Thoughts on US-EU Trade Deal

Good or Bad ? And a New Trade

As written in ATW, I anticipated a US-EU deal as previously announced in last week’s FT article. As the market opened for the Asian session last night, the EUR was modestly bid. This turned into a sharp reversal once London came in and digested the news.

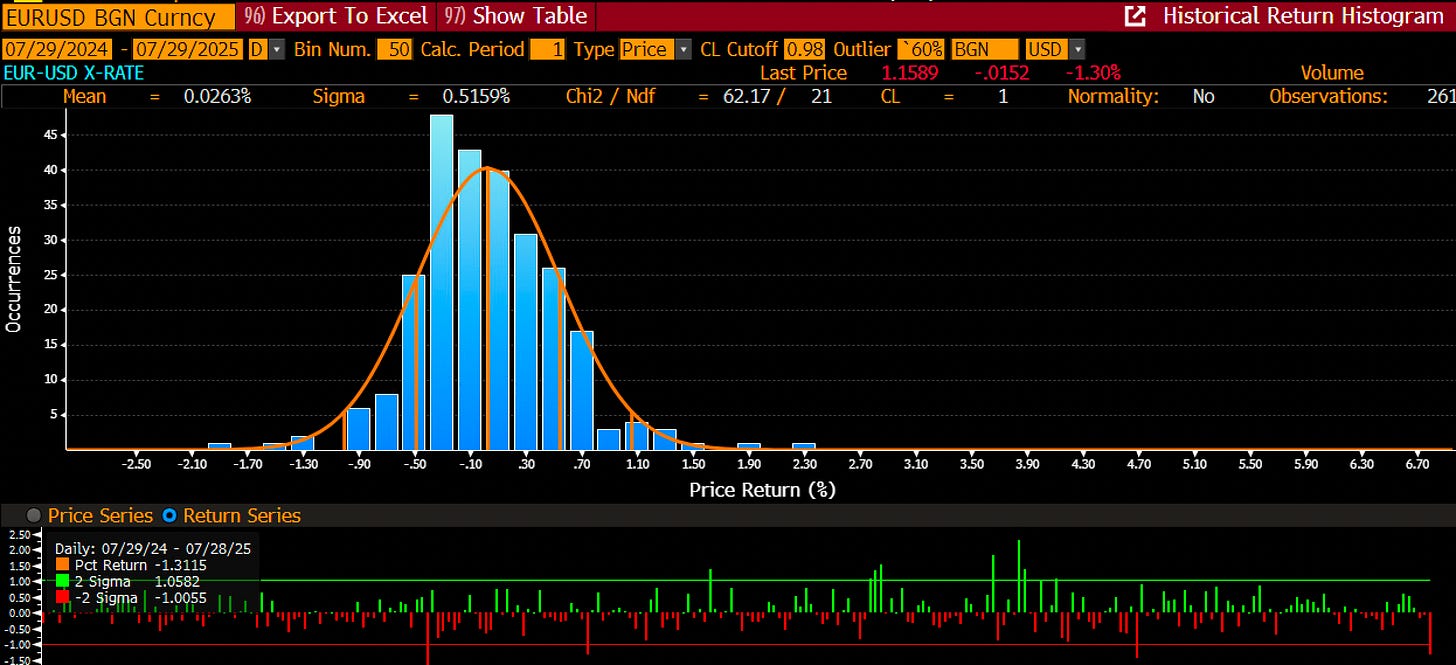

At the end of the day, it turned out to be the second-worst EURUSD performance this year (see histogram below).

What has happened? It was great to see how the narrative for the deal quickly changed as markets turned. I called Macro D and discussed what had happened. On the surface, the deal doesn’t look as bad, especially versus previously discussed much higher tariffs. Has Europe just rolled over? Will the classical Dollar appreciation now follow suit to shoulder some of the costs that US consumers and businesses will have to foot?

Below are some excellent points by Macro D. Similarly, I took this morning’s initial softness to initiate an FX option trade for our Paper Alfa Hedge Fund Book. You will see the rationale and details below behind the paywall.

Enjoy!