Friday Chart Book

March 28, 2024

Q1 is almost in the bank and what a relatively boring quarter it was. Great for asset holders, but I am sensing much frustration out there. As mentioned a few weeks back, my network of various investors and traders applying their time-tested strategies to this environment are all experiencing the same thing: boredom.

The common theme is that, given relative rate paths and the sense of magnificent synchronisation, there is just not much to get excited about as central bankers sing all dovish despite not meeting their mandate.

In my post about optimal control monetary policy and the likely path going forward using Taylor Rules, I declared the likely path for policymakers to be a higher-for-longer theme. See below.

Taylor Rule Update

I updated the Fed’s Taylor Rule for the current readings and applied a few scenarios.

Now, all of this is theoretical, of course, but we know that the Fed is using a form of Taylor rule approach as it is willing to ease ahead of meeting its target.

Interestingly, the Taylor Rule implied Rate would give 4.13% as the appropriate level of Fed Funds for 2024, which is roughly 50 bps below the Fed’s SEP and 40 bps below current market pricing. Further out, however, we see larger divergences, especially on the long-run rate where the Fed is 120 bps below the Taylor Rule.

Running a few scenarios would also highlight the Taylor Rule's sensitivities to changing growth and/or inflation dynamics. A G 3 / I 3 (Growth 3% / Inflation 3%) scenario would imply a 4.9% Fed Funds rate, which is very informative in the context that this would not necessitate further rate hikes.

The average of all scenarios is interestingly pretty close to current market pricing for 2024 rates, with the most bullish for bonds scenario being a G 2 / I 2 world, with an implied Fed funds rate of 3.9%. There is a trade in there for everyone’s view, but it needs to be a strong one from here.

The models had a terrific first quarter where we caught the major market moves correctly, especially in Equities. Bonds were a bit more choppy which equates to relatively lower hit ratios as we witnessed a range rather than trend environment. The same can be said for FX, while the calls for commodities, especially gold, oil and crypto, have been spot-on. I hope the models worked as nicely for you as they did for me.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts for a fee. If you are interested, ping me an email with your TV username.

I am close to reaching capacity in terms of the number of users granted access. After that, I want to limit the use, with only paying subscribers having the option to subscribe.

By now, most of you will be very familiar with the models and their signals. If not, please study the guide I have published. I have now also recorded a brief video tutorial, which you will find further below.

For now, let’s focus on what’s in front of us. So, let’s review the full book of 254 charts. We cover the whole asset spectrum from equities, bonds, commodities, FX and Crypto to give you the most extensive view.

Let’s go!

For a brief Video Tutorial on how to read the charts and the scripts, please see here.

Watch List

RTY & DJI are seeing reversal windows opening up (yellow candles & red histogram), which means that we are looking for a likely consolidation lower in the coming sessions.

FTSE-100 had a similar setup but is defying the consolidation call as we are breaking to new recent highs while momentum is still long.

GDX is seeing a leap higher, with another momentum-long marker coming through the week.

KRE saw a new momentum buy, switching from short as we broke out of the recent range.

LVMH is seeing a flip by the momentum model to short, trading just below the 20-ema line, with the 50-ema as support further below.

SANOFI is sitting at the 200-ema line with momentum long and a likely reversal sell coming through in the coming trading days.

TLT is seeing a flip by the momentum signal to long from short, although we have been in a range market for the past few weeks, so scepticism is warranted.

MSOS has climbed back to the recent highs, with the momentum model printing another buy signal.

US Rates Futures are still struggling to break above the 50 ema line, with only the 20 and 30-year being able to surpass the resistance. Momentum is short on all of them, but the US is 20 years.

German 10 & 30-year bond futures are seeing a buy momentum marker, joining the UK bond market for now.

SOFR 26 pricing is seeing new highs as curves flattened back aggressively, pricing out the easing cycle

