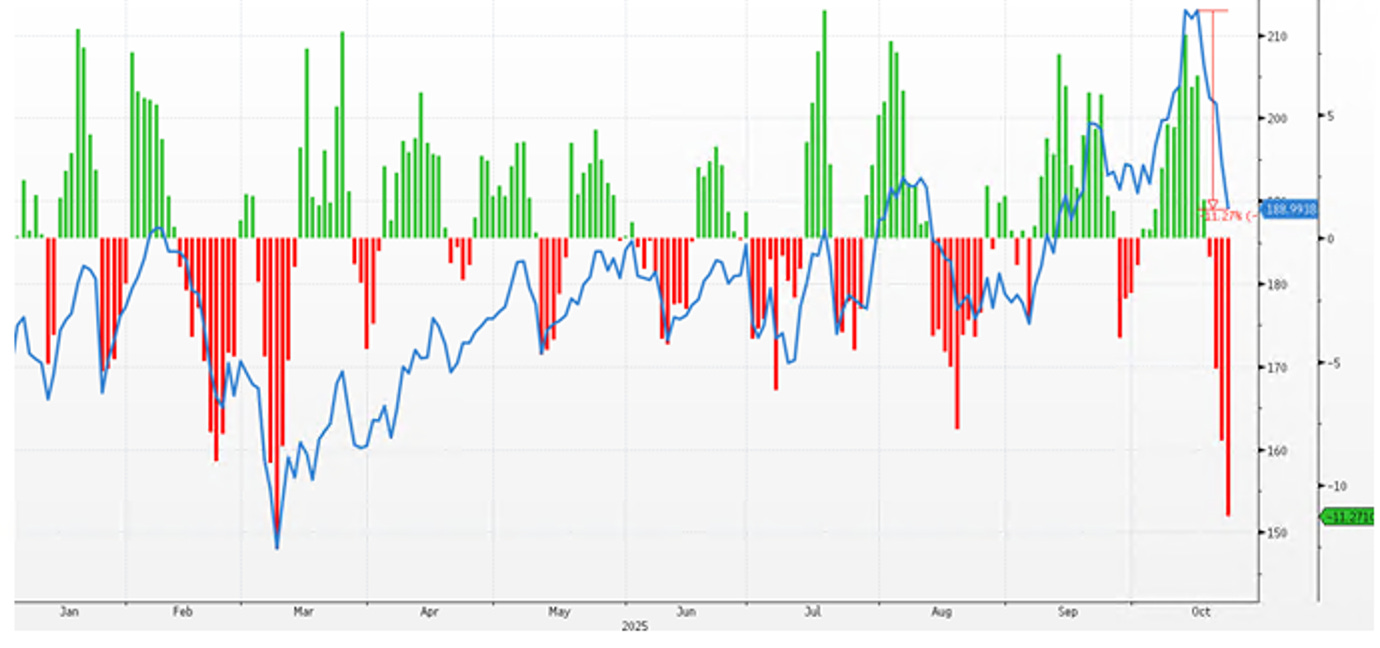

Gold finally had a day of reckoning this week as we saw the biggest 1-day % decline since 2020. I warned in ATW of a nasty candle on Friday, which then was engulfed on a Monday rally. I warned subscribers on Tuesday morning of a potential setback, which was timely.

It is safe to say that the debasement narrative had little to do with the reversal but was rather symptomatic of an exponential run, fuelled by speculative leverage, which had to be cleared out.

