Friday Chart Book

Risk Parity / Gold re-valuation / Alaska Party

Another week is almost in the bag, and we are now eagerly awaiting news from Alaska. Markets are already discounting positive news coming out of the state, which we bought on March 30, 1867, for 7.2 million USD - a bargain.

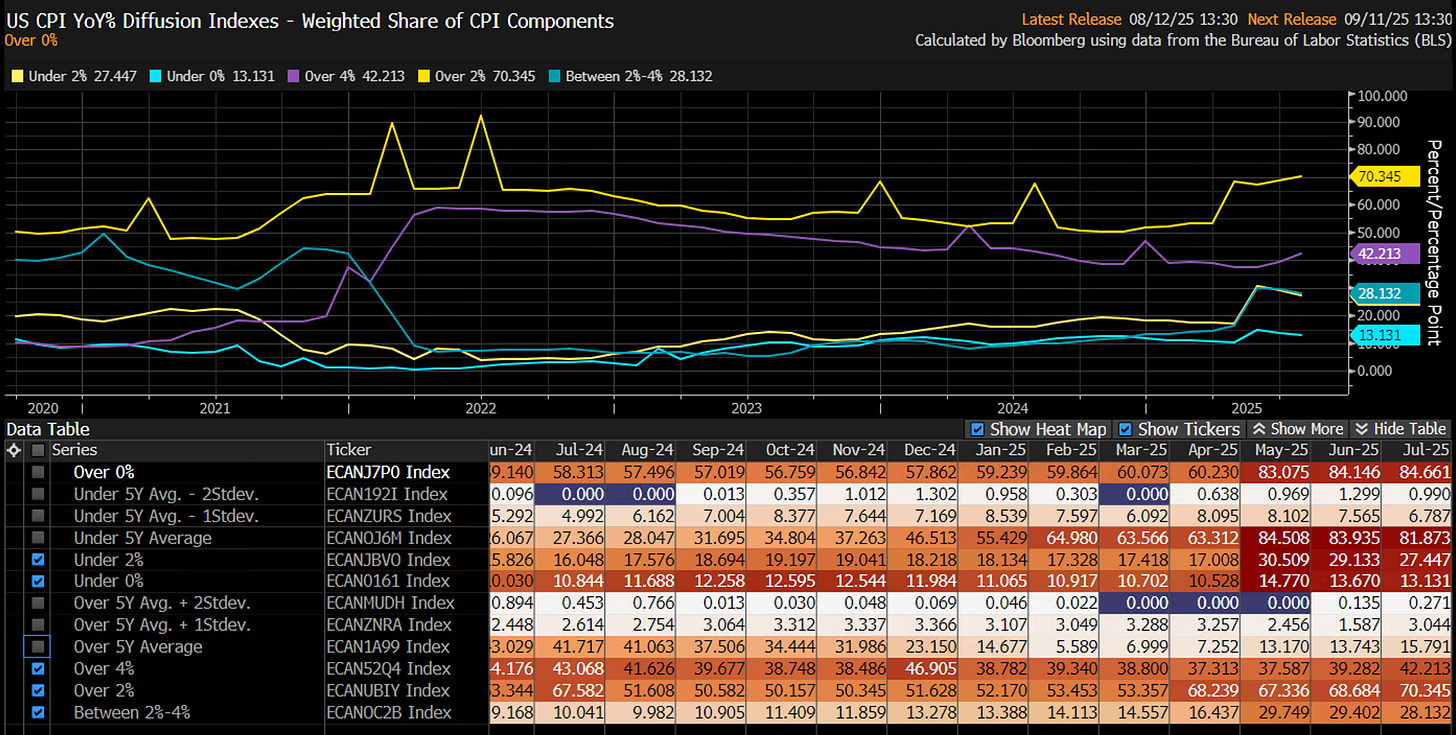

CPI Inflation, for now, seems to be in the rear-view mirror. The diffusion index has news for bulls and bears, with components of items below 2% and above 4% tracking higher. See the chart below.

Ahead of the CPI release, I shared with subscribers why I thought the market had discounted too high a print, which proved correct. This propelled a wave of soft landing risk-parity trades, with bonds and equities benefitting. A few trades that I looked at benefited from the outcome.

Some of the bond rally was also reflected in a sizeable rotation from Nasdaq into the Russell. Remember that we had a similar occurrence last summer, when we printed softer retail sales, starting a bond rally, which squeezed this ratio quite aggressively. Early days, but can something similar happen again?

