Friday Chart Book

Powell Stands Still / Equity Margin Debt / New Trade

Despite the parody around the Fed being under pressure to deliver steep rate cuts, Powell stood his ground, despite two of his gang dissenting and voting for a cut. It was a masterful press conference, where plenty of good questions were asked. Yet, it wasn’t him answering them confidently; it was more the case of him not knowing. You can’t blame him, although there seems to be a real fear within the FOMC chair of not getting inflation-expectations de-anchored and ultimately forcing the Fed to do the unthinkable: Hike rates again. Jay actually said that they are looking through tariff-induced inflation in an effort not to tighten monetary policy. We saw this film before.

Yes, housing is seeing weakness, yet, housing-related employment (see chart below) is not falling, which would be a good first indication of trouble ahead. This was produced before NFP.

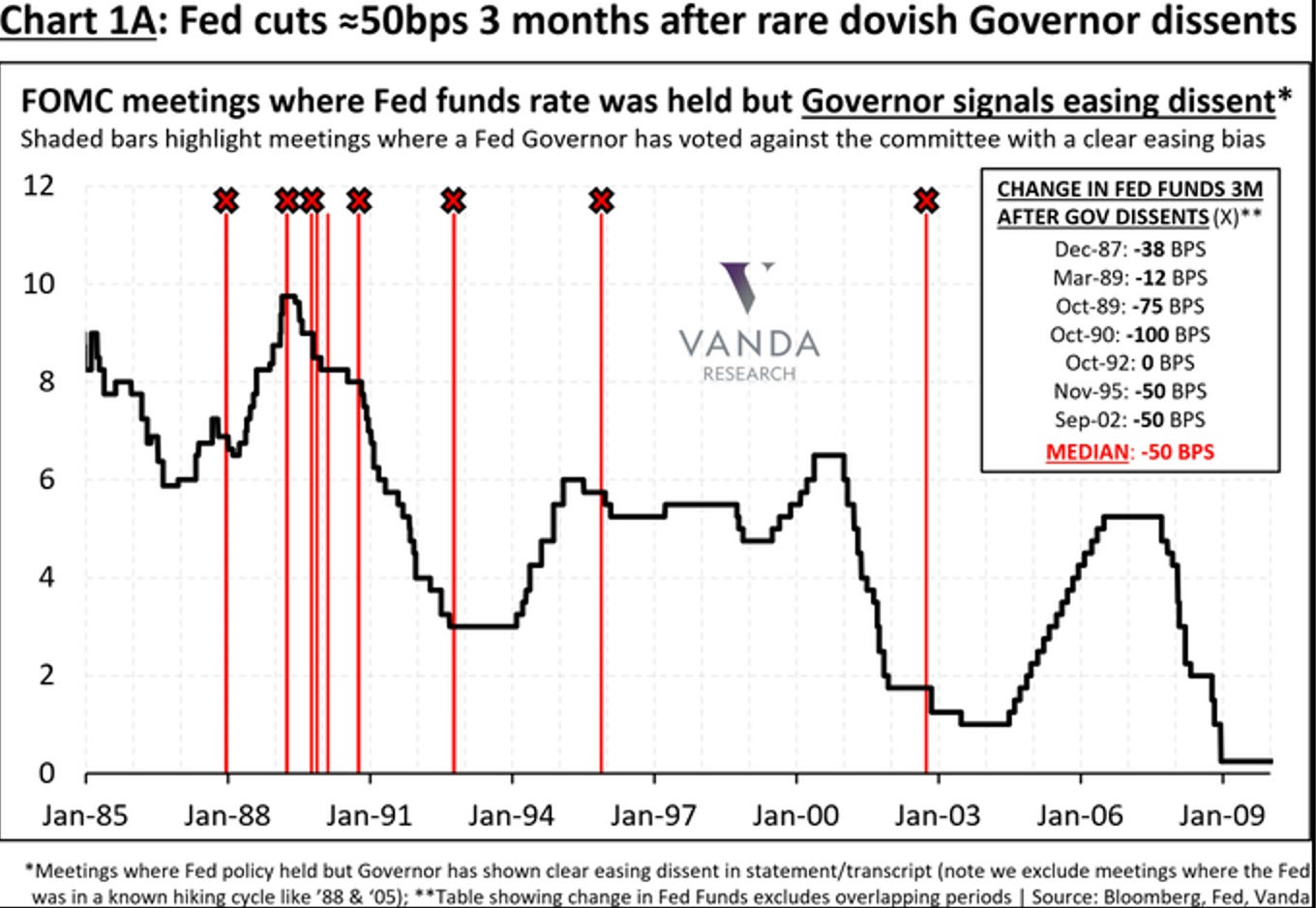

Typically, a dissent resolves in cuts 3 months down the line. However, this cycle is so different that I wouldn’t want to bet my house on a similar outcome.

Observing it all from a distance, growth is slowing a bit, and labour market weakness is visible, although not worrying. Meanwhile, inflation is stubborn and possibly accelerating as tariff pass-throughs materialise. Financial conditions are super easy, and risk asset behaviour seems euphoric.