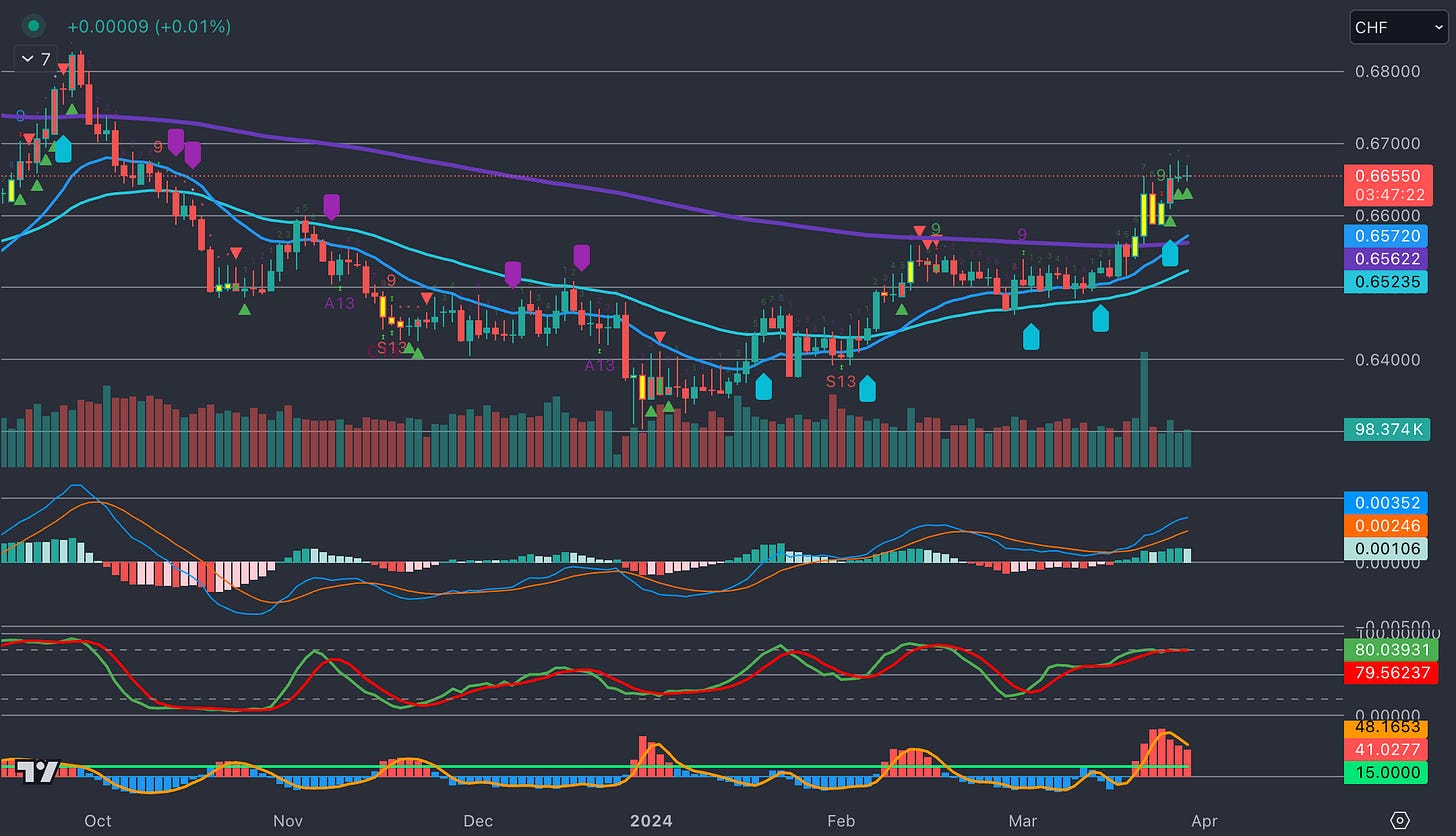

CHF is seeing a buy reversal indicator at current levels while momentum is still short.

GOLD saw a good pump on Thursday, climbing back to the intra-day highs from a week ago. Momentum is still long.

DOGE, new recent highs have been reached after a nice consolidation back to the 50 ema, which followed another buy marker. Well played by the model.

