De-Synchronisation Theme?

When the waiting for the Fed ends

I briefly mentioned the evolution of the new theme of de-synchronisation in this week’s ATW. See below.

While everyone was waiting for the Fed to open the door to the coordinated policy easing, recent data and a sharp repricing of front-ends put a sharp stop to that strategy. Some central bankers are now forced to consider steering policy away from the Fed’s autopilot reaction function. We have already heard the ECB opine that it wants to diverge itself from the Fed’s actions. The USD took obviously notice with plenty of markets now at key levels where a new bearish trend could materialise.

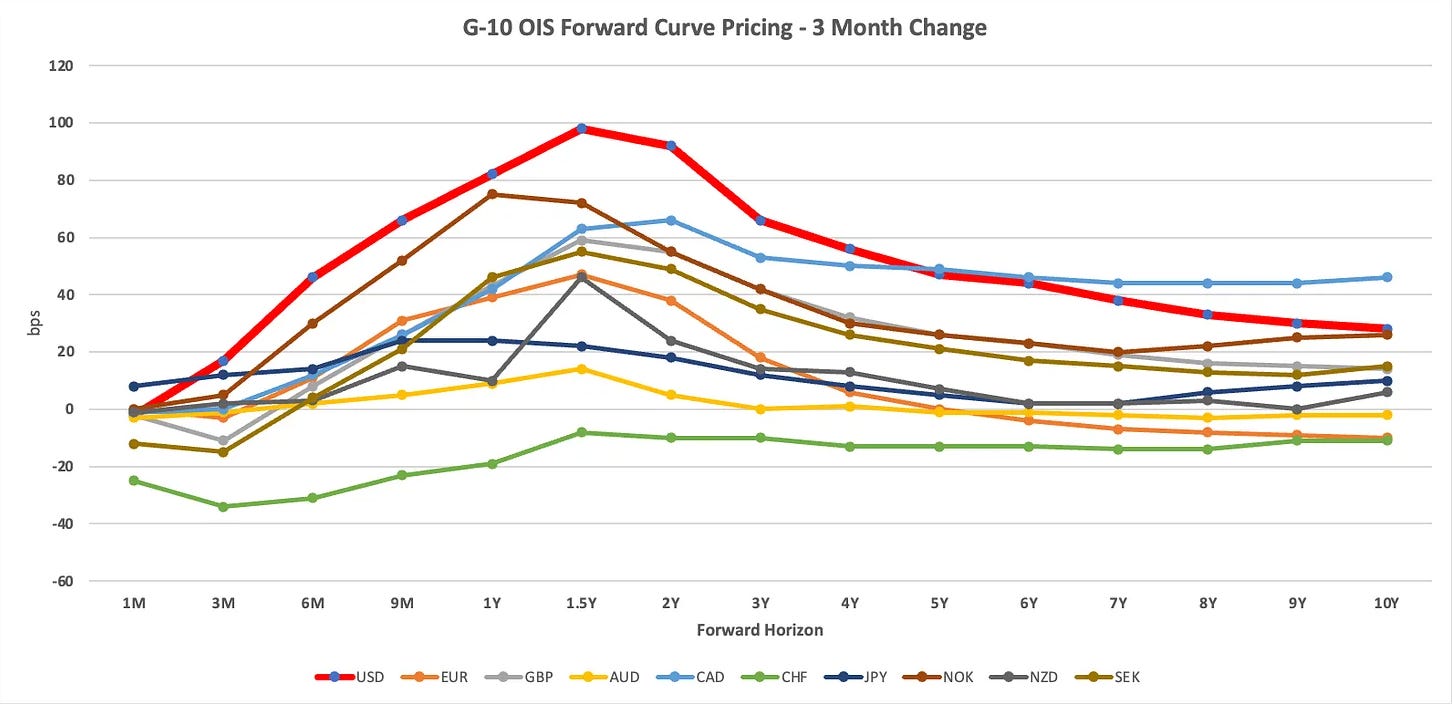

The relative change over the past 3 months in G-10 STIR rates has opened the spectre for spreads to follow a less synchronised pattern from here.

Let’s explore this in more detail. I will also outline how I think about playing it from here.