When looking at call option volumes (see below), we would indeed find ourselves in a re-leveraging cycle.

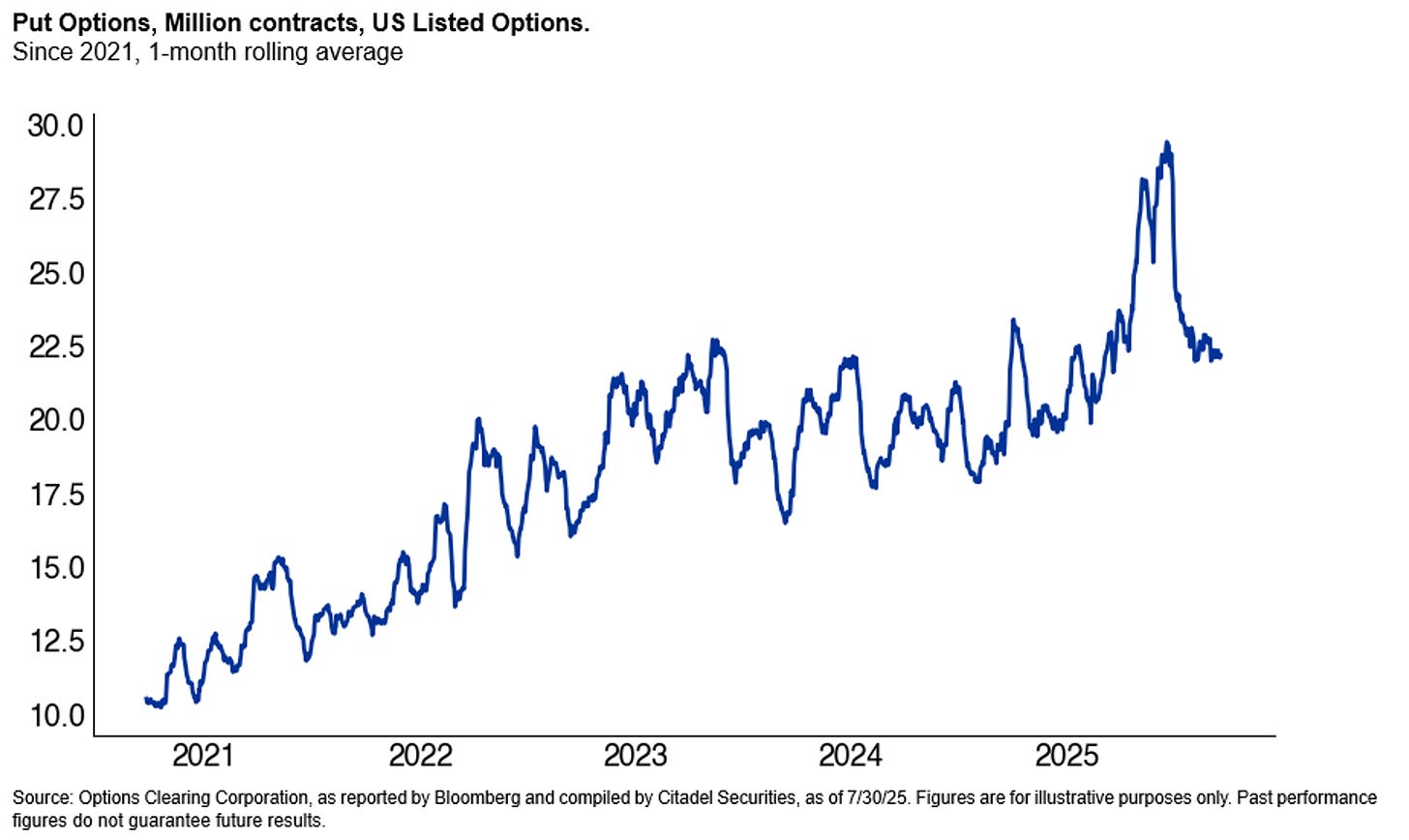

Meanwhile, the appetite for hedging downside seems muted.

Margin debt taken out to purchase equities has now surpassed 1 trillion USD or 3% of GDP. US equity capitalisation is just over 200% of US GDP.

This is just a reflection of the now, but doesn’t tell us much about the road ahead. Sure, things are possibly a bit too euphoric, and there is fragility building. This could take some time to unravel. With seasonally weaker months ahead, I am leaning towards caution. For the Paper Alfa Hedge Fund portfolio, I am considering downside (please note this was written before the latest downmove in equities). This week’s EUR/USD put has worked nicely. See details of the downside structure below.

Our buy-and-hold portfolio is up +14% YTD, and we just let it run untouched. The asset allocation model (PAAM) is long SPX and has no position in bonds currently (rebalancing weekly).

In addition, a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

If you are interested in exploring Paper Alfa’s full package, subscribe below.

Let’s now look at the mentioned trade idea, read some of Macro D’s latest thoughts on the Powell, Macklem and Ueda, before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

Enjoy a fantastic weekend!