Attack the Week (ATW)

September 24, 2023

Monday Thoughts

My mother-in-law had a few tough weeks after recovering from an operation. She is in her late 70s and has struggled with all the post-op medication given to her while trying to get back on her feet again. It doesn’t help that she is a proud and strong Irish woman who has been independent all her life, working since she was about 14 and then raising five children. But I have been offering my services and worked from their house for a few days, helping where I was needed and walking the dog a few times a day. She has been getting stronger by the day and also finally managed to go out for a little walk, which is encouraging to see. Hopefully, the lady will bounce back to her previous strength soon.

It is not easy getting older and becoming more fragile. It has prompted a lot of thoughts about my own health and how to at least prepare for the inevitable weakening process. A strong and positive attitude, of course, helps. Resilience is very strong with the older generation. There is certainly an element of becoming stronger during testing times and building the extra bit of toughness required to endure what’s to come. The process of hormesis is a key ingredient in stressing a system in order to generate strength. This is true throughout nature, and I would argue that it is also healthy for financial systems. The outcry over the recent rise in bond yields is maybe an indication of how weak of an overall system the post-GFC QE world has become. What if this is the best thing that could actually happen to financial markets?

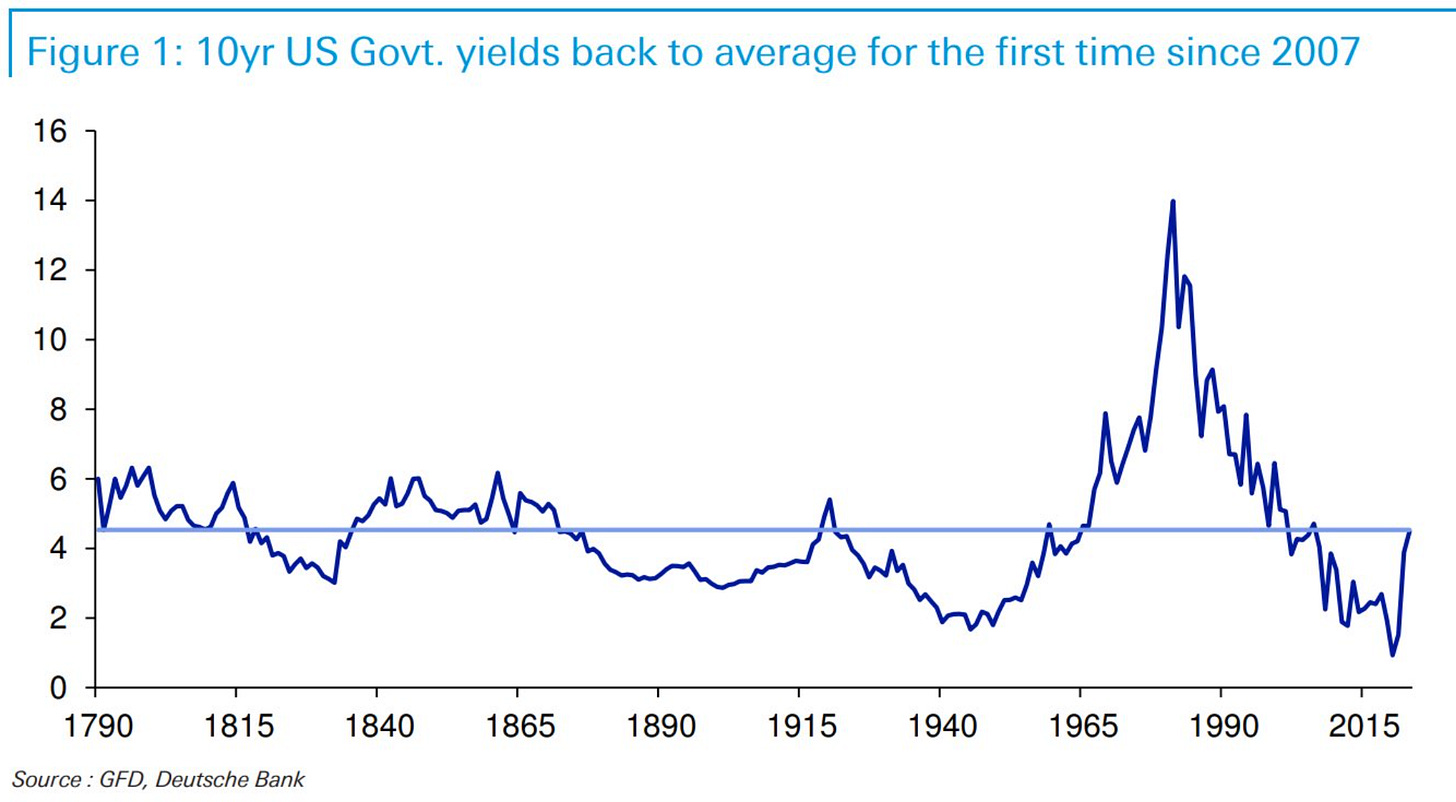

Looking at the below chart, we are now back at the average yield in US 10-year government bonds over the past 230 years. Hat tip to Michael Kao who had this chart in his tweet over the weekend. A certain recency bias gives us reason to think that we are due a quick rundown of yields to recent lows. What if not?

As market participants, we often fall victim to fighting the last battle rather than anticipating what secular shift is currently in force. Nobody is immune to this. A thorough regime analysis is required to look at what is possible rather than just where we came from.

Such a shift change was felt and required when we had the first US rate lift-off in March last year. Once we reached 2.5%, we looked at what happened in 2018 and concluded that it wouldn’t likely be possible to hike beyond that level as it previously broke a few things, especially equities. That was clearly a wrong assumption.