Equity Index

ES

NQ

RTY

DJI

FTSE

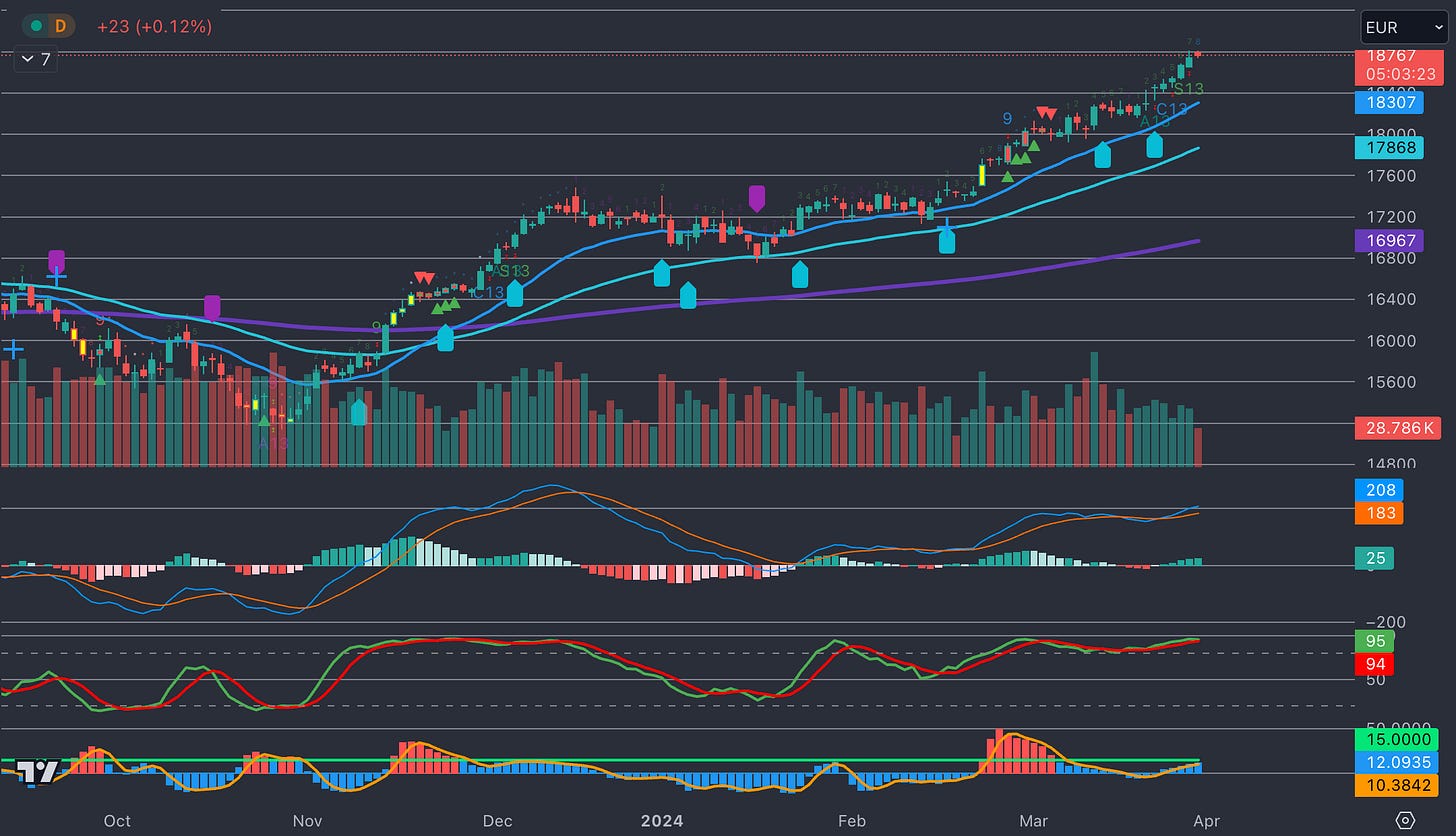

DAX

CAC40

ESTOXX

SMI

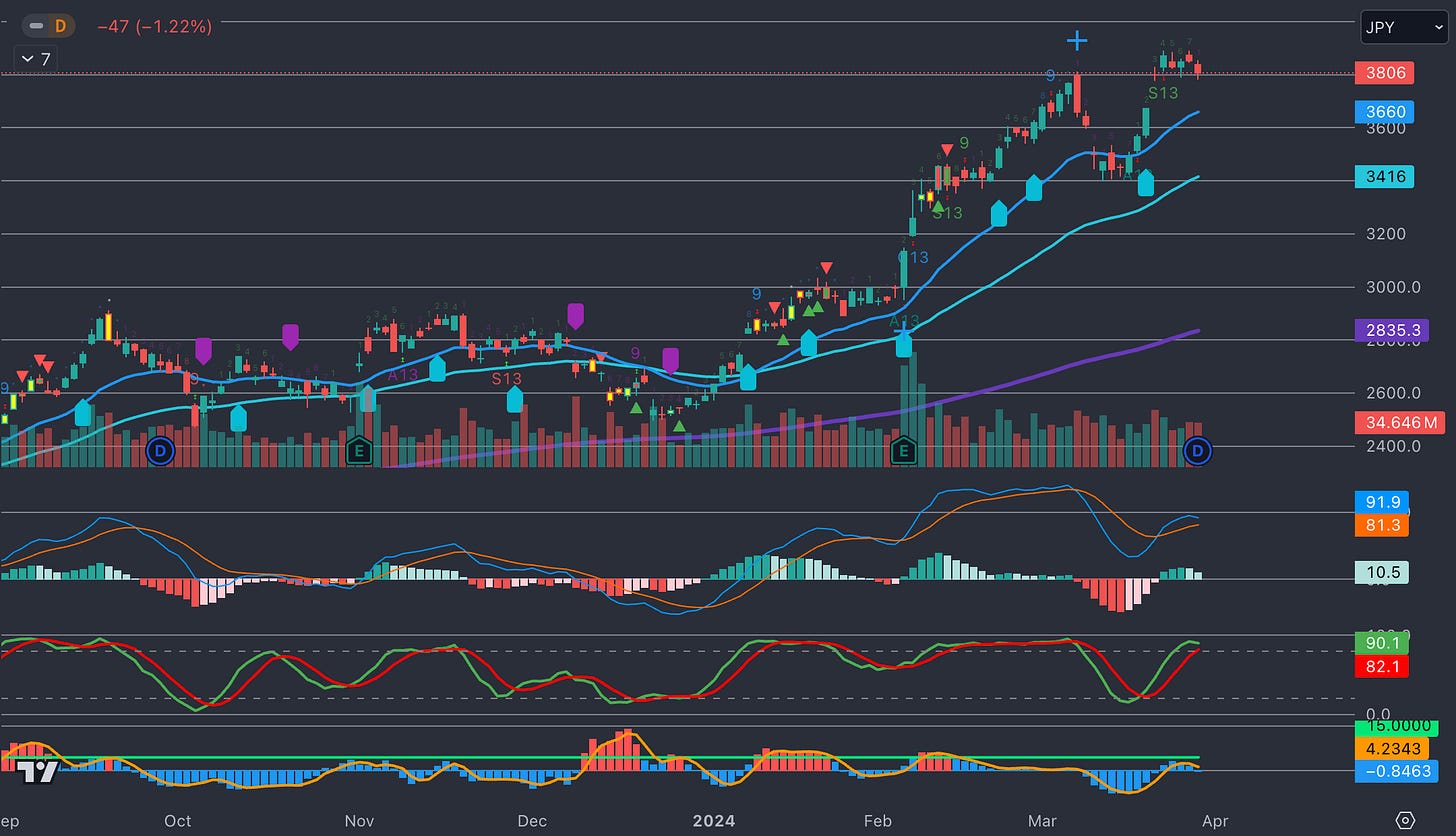

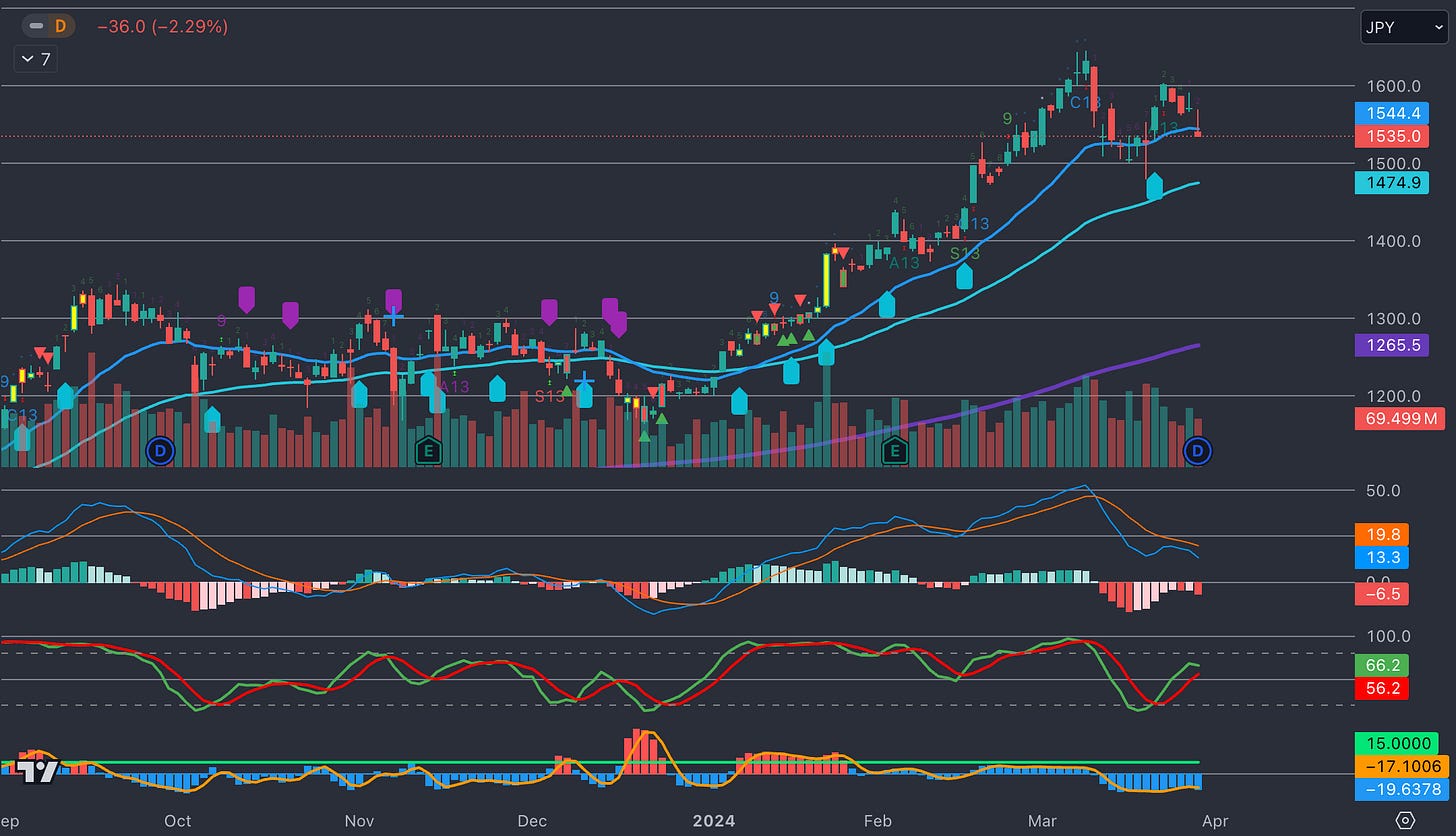

NIKKEI

HSI

HSTECH

CHINA A50

BOVESPA

ASX200

NIFTY

KOSPI

OMSX

TSX

Equity Sectors

XLE

XLF

XLB

XLI

XLC

XLP

XLRE

XLU

XLK

XLV

XLY

XOP

XHB

GDX

XME

XRT

SMH

IBB

KRE

OIH

US Stocks

AAPL

