Friday Chart Book

Davos Rupture / Market Thoughts / 250+ Global Macro Chart Book

Another eventful week is coming to a close. Needless to say who was running the show this week with a solution for Greenland now firmly on the cards. Risk markets panicked a bit and were then rescued back to trading flat on the week.

What comes next, and what have we learned? Much of my thinking is aligned with Macro D and his excellent piece about the current situation, dissecting history and the likely path ahead. It’s free to read, and the third instalment will be published in the coming weeks.

Having listened to all speeches that mattered, I was left with a few conclusions. Rupture is the word, and while our esteemed leaders are all dancing around the Donald, there are now things that can not be undone.

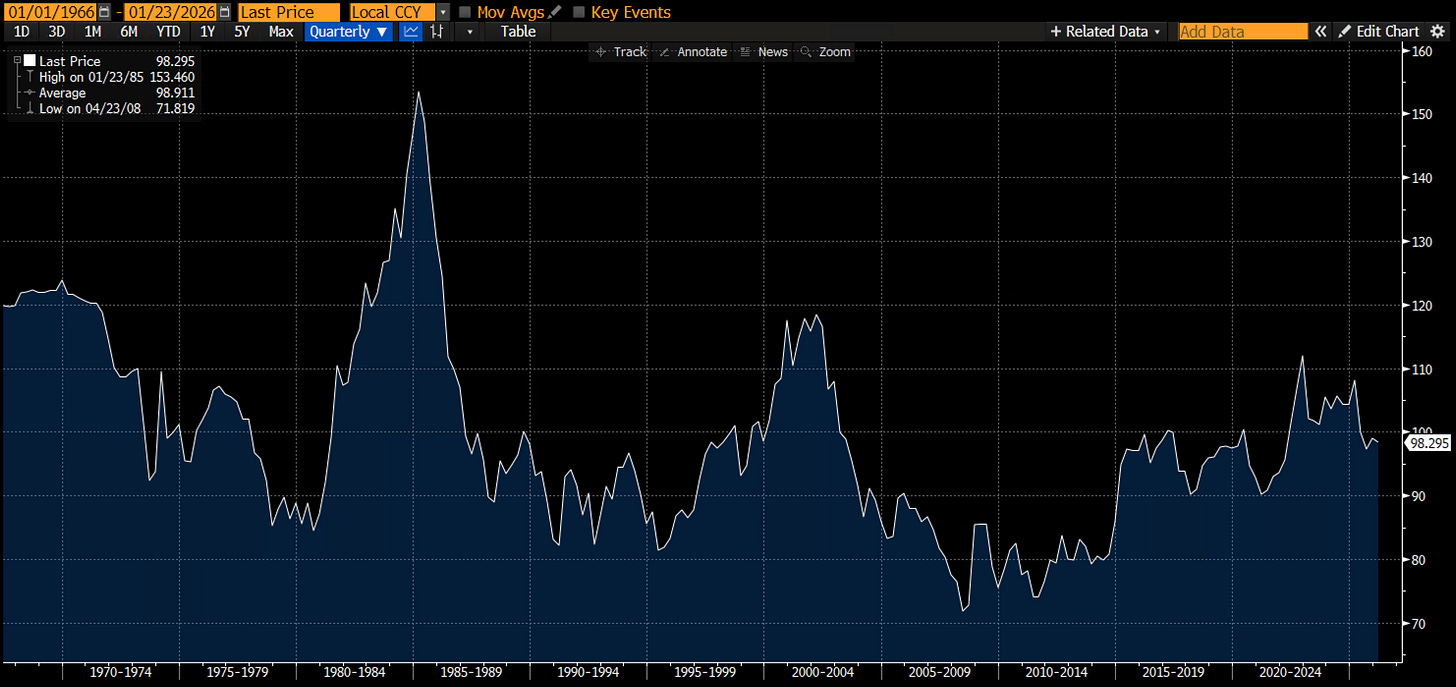

My first thought is that US assets held by foreigners are slowly going to bleed and will need to find a home somewhere else. Easier said than done, given the deep and liquid markets the US offers. This supports my overall view that USD strength will be capped throughout the year and possibly beyond. DXY chart below.