Now, we are at yield levels last seen in 2007 and again, narratives are doing the rounds that we couldn’t sustain those yield levels for long for a variety of reasons. I actually have sympathy for this view as I believe the unstressful times of ZIRP have weakened the overall capacity of markets to endure higher rates for too long. I could be wrong, of course, and I opined in an earlier post about how the recent rounds of QE have possibly damped the effects of those steep rate rises.

Overall, however, I do think this to be a positive development. An economy that can endure higher rates is a welcomed signal that we might indeed be due a bit of a regime shift, with rates normalising to levels that were previously way too loose and led to misallocations across financial markets. Rather than envisage the immediate fall of such an empire, I am open to the idea that we are in the middle of a process, which will be bumpy but longer-term, the necessary stressor that will be beneficial to the system as a whole. I might be too optimistic for my own good here, but there are quite a few big implications of such a view. I shall expand on this in a separate post.

Friday’s Fedspeak stayed committed to this "higher for longer" regime despite the new yearly low in the US PMI composite. Treasuries still ended the week stronger, and curves flatter because of positioning. Growth/tech stocks temporarily enjoyed the lower yield environment but weakened into the close. Friday’s charts highlighted the possibility of a short-term reversal in bonds. I will pick up on the implications further below when we look at the charts for the week.

SPX, however, ended below a critical support area, though selected high-beta G-10, emerging market FX held onto gains against the dollar. USDJPY climbed back to 148.4, given a dovish BoJ. EUR erased its modest gains post-EU PMI, while GBP found some support at 1.224.

This week will see the month and quarter end with all its usual shenanigans and rebalancing occurring. Typically, a very high noise to signal week. Mid-autumn festivities in Asia and China's incoming Golden Week (Oct 1) will add to the choppiness. Monthly inflation reports get released in the EU, alongside core PCE in the US. Fedspeak, ECB speeches, and more central banker appearances are likely due. UAW strike and rates' auctions will make headlines.

Now, let’s look into each of those components in a bit more detail. Let’s also look at the charts for the week as well as our watchlist for you to consider.