AMZN

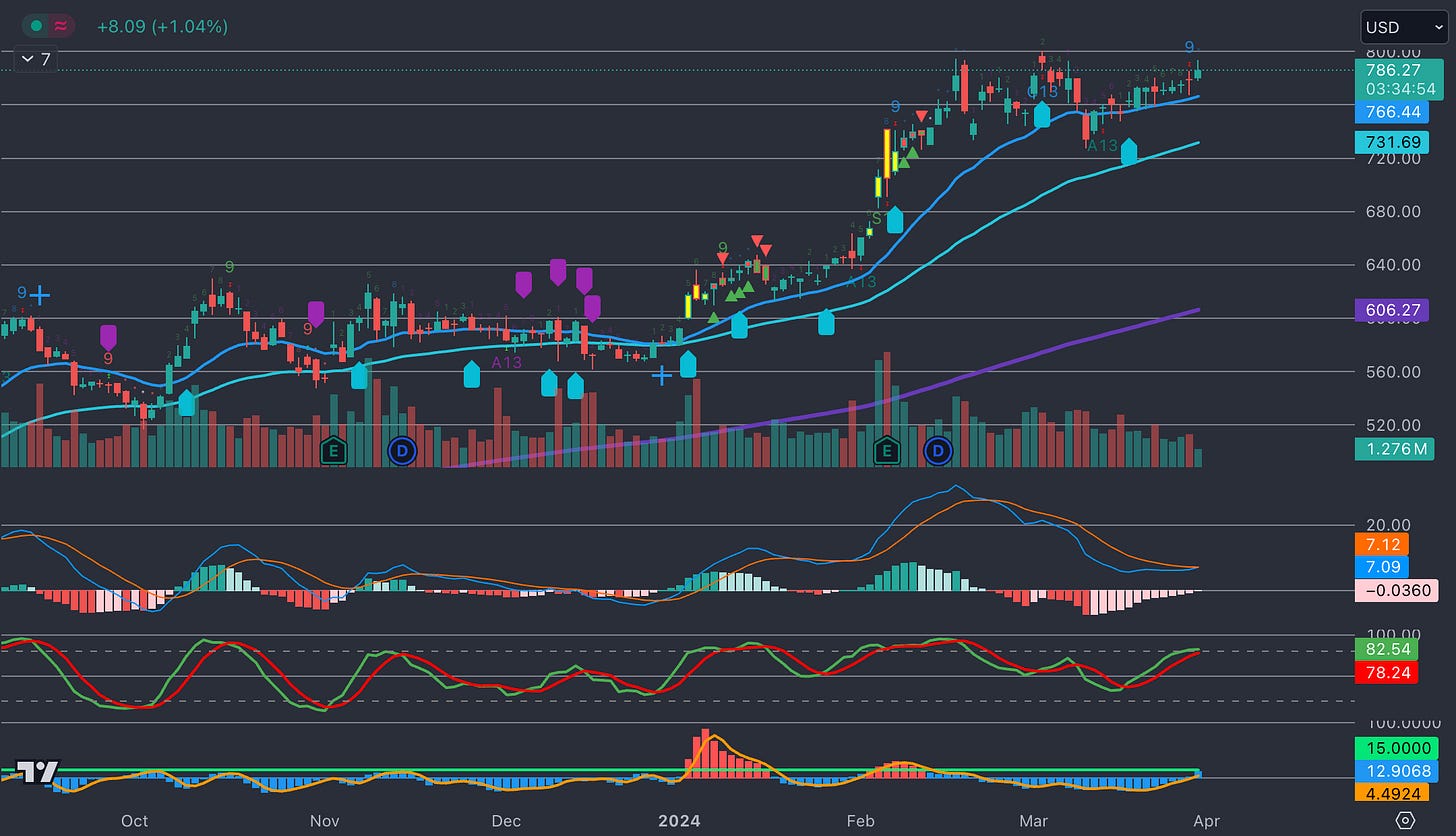

NVDA

MSFT

GOOG

TSLA

META

JPM

LULU

WMT

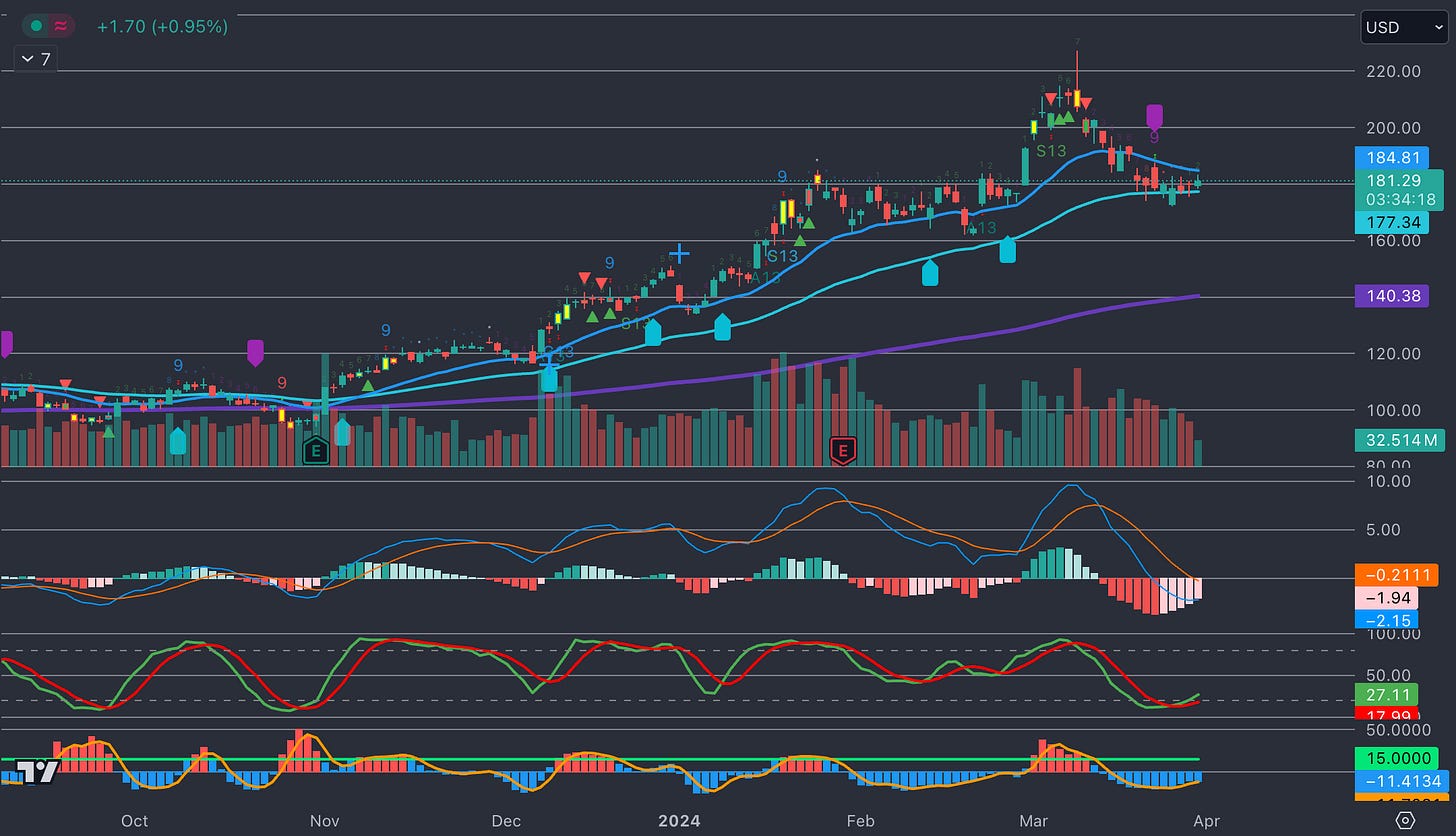

LLY

PG

AMD

PLD

TSM

NVO

XOM

BAC

CRM

CVX

KO

DIS

WFC

CSCO

BABA

INTC

QCOM

PDD

AMAT

CMCSA

VZ

UBER

PFE

MS

ARM

C

LOW

COP

T

SCHW

BMY

MU

PANW

BP

SHOP

GILD

WDAY

SLB

DELL

VALE

PYPL

MRVL

PLTR

OXY

COIN

SQ

SMCI

MSTR

International Stocks

