Attack the Week (ATW)

Narratives & Trades / Tariff-Man is Back

Sunday Thoughts

Nothing sharpens a narrative like price action. Often, it will be born out of a surprising move, just to discover whether we are facing a new truth. Financial markets don’t work on the prospects of equations, and often, valuations don’t matter while a narrative is driving flows. It amazes me that many pundits forget how markets ultimately work. Yes, fundamentals matter, and real macro forces drive ultimate results, yet there are periods where collective psychology turns the short term into a feedback loop. This isn’t always at extremes, but rather a function of how tightly participants cling to a story, especially when prices cooperate. We'll see furious rallies just as easily as a depressive spiral when the winds change.

In the end, markets eventually reconcile with reality, but that reconciliation can take longer and be more violent than most expect. In the interim, narratives will shape price action more than spreadsheets will, and our biggest edge is in recognising when momentum is the message. That’s why I combine a rigorous top-down macro approach with sentiment and positioning while taking the pulse in my rigorous technical analysis approach, deciphering whether markets are telling me something will be on the move.

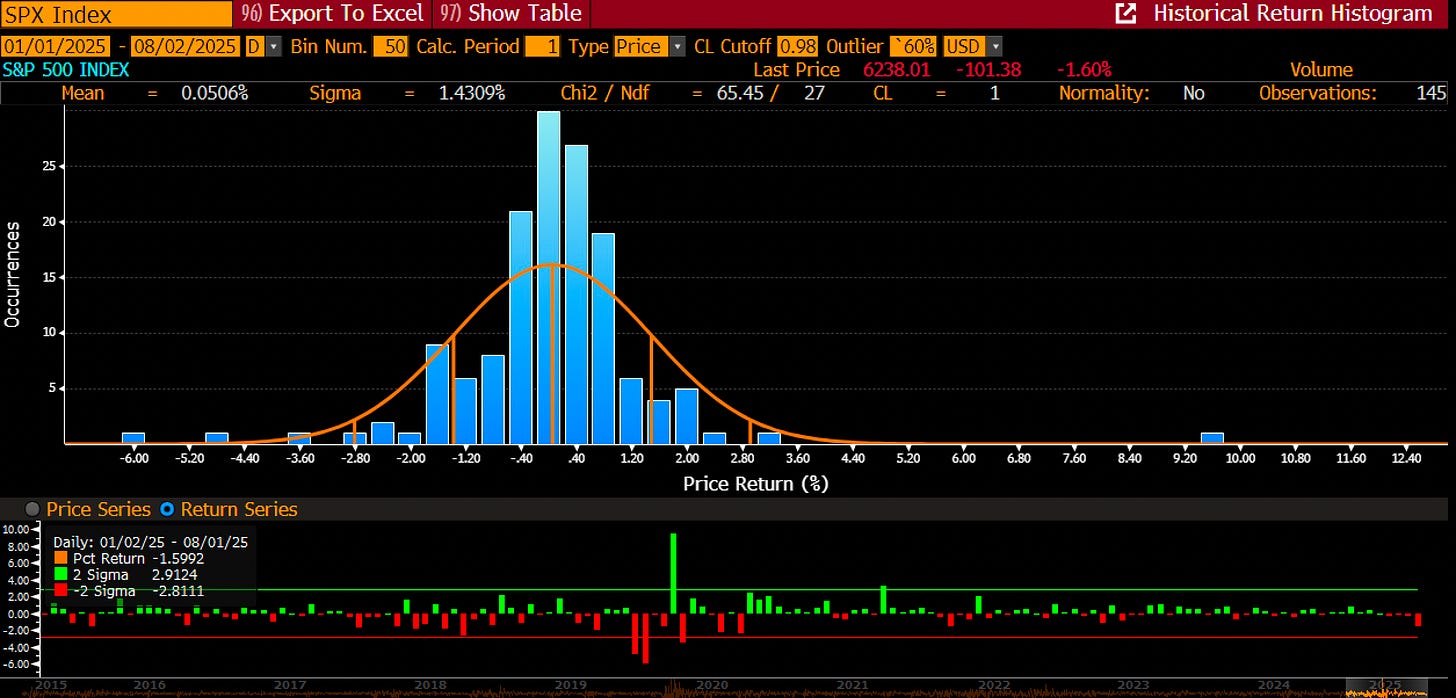

This week was one of those moments when I thought that the set-up grew fragile in risk assets. The truth is that assessment can often be misconstrued, and I can find myself having the same view multiple percentage points away. Timing, as they say, is everything. An impossible task for many, but why not pursue it? This week, I bought downside in the SPX, which was pretty close to the top. Sometimes the ducks align. Subscribers were told about the rationale and trade structure in Friday’s Chart Book, which was sent out before payrolls were published.

This is part of my new interaction with subscribers, where, in addition to asset allocation and technical models, I structure trades in a hypothetical 100 mio USD hedge fund portfolio. This is often expressed through options. So far, we bought ZN (7-year Treasury bond) upside, EURUSD downside, and the most recent trade is putting on SPX downside. I will also use Notes to communicate more immediate thoughts and trade structures. For readers who are not yet making use of Notes, I would recommend joining my chat.

