Attack the Week (ATW)

March 30, 2025

Sunday Thoughts

Today is Mother’s Day, and I celebrate and salute all mothers. I have so much to thank my mother for. Though she is no longer with us, her wisdom and teachings still shape every part of my life. She was a tough cookie and ruled her household with a strict moral compass. There was no escaping. Being from an immigrant family, she ensured we were accustomed to all traditions and integrated into society flawlessly.

She was a fierce fighter, standing her ground when it mattered and defending us in every possible way. She knew education would be the most critical aspect of raising her boys, so she always made sure we completed our homework on time. I was a sluggish learner in my earlier school days, but despite working several jobs, she made time and created more homework for me to ensure I kept up with the rest. I hated it back then, but I’m forever grateful for her dedication.

Although our family came from humble beginnings and was strapped for money, she never wanted us to miss out on anything. Working night shifts, she would go home every morning and make us breakfast before we had to leave for school. Our family was her life, and she asked little in return but to be a good person and work hard. She was incredibly generous to others and helped people where she could. She believed in Karma and that good things come around. I have indeed witnessed it on many occasions.

She taught me everything that matters — how to be strong in adversity, kind in the face of hardship, and humble in the presence of success. She taught me the value of hard work, the power of a gentle word, and the strength of showing up, even when life seems overwhelming. Her unwavering belief in me, even when I doubted myself, has been my greatest source of strength.

Today, I know that a large part of who I am is because of her. She is forever a part of me. Thank you, Mum, for everything.

Now go and hug your mothers and give them flowers.

Clocks moved forward in Europe this weekend. I cleverly wanted to front-run and change the clocks in the house, only to be reminded by my wife that I had changed them backward. So, here we go again. Maybe I am subconsciously trying to escape next week, which could get messy. We have month and quarter ends and then April 2nd’s tariff announcements to deal with. Not an easy week, and markets are clearly already getting nervous ahead of it.

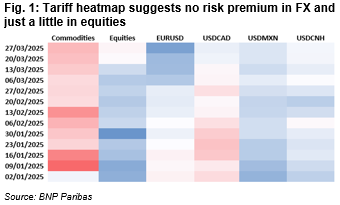

How much is priced? BNP has provided a heatmap, which would indicate that various asset markets exhibit different risk premia ahead of the announcement. I would take this with a pinch of salt as different markets have to price in different growth and inflation dynamics ahead. I’d think the FX markets are possibly the best indicator, and they are still seemingly relaxed.

Which countries are most vulnerable? Again, that really depends on the tariff route taken. The table below, again from BNP, shows the various permutations.

I put together a macro roadmap in Friday’s Chart Book, which I would encourage every subscriber to read and bookmark. Trade and Budget Deficits, as well as Net International Investment Positions, are at extremes, and their prospective deltas are going to have significant macro impulses for the road ahead. For subscribers, I will, therefore, add a macro blueprint to the mix of available tools. Our allocation and tactical models are doing their job as they should, but we need to expand the arsenal in these potentially unprecedented times. The goal, as always, is to help all subscribers in these times.

This is a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read Macro D’s latest thinking before briefly scanning the week’s upcoming calendar. We then revisit some charts, which give us some interesting setups. As always, we close with a look at the output of our asset allocation model. It had another positive week last week despite all the noise. Let’s see what it decides to do for the upcoming trading days.

Let’s go!