ASML

NESTLE

SAMSUNG

TOYOTA

TENCENT

NOVARTIS

LVMH

SHELL

ROCHE

UBS

ASTRAZN

SAP

BHP

HSBC

TOTAL

RBC

SIEMENS

CBA

UNILEVER

SONY

TD

SANOFI

MITSUFJ

ALLIANZ

BP

AIA

DT

DIAGEO

GSK

RIO

Cross-Market ETF

EEM

LQD

HYG

AGG

VTI

VXUS

VYM

TLT

ARKK

VNQ

EMB

TIP

DBC

MSOS

LIT

SPROTT U

BOTZ

Rates

ZT US2

ZF US5

ZN US7

TN US10

ZB US20

UB US30

UK10

JP10

DE2

DE5

DE10

DE30

IT10

Greece10y

Aus10y

NZ10y

Can10y

Nor10y

Swe10y

Swiss10y

Brazil10y

China10y

Chile10y

Czech10y

Vietnam10y

Thai10y

Malaysia10y

Curves

US 2/10

US 5/30

US 10/30

US 5/10

US 5/7

US 2/5

DE 2/10

GB 2/10

JP 2/10

SOFR 2024

SOFR 2025

SOFR 2026

IT 2/10

FX Futures

EUR

GBP

JPY

AUD

CAD

CHF

NZD

MXN

BRL

ZAR

NOK

SEK

DXY

FX Minors

AUDJPY

EURCHF

