FOMC Day

Inflection Points & Market Set-up

After 9 months of inaction, we are going to witness yet another rate move by our dear friends at the Federal Reserve. Normally, an action point reflects a policy shift, a move from a steady state into a new regime, which excites us macro people.

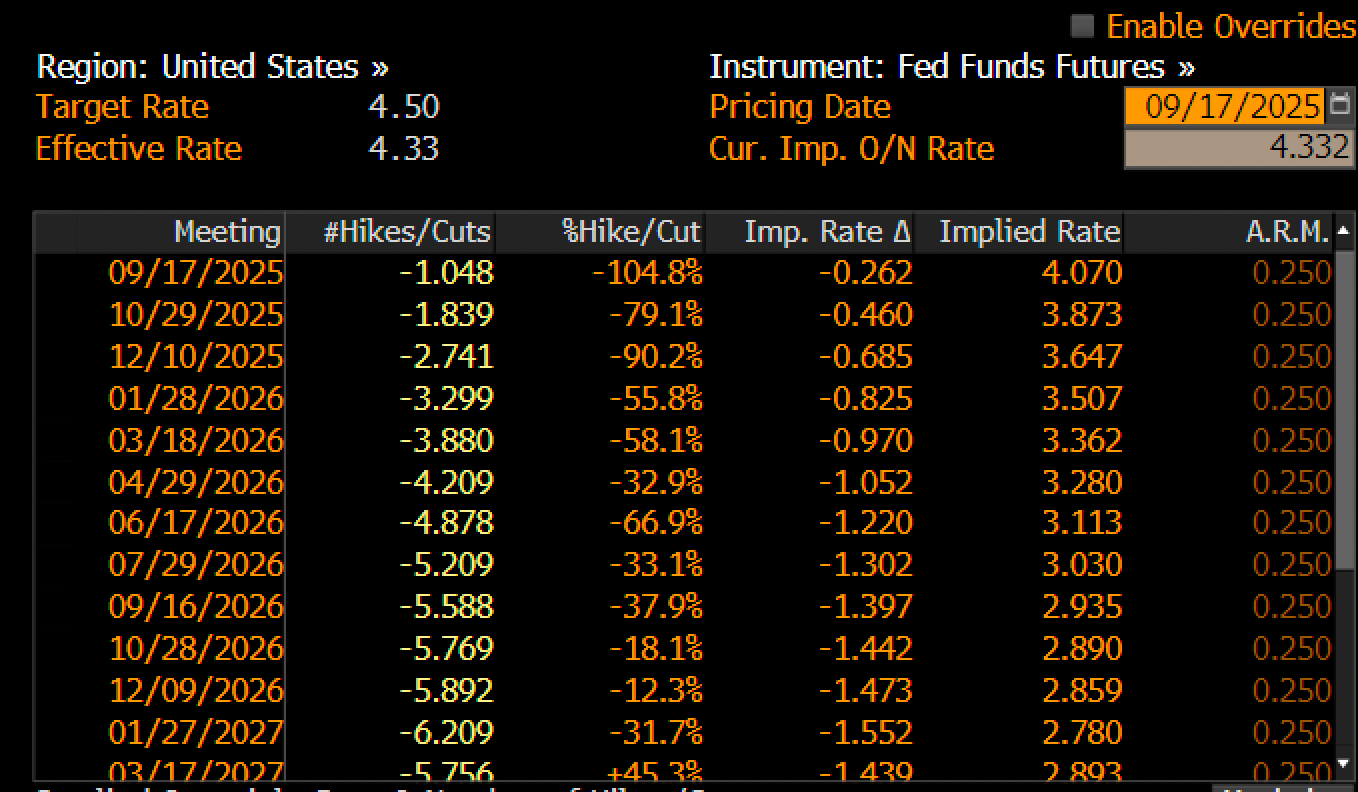

That, of course, has to be weighed against the expectation build-up, which has quite drastically changed over the past 6 weeks. Not too long ago, there were questions raised about whether the Fed would even need to adjust rates lower, given robust growth and a strong labour market. Two soft payroll prints and a sizeable revision later, we now price close to 3 cuts (69 bps) until the end of the year - one for every meeting.

Much focus is given to the fact that growth currently is holding up well, arguing that there is no immediate need for the Fed to cut proactively. This, however, misses the point that their entire job is predicated on safeguarding forward conditions, something that equity and commodity markets have already sniffed out. With around 150 bps loaded into the STIR market (see below), what can we expect and how should we play this?

The buy-and-hold long-only portfolio for this year has now crossed the +20% YTD mark. Much of my macro thinking is reflected in the asset allocation, which doesn’t change for the year. This doesn’t reflect my tactical macro trades, which I am sharing through the Substack Chat. To receive those updates, become a paying subscriber.

Let’s now dive straight into the pre-FOMC setups.