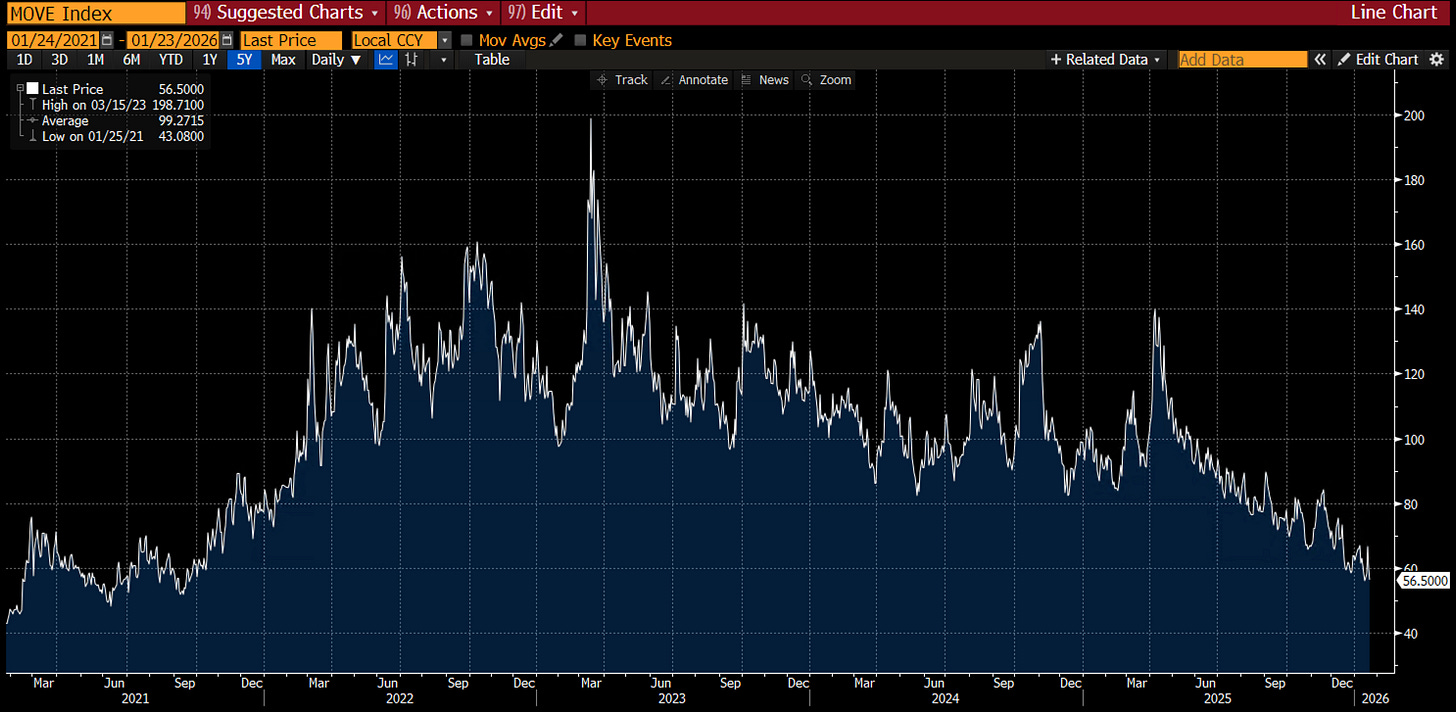

My second thought is that bonds, globally, will show much more idiosyncratic moves compared to the past, where US rates were the drumbeat for global rates in the developed world. Ironically, implied ATM volatility for Treasuries has collapsed to new lows (see chart below).

Re-industrialisation and striving for energy independence will probably drive real rates higher globally, as evidenced below for G3 and their respective 5y5y real rates (US blue, UK, purple, EU, white). Smaller current accounts and higher deficits will be the name of the game going forward.

I am prepared for this new dawn, and I shared my thoughts on a suitable allocation for the 2026 buy-and-hold portfolio, which has done an outstanding job and performed as intended over the past weeks as volatility increased, protecting downside, while maintaining suitable upside exposure. We are tracking +4.5% YTD so far, compared ot the SPX, which is up below 1%.

As the year progresses, I am thinking of writing more ad-hoc, detailed thoughts and trade ideas around macro, as I am expecting much more volatility ahead, certainly more than is currently priced. The format will likely be shorter notes through the Substack chat platform. This is in addition to the wide range this place already offers and will only be for paying subscribers.

Alongside it, the technical trading models and allocation outputs will continue to inform us about the world and macro currents.

A reminder that you can use my trading models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read some of my friend Macro D’s detailed thoughts on Davos speeches and their implications, Japanese bonds and his current Macro FX book, before we go through the entire chart book, comprising 250+ charts of the whole macro universe (Equity Index and single names, Sector ETFs, Rates, Curves, FX, Commodities and Crypto).

Have a blessed weekend, let’s hope it’s for once quiet.