AUDNZD

NOKSEK

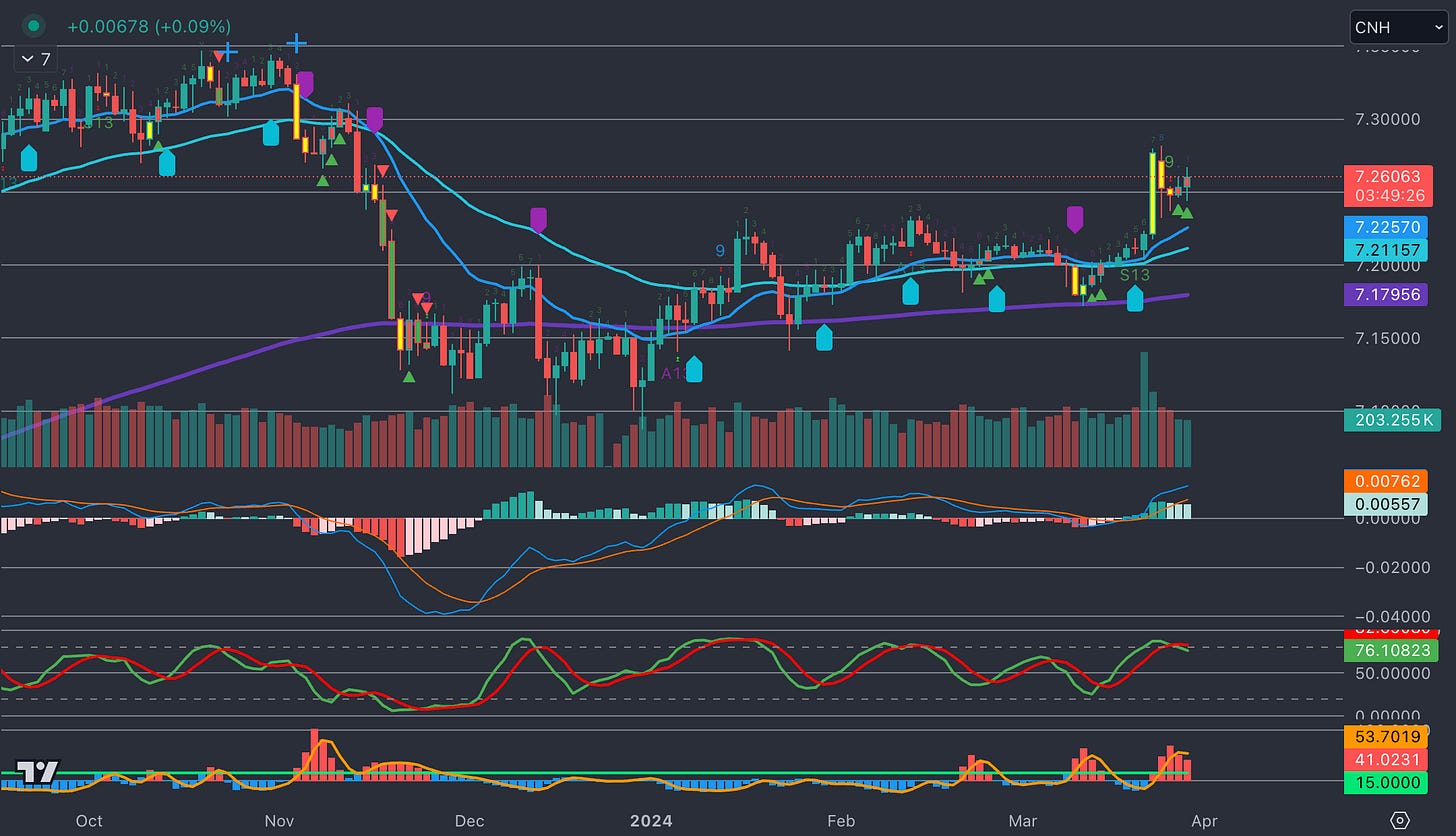

USDCNH

USDKRW

GBPJPY

GBPCHF

CADJPY

CHFJPY

EURCAD

CADCHF

INRJPY

USDHKD

USDSGD

EURNOK

EURSEK

CHFNOK

USDTRY

USDILS

EURPLN

EURHUF

EURCZK

USDIDR

USDINR

USDPHP

USDTHB

USDTWD

Commodities

GOLD

SILVER

CRUDE

COPPER

NATGAS

PLATINUM

PALLADIUM

WHEAT

CORN

COCOA

SOYBEAN

COTTON

LIVE CATTLE

ORANGE JUICE

