Friday Chart Book

Macro Restart / Political Focus / Full 250+ Chart Book

The first trading week of the year is behind us, and the focus, as was so often the case last year, has once more been snapped away by political developments and their implications. It’s almost as if nothing coming from the White House can shock these days anymore. While this might be true at the moment, I am sensing that the developments so far will matter much more in a few weeks and months’ time. Macro D has written an outstanding piece on the latest political developments and how they could potentially affect markets going forward. I highly recommend it.

As I write this, we are awaiting payrolls as the macro calendar turns over. I am expecting a beat, and I’m going for a number north of 130k, with the risk of the unemployment rate dropping more than expected. Bond markets have been relatively muted at the onset of the year, but the renewed focus on the macro calendar might reinvigorate rate bets.

More importantly, I am focused on the upcoming inflation prints, which I think the market is underpricing. It wouldn’t surprise me if core comes in closer to +0.4% versus the +0.3% consensus. But that doesn’t automatically mean that inflation is re-accelerating. A decent chunk of it is mechanical catch-up from the messy October/November data collection disruptions.

The bigger issue for me is that the signal quality remains poor. Even if December patches some holes, it doesn’t clean the whole window. Rents are still a lingering fog until April, which means CPI can keep understating (or misrepresenting) what’s really happening beneath the surface. So we end up with a market that demands clarity, a dataset that can’t provide it, and a whole crowd pretending they can nowcast truth from a broken thermometer.

What does the Fed do with this information? Probably what cautious risk managers do: they slow down and triangulate. If inflation prints are unreliable, they’ll lean more on labour and wages, but they already seem biased toward a pause and a “wait-and-see” posture anyway. In other words, a couple of spicy CPI prints may create volatility, but not necessarily conviction inside the Fed.

Then there’s the tariff/legal headline risk from the IEEPA ruling, which we might see some clarity on Friday. If the ruling brings clarity and firms finally know the framework they’re operating under, you can imagine more pass-through showing up sooner. If it goes the other way, do prices really roll back meaningfully — or do we just trade another chapter of uncertainty?

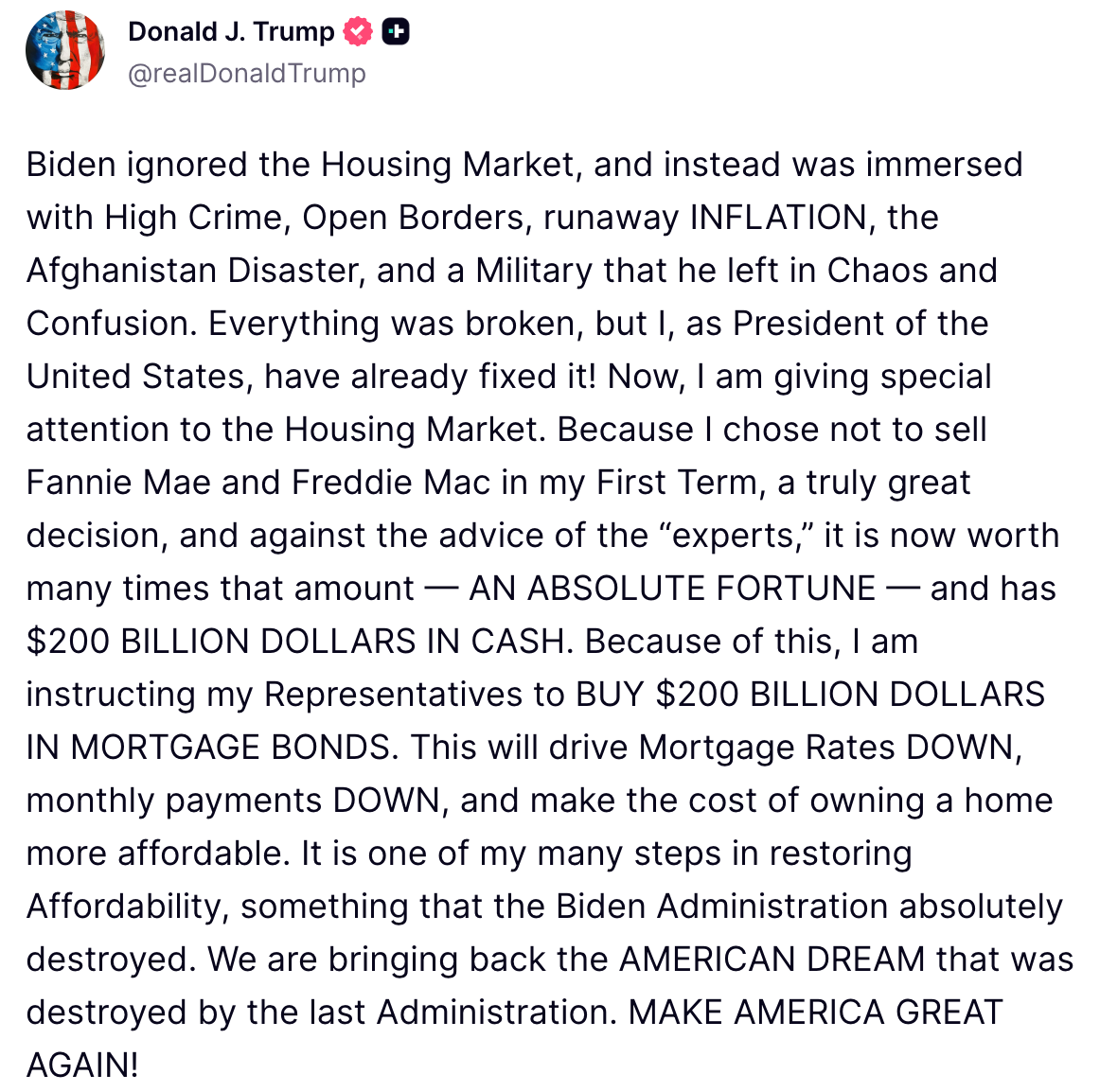

Just as I’m writing this, Trump has been busy again and decided to use the Mortgage Agencies to buy up mortgage debt to bring down financing costs. It won’t work. But it clearly shows the pressure Trump is under to tackle the affordability crisis.

The Paper Alfa buy-and-hold portfolio for 2026 has posted a good start to the year so far, up by more than 2% YTD as of Thursday’s close. See the link above for the detailed allocation summary.

Let’s now read some of my friend Macro D’s thoughts on the latest political developments and the macro outlook before we go through the entire chart book, comprising 250+ charts of the whole macro universe (Equity Index and single names, Sector ETFs, Rates, Curves, FX, Commodities and Crypto).

It’s going to be a long year, so let’s dive straight in.