Attack the Week (ATW)

April 14, 2024

Sunday Thoughts

The events over the weekend involved a first-ever direct Iranian attack on Israel involving drones and missiles. A lot of speculation and extrapolation of events is already taking place, which I am sure you can read tons about in Fintwit. I am no geopolitical analyst, and I am well aware of my limitations in calling any possible outcome to this situation.

Those events, while worrying, usually leave only a brief mark in financial markets. By now, most will have learned the lessons of the Ukraine/Russian escalation and the more recent Israel/Hamas war. As such, I am obviously curious to see how markets react once we open for the week. However, I wouldn’t be surprised if most of the initial moves reverse as we progress through the week.

It is also important to keep in mind that markets had already digested the possibility of an attack on Friday when the news broke. This sent risk assets lower, with a bid materialising in bonds and the USD. Gold, in particular, showed very interesting price action on Friday, where we saw a huge intra-day candle which then resulted in a lower daily close. This typically is a bearish pattern.

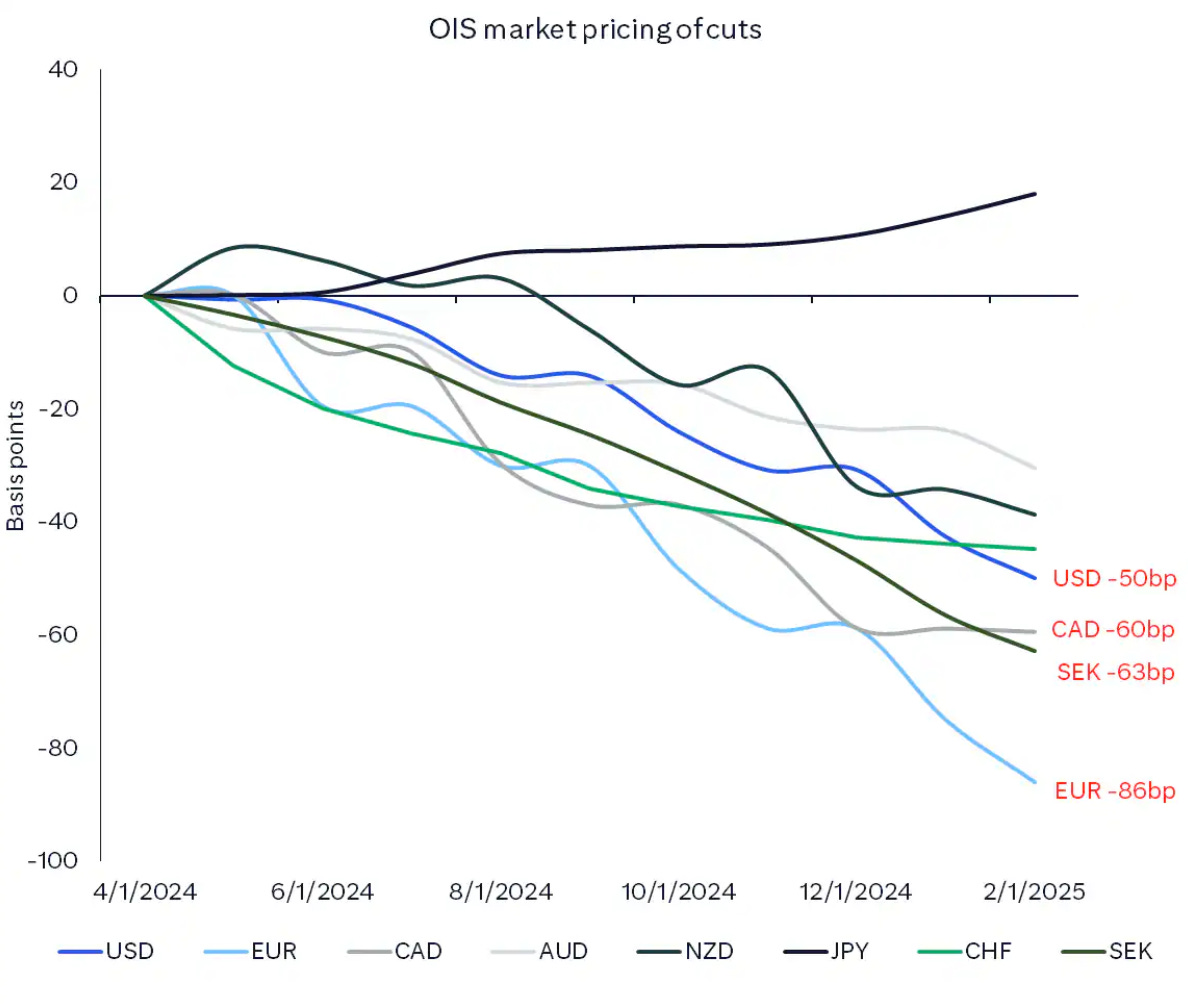

There is an increased theme of a de-synchronisation of forward policy paths developing. Data in Europe and China, as well as dovish ECB speak, reaffirms attractive US interest rate differentials, driving the bid for the USD. An additional 12 bps of ECB rate cuts have been added to the curve since Lagarde’s speech. “Now it’s time to diverge,” Stournaras said on Friday, reiterating his expectation for four rate cuts this year.

EURUSD is trading at key levels as European bonds outperform their US counterparts. A huge miss in the Swedish CPI helped develop this theme further. See the chart below for relative OIS pricing for the year-end 2024.

Let’s now look at what the week has in store for us while also considering the most important charts for the busy week ahead, which will see the first full week of earnings focused on financials.

Let’s go!