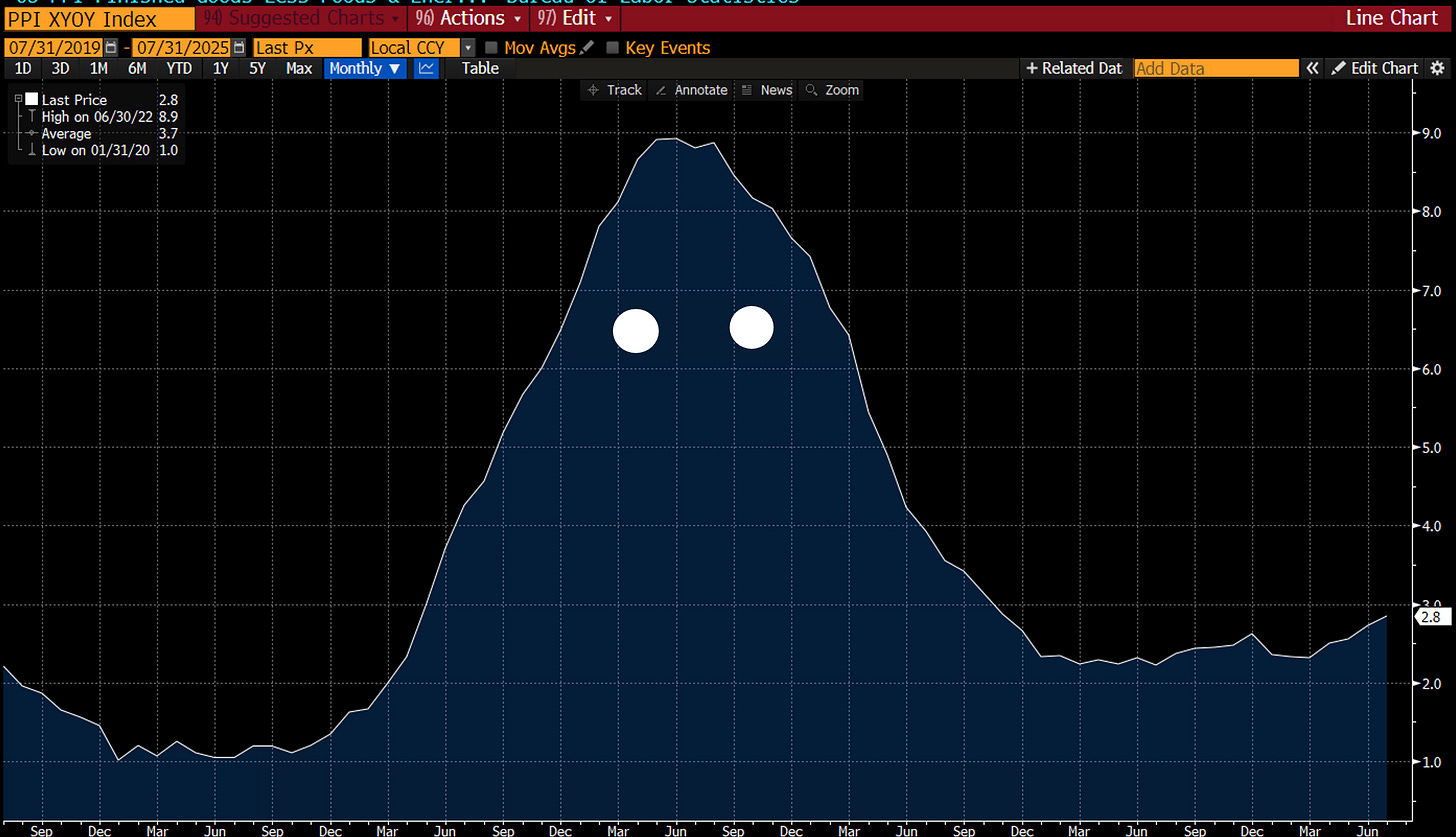

Not so fast, as Thursday’s PPI print stopped some macro punters in their tracks, when a vicious reversal ensued. Core services PPI accelerated to 1.1% m-o-m, the largest advance since March 2022. The inputs for the read-through to PCE translated a running estimate of around 0.3% m-o-m, which was around 0.05% higher than the post-CPI input. Looking at the chart below, you don’t have to use too much imagination to see the ghostly figure of inflation. The outlook remains for a steady climb in core PCE inflation towards a peak of about 3.25% at the end of this year.

Yes, and we are still pricing the Fed to deliver a bit more than two rate cuts by year-end, roughly at the level post the NFP print. From here, it is all a binary bet on future labour market data and growth. The odds for only one cut by year-end are not too bad. I will present a SOFR option trade behind the paywall section.

Another interesting piece of news was a Fed paper, looking at the historical precedents of Gold revaluations. Quite timely. Has someone told Trump that they could reduce the deficit by a trillion USD, using just an accounting trick? While the paper doesn’t add the pros and cons of such an undertaking, the effects would be pretty clear to me. Much steeper curves and USD weakness.

Oh yeah, then we have suggestions of NFP releases being suspended and David Zervos being lined up as a Fed Chair. I mean, there is never a dull day, that’s for sure. I think I will look at my macro roadmap again, which served us so well this year so far. I will update it for subscribers in due course.

Part of the roadmap contains the building blocks of our buy-and-hold 2025 portfolio, which has now surpassed the 15% YTD mark in USD terms.

Meanwhile, our models are keeping us informed as to what risk-reward setups look best across the macro universe. That’s what the Chart Book below contains. 250+ charts for readers to digest and study. On Thursday, I highlighted reversal signals across Crypto, especially in BTC, ETH and SOL. It helped with a very timely exit.

I want to extend a warm welcome to all new subscribers. Very happy you are joining the pack. Remember, this place doesn’t do tons of self-marketing, and all I am asking for is compensation for my time, which I value as everyone should. Educational content on here is all free. After all, my goal is to make everyone a better investor over time. The rest, of course, is all up to you.

In addition, a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

If you are interested in exploring Paper Alfa’s full package, subscribe below.

Let’s now look at that SOFR option trade idea, read Macro D’s latest thoughts on the upcoming meeting in Alaska, before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

Enjoy a fantastic weekend!