Stories from the Institutional past

Big Ideas, Big danger

This is the second instalment of my reminiscence of my professional past. It is just a collection of anecdotes and stories (never real names or places used), hopefully giving you a glimpse into the world of institutional asset managers and hedge funds.

Big Ideas can be dangerous

Big Ideas, big payouts, right? Yes, that can sometimes be true. Big ideas, however, can also be an acute source of screw-ups, especially if this is linked to strong opinions. I was never a man of strong opinions. This is mostly the result of seeing many falter from their strongly held beliefs, ultimately costing them their careers. I had them too, but I corrected my errors rather quickly.

Now, I am not saying that any big idea or strong opinion is bad, far from it. You can have one big view that will reap the rewards for many years. There are plenty of big ideas out there that made people billions, and long may it continue. I am not talking about the entrepreneurial vision but how some of the investment ideas, when combined with strongly held inelastic views, can lead to adverse outcomes.

The best mental attitude I have always aspired to is to have strong opinions but loosely held. Change when facts change without carrying your mental burden of being right. “Being right” is the single largest contributor to people failing. I have seen it many times over. It makes sense. Looking stupid is the worst thing that can happen to you professionally, both towards your colleagues and hierarchy and clients. Overly dogmatic thinking about how things should be is a dangerous path. I opt to understand the “what is” and keep my mental flexibility about how things can turn out. This is also due to my personal learning and the scarring process that markets have inflicted on me. Oh yes, I had big ideas, and I got battered more than once.

The following are a few market episodes where I remember the fallacy of strong views being dramatically detrimental.

JGBs (Japanese Government Bonds)

This is a chart of Japanese government bond yields. Pretty low, right? They can’t possibly go lower. Ballooning Debt/GDP ratios and disastrous demographics were some of the arguments to describe this asset as a “fly waiting to hit the windshield”. Many shorted JGBs in anticipation of way higher yields. Guess what? They went lower and lower. Arguments were found that a large pool of assets is being dominated by domestic demand. Every global assets manager I can think of was shorting JGBs, in size. They all lost by a million little cuts. Yours truly included.