Payrolls helped my trades nicely. I don’t need to rehash the details. The revisions were shocking. Participation increased, which helped the U/E rate from printing closer to 4.4%. The ISM Manufacturing Employment index slipped to levels last seen during the COVID-19 shutdowns, and anecdotes in the survey suggested layoffs and uncertainty about demand. Payroll gains are concentrated in health care and social assistance, while federal government employment continues to decline. Those sectoral divergences reinforce the narrative of a labour market losing steam even as wage pressures persist.

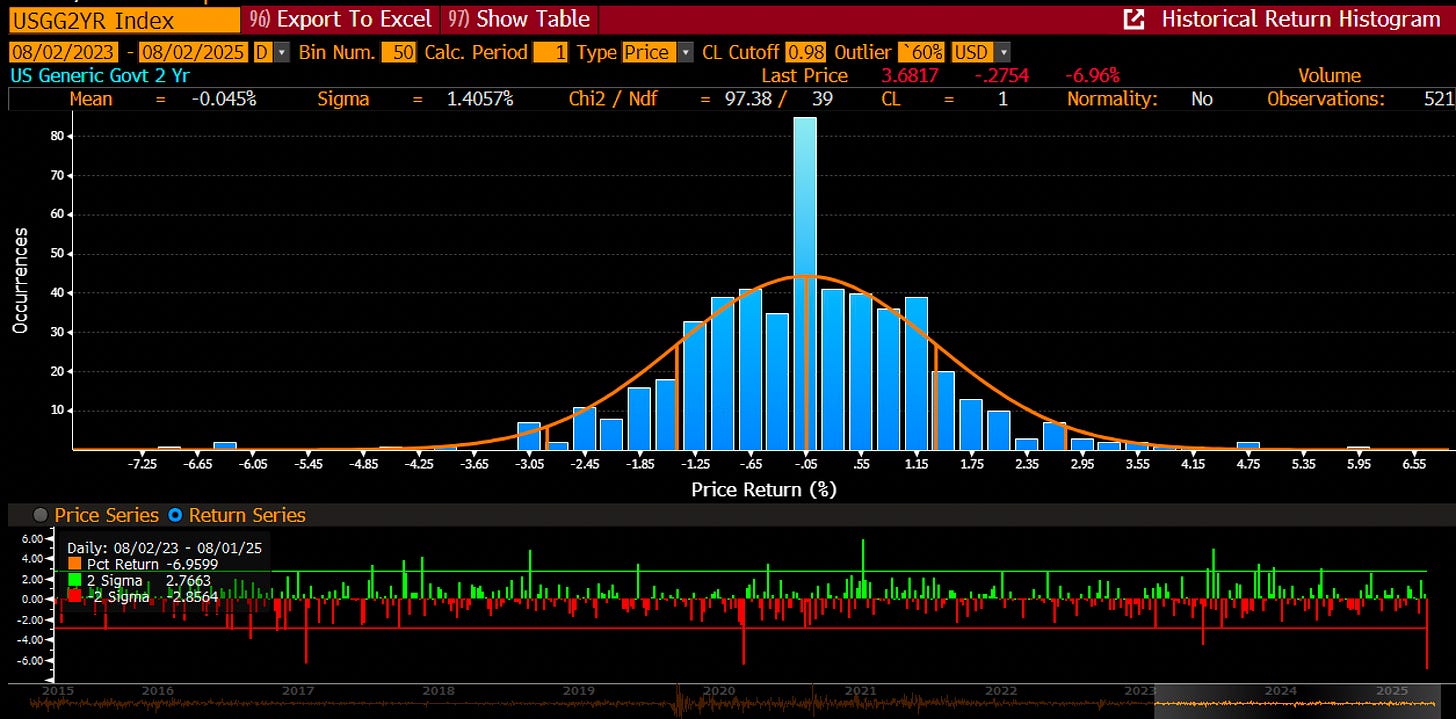

2-year Treasuries had a nearly 3-standard-deviation daily move, surpassing what we witnessed exactly a year ago following a weak payroll and JPY carry unwind.

Stocks had their most significant daily move in more than 2 months. Finally, the summer lull seems to be over.

Equities were already weaker ahead of the labour figures, driven by renewed trade policy noise as Trump extended the deadline for U.S. tariffs on imported goods from 1 August to 7 August, allowing more time for countries to negotiate. Switzerland faces a 39 per cent levy, while Brazil could see tariffs as high as 50 per cent. Better get your hands on a Swiss watch soon if you are planning to buy one in the US. And no, prices will be fully passed through, contrary to what some US officials might tell you.

The Dollar had a very interesting week. After running into an aggressive counter rally (see charts for the week further below), it stalled at the 100-day moving average and then retraced aggressively following the NFP print.

Where do we go from here? We haven’t even priced a full cut in September. I think that’s possibly going to drive towards a decent probability of a 50 bps cut. The Dollar will trade in line with risk sentiment. My read is that more weakness is ahead. It depends, however, if risk markets continue to suffer. If volatilities spike, the USD will likely see some demand again. More detailed views in the charts section behind the paywall, as well as on my trade thoughts. Most importantly, we are not being driven by narratives but by what setups make sense through our approach. Follow us on a 7-day trial by clicking below.

Let’s now read some additional thoughts from Macro D on the ongoing circus and tariffs, before we scan the weekly macro calendar, check a few interesting chart setups, and update the weekly asset allocation model for its latest change and performance.

August has started well. This could have been one of the most defining weeks of the year. Let’s go!