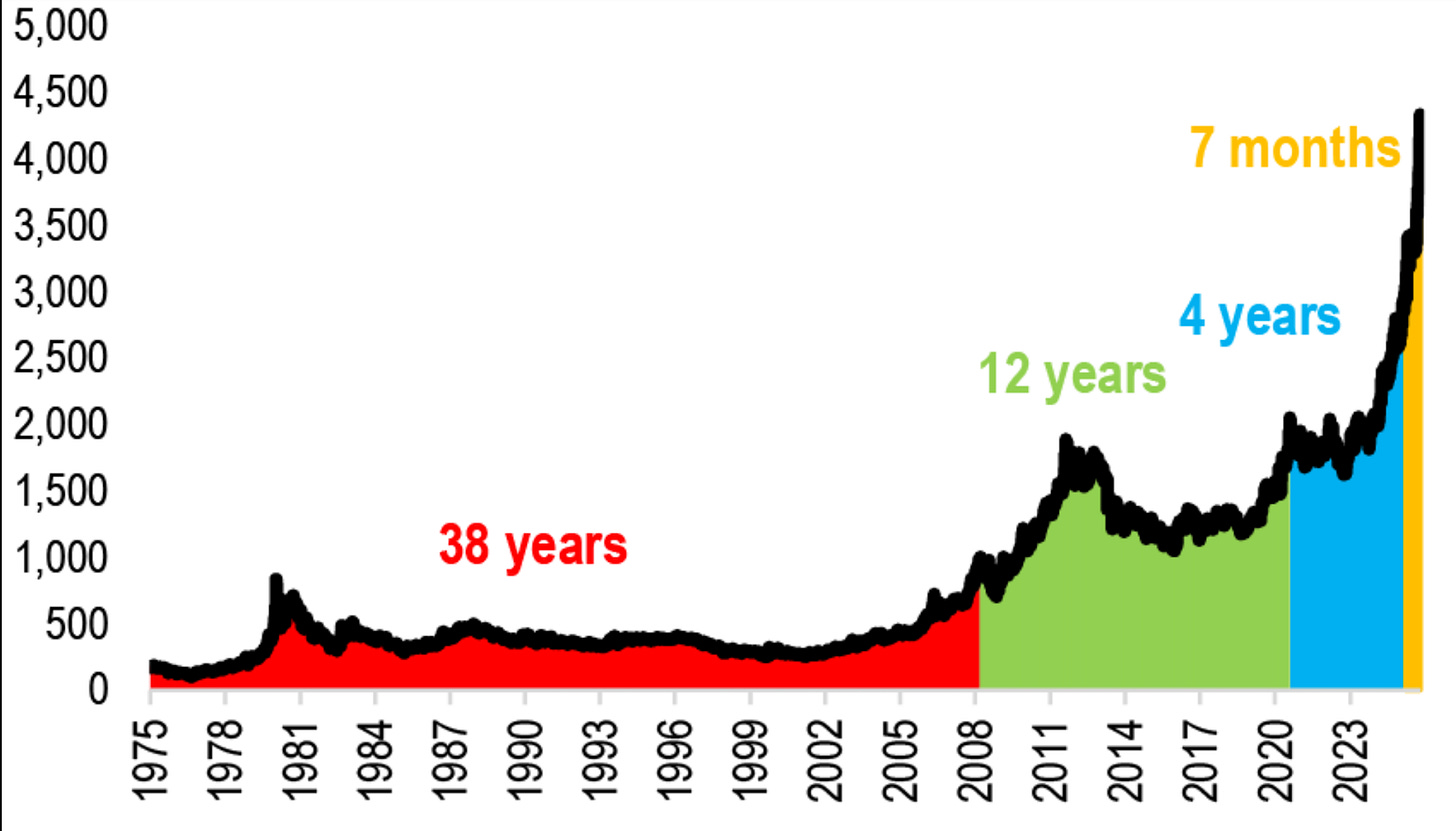

What’s next? After such a volatility event, usually, more choppy conditions are upon us as an equilibrium level will have to be found. Trend following funds will have to reduce their allocations due to higher realised volatility. We are currently holding the 20-day moving average as a first line of support. Should this fail, we would be looking at a deeper correction towards the 50-day line around 3740. See more details in the charts below. The chart below shows the progression of 1000 USD increments over time. What took half a lifetime 50 years ago was now achieved in a few months —exponentiality at work.

There are tremors in equities, which are invisible on the index level, but the momentum factor suffered the worst 5-day return since April.

Bonds were recently supported by declining oil prices. This picture has abruptly changed on Thursday as the US presented new sanctions on Russian oil producers.

US 10-year yields are still in an overall downtrend, with the channel upper band coming in at 4.10% for a consolidation higher as we await CPI. I’m expecting a print in line with the consensus.

I would also like to highlight two thought pieces posted this week by Macro D: one on Japan’s current monetary policy / political backdrop, and the second post on the investment case for lumber. Please see the pieces below.

A reminder that you can now also use my trading models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read Macro D’s latest thoughts on Canada, Japan and the UK. In addition, you will find the updated chart pack of all 250+ charts across the global macro universe.

Have a wonderful weekend!