ECB

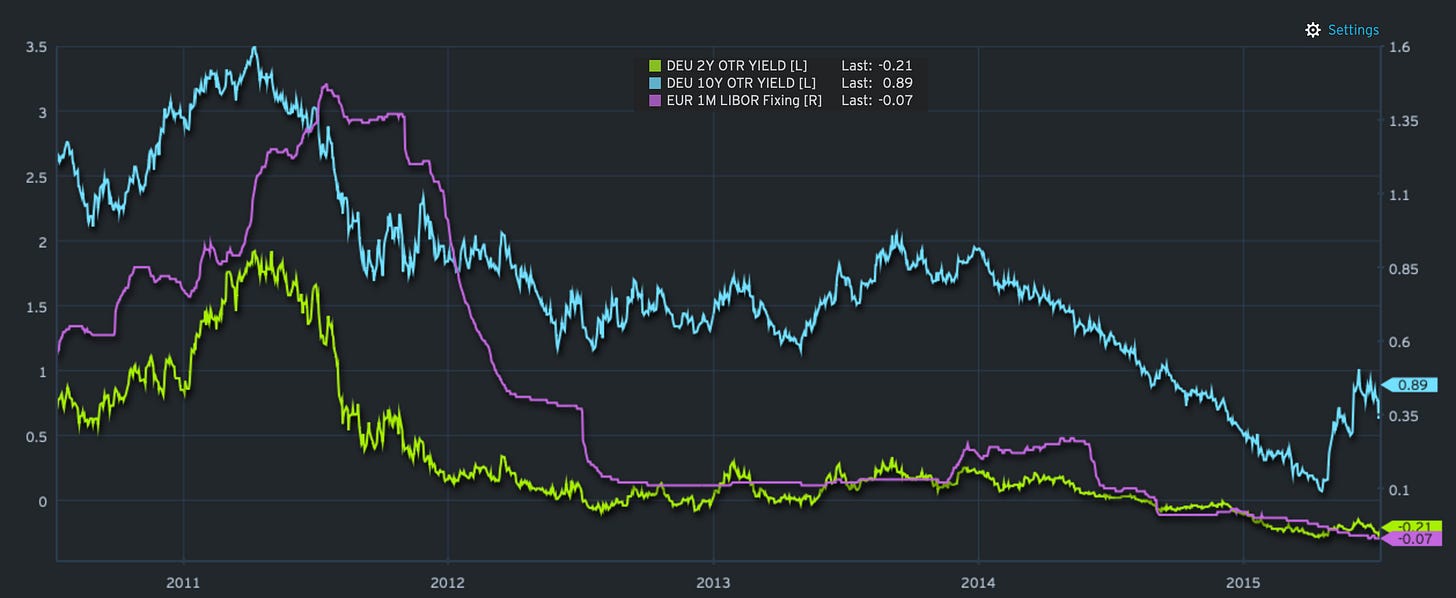

The largest big idea failure I have ever witnessed was during Draghi’s reign at the ECB. Many were sceptical about his ability to convince the broader committee, especially the Germans, to support further monetary easing. The head of my firm’s fixed income department strongly believed that the ECB would never be allowed to cut rates below 1% and that QE would be unconstitutional. In short order, Draghi cut below 1%. Still, beliefs didn’t change. Monetary support lines were put in place to support weaker sovereign markets. Ideas did not change, and if anything, doubled down. “ECB will never cut into negative territory”; boom, another slap in the face. “You can’t make money buying negative yielding bonds”. Well, I’ve done it; no magic there.

This episode not only defied logic in the eyes of a central bank president, proving repeatedly to tear up the rules, but the unwillingness to change opinions. German 2-year yields spend nearly eight years in negative territory.

The best thing was that the beholder of those strong beliefs offered anyone any size bet that the ECB won’t be hiking rates for five years, which was priced in 2014. I took the bet(in decent enough size) but left the firm before maturity. I won as they didn’t hike for eight years. This reminds me to call in the debt collectors.

Brexit

Nothing better than having strong political opinions. I’ve got burned many times, and many did so during Brexit. Betting probabilities were somewhere around 97%. I did an all-nighter just to see the mood change dramatically as North-English cities were casting their verdict. A disaster which is still impacting markets today. Strong opinions, especially on binary outcomes where probabilities are observable, are a dangerous tactic. Many got that one wrong. As a matter of fact, I wasn’t allowed to short the pound, given the strong opinion of our internal strategy team. Well done, lads.

Trump

Having gone through Brexit, I thought populism must be on the rise, possibly everywhere. I anticipated a Trump win, especially as the odds were, again, quite heavily favouring Clinton to win. I was long rates and short equities. Again, an all-nighter. Polls were coming in. I was “right” for about 2 hours. Then all my positions blew up in my face. A terrible day. I had to close positions at a loss. Being right doesn’t equal making money.

Conclusion

The conclusion, hopefully, should be a pretty straightforward one. By all means, have strongly held views and opinions but maintain the flexibility to change when facts almost demand you to do so.

The old adage of not holding on to your losing positions for too long should also be intuitive here as it’s strongly signalling your views/opinions are wrong or not right at that time.

It’s a complex task in markets, as some of the best trades will demand your highest mental resiliency. Markets will make you question yourself and your view. Should you always fold? The answer is no. Make sure you leave yourself enough room for the position to breathe in enough momentum so it can perform. It is useful to write down signposts and events that should give your view a catalyst or cause for revisiting. Don’t fall prey to hopism or overly stubborn views. Remember, strong opinions but loosely held.

Music

Agnes Obel is a constant on my personal playlist. No, not the one I dance or entertain to. It’s my thinking playlist that I often listen to my morning walks.

This one is particularly moving and inspiring. It’s just instrumental, but her voice also gives a lot of weight to her other amazing pieces. I have never seen her live but heard only good things about her performances.

Good Luck out there!

Your,

Paper Alfa

Yes. Humility is critical for success in any field of life. Especially where the stakes are high!