Friday Chart Book

Central Bank Week / Full Chart Update

A busy week has come to an end with the much-anticipated FOMC meeting not offering much of a volatility event. I wrote a pre-Fed post outlining my expectations, which included bonds continuing to perform well and the Dollar reversing higher, as indicated by the reversal model. Here is the full write-up.

Not all of my forecasts came through, although the reversal in the Dollar became evident over the past two trading days. In general, Powell played his tactics well, keeping optionality ahead whilst managing no hick-ups and allowing volatility to collapse post-meeting. A pro-active Fed in “risk-management” mode is a godsend for risk, which sees this insurance approach as a clear road ahead.

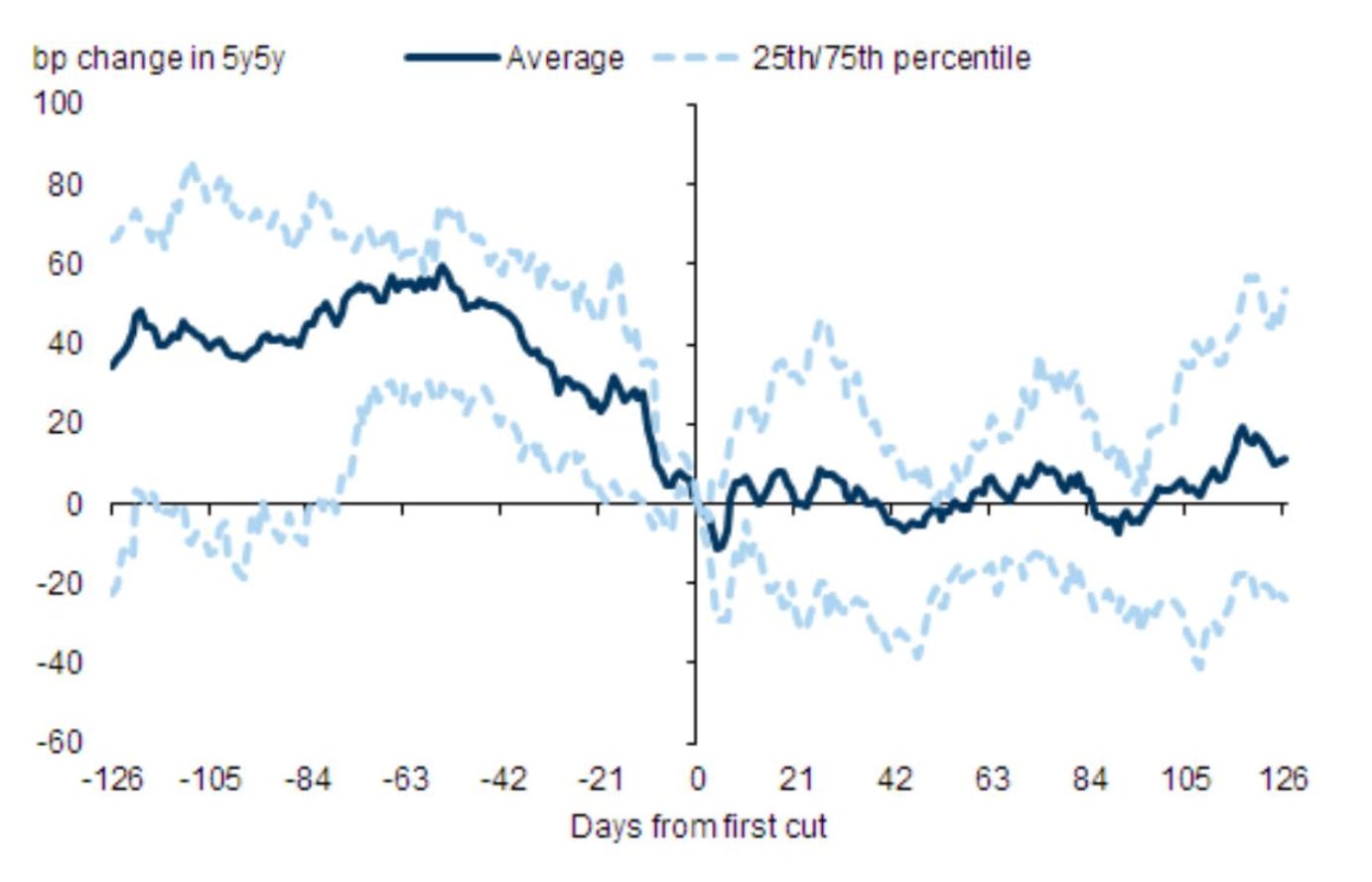

Bonds re-steepened post-Fed, which is the normal playbook when the Fed cuts for the first time in a series of adjustments. The chart below shows this relatively, which means that vol will unlikely come from bonds.

Since the April/May carnage, 1y1y OIS has drifted steadily lower, while stocks have ramped, indicating a risk-parity ideal negative correlations, reducing volatility, allowing levered players to amp up risk over time.

I will share more thoughts and conclusions after this week’s central bank meetings. In general, I envisage a beta environment leaving little room for outsized moves for now. At this time, our allocation model (currently long both equities and bonds), as well as our tactical momentum and reversal models, will inform us of trade setups.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read Macro D’s latest thoughts on geopolitics and this week’s FOMC, BoC and BoE meetings. In addition, you will find the updated chart pack of all 250+ charts across the global macro universe.

Have a wonderful weekend!