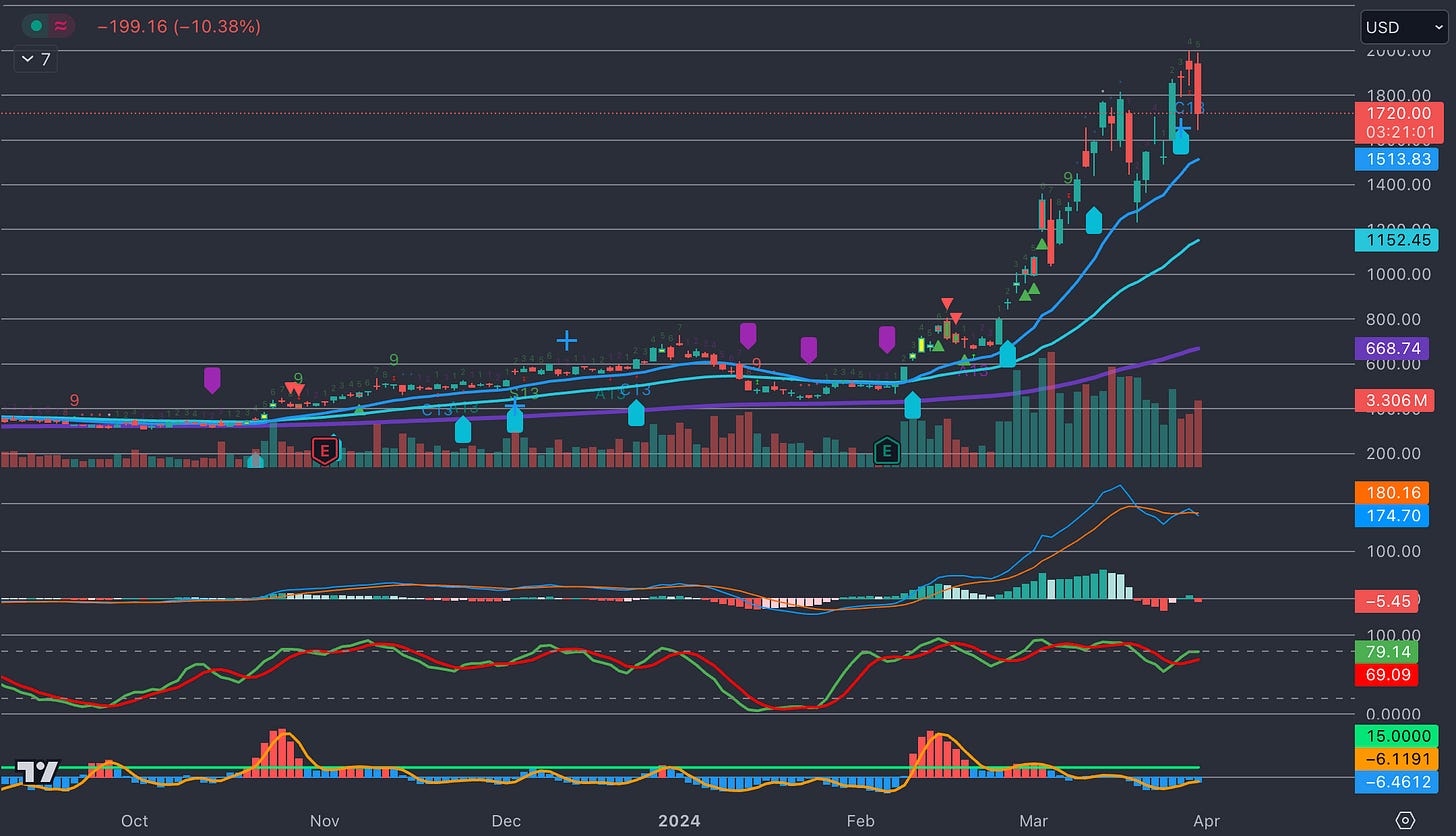

Crypto

BTC

ETH

SOL

XMR

XRP

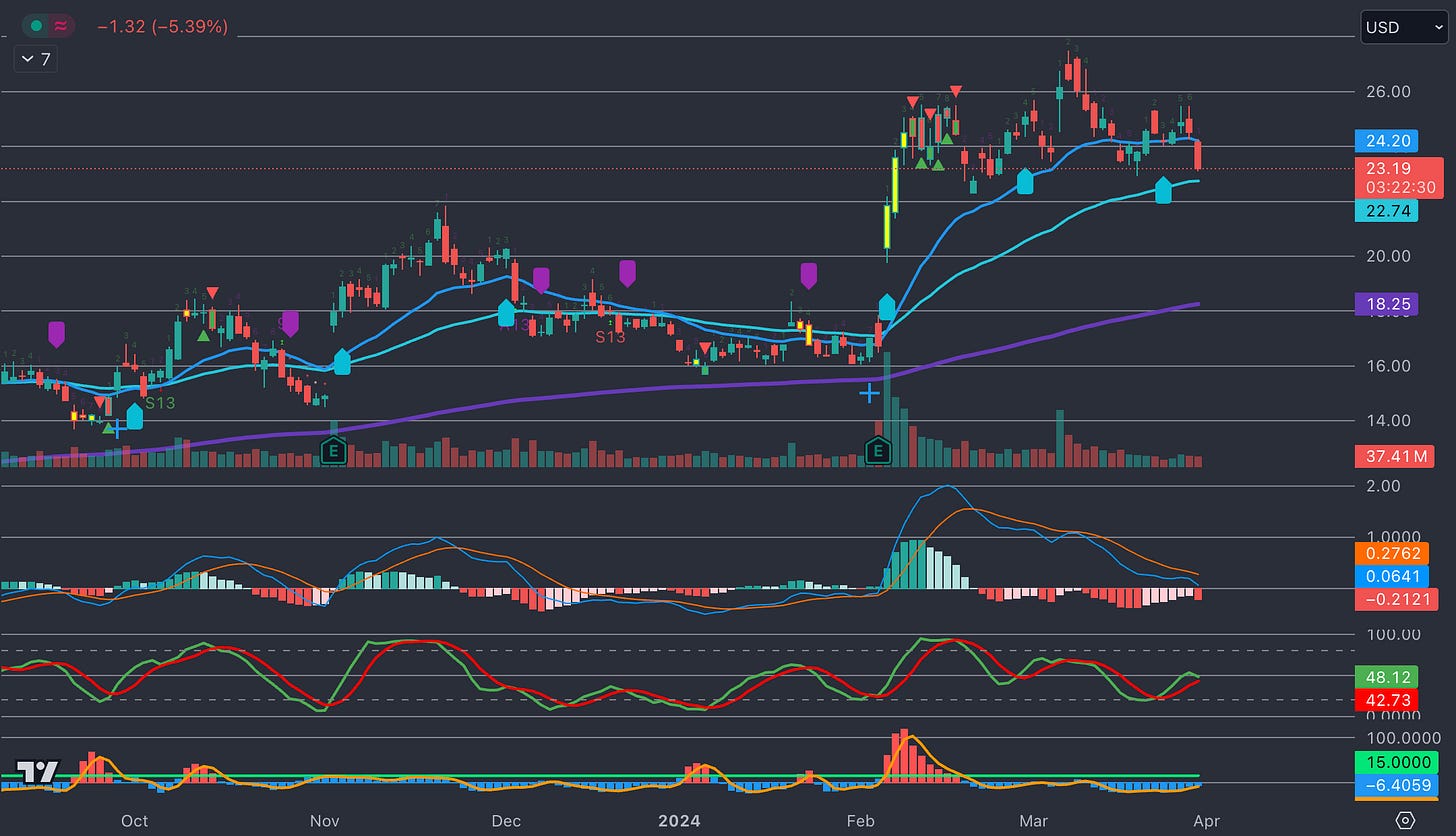

DOGE

ADA

LTC

MATIC

DOT

HBAR

AVAX

TRX

BNB

Have a wonderful and blessed Easter break, everyone.

We will attack Q2 from Monday.

Best of Luck out there!

You too, have a wonderful and blessed long weekend.

PS this week was not boring for those of us overweighted in BTC, MSTR and ETH. :-)