Paper Alfa's 2024

How have my forecasts turned out?

Another trip around the sun has almost been completed. I truly hope that it has been a successful year for you and your loved ones. No year is easy. Remember last year, as suppressed financial assets and disappointing returns made for a sombre mood. This also impacted outlooks for the new year, where recession fears, and structurally higher inflation forecasts dominated. As always, markets have their own path in mind. Yes, we had a mini-banking crisis to deal with and let’s also not forget that up until October, bonds looked to mark another negative year; TLT 0.00%↑ is still down for the year but made a dramatic recovery from almost 20% down.

What was your best trade idea going into this year? Many had bonds to outperform, but they have just barely eeked out a positive return, depending on what asset class and point on the curve you are looking at. In my post from last year, I wrote about the futility of forecasting asset returns, even though many organisations still do it. While I am looking at various 2024 forecasts, I shake my head, knowing that pretty much all of them will be wrong. This year, the mood has obviously been lifted, as asset returns and a pre-Christmas Fed pivot have given people hope for another great year of returns to be upon us. I am sceptical. Things are forecasted to be too rosy, and the so-distant soft-landing scenario seems all but baked into our expectations now.

Remember the forecasting table from last year? I gave my predictions. I wanted to show the futility of forecasting by calling the market for 2023 YE. Let’s see how I fared. Apart from getting close to guessing Germany's 10-year yields, the rest of my forecasts are rather disappointing.

If forecasting is a fool's errand, what should we, as investors, do? The answer lies in abandoning the allure of clairvoyance and embracing adaptability. Instead of chasing ephemeral predictions, focus on building robust portfolios that weather both sunshine and hail storms. Diversification becomes your most important task, mitigating risks and allowing you to ride the waves of volatility without capsizing.

Looking back, Paper Alfa’s 2022 fictional long-term portfolio was successful, mainly by avoiding bonds and being exposed to commodities and the energy sector. The team at Composer lets you build your “symphony” model portfolios and get basic back-test capabilities on them. Check it out; it’s pretty cool and free. The 2022 allocation looked like this.

30% Cash

30% Energy Stocks (XLE)

15% Gold

15% Uranium (Uranium ETF)

10% Commodities (Tracker)

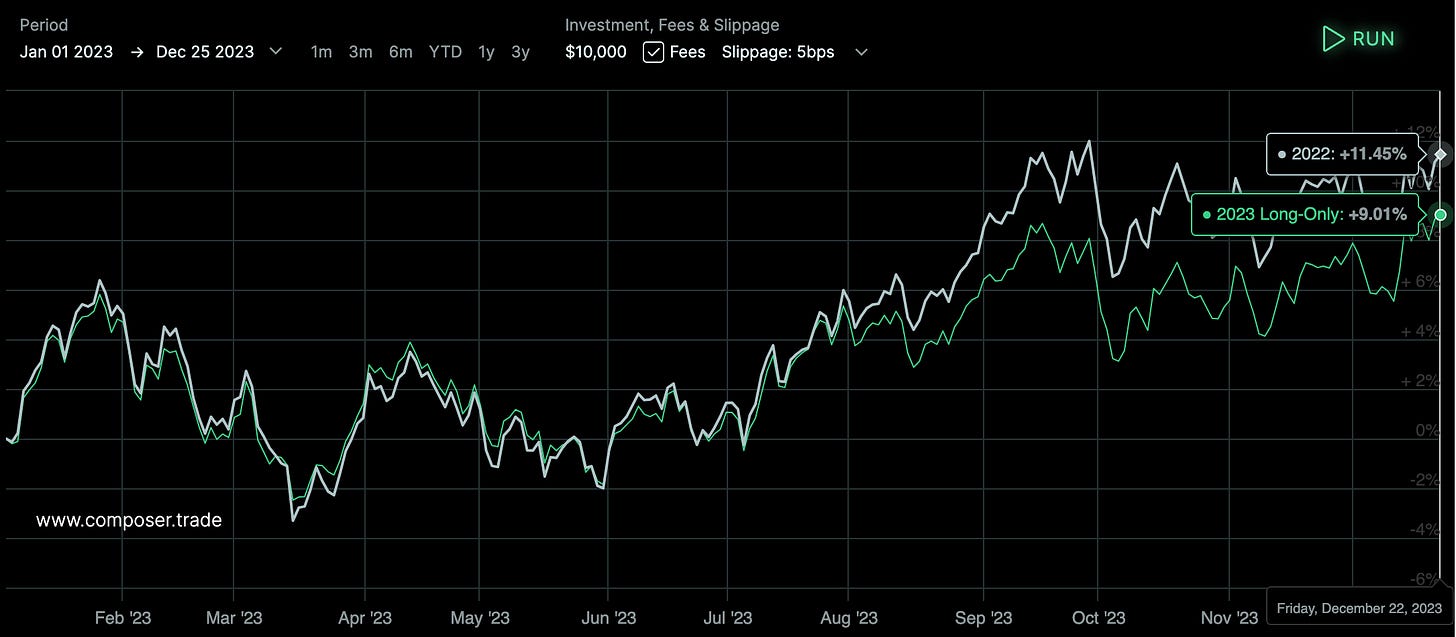

The performance of this portfolio (tracked in Composer) is visualized (without trading costs or rebalancing) over the last two years as follows (up until December 21, 2023):

Not only did this very simple portfolio outperform the SPX (easy to forget that the SPX has been almost flat over the past two years), but it also exhibited lower volatility and, therefore, superior risk-adjusted measures.

Paper Alfa’s 2023 long-term portfolio saw changes, as I saw the re-pricing of bonds, especially inflation-linked (real) bonds, as attractive enough to dip a toe in. The Portfolio changes last year were, therefore, as follows:

30% Cash → 30% TIPS

30% Energy Stocks (XLE) → 20% Energy Stocks (XLE)

15% Gold → 15% Gold

15% Uranium (Uranium ETF) → 10% Uranium

10% Commodities (Tracker) → 15% Commodity Basket

10% Value Stocks (ex Energy)

Remember that this is just an educational exercise with a virtual portfolio. This should not be construed as investment advice, as anyone’s risk profile might differ.

Was the change worth it? The answer is no. The small changes didn’t result in any outperformance; in fact, we underperformed the 2022 portfolio by roughly 2% over 2023, mainly because of the reduction in Uranium, which rallied around 40% YTD.

Overall, however, I am very pleased with the outcome of the portfolio, generating a decent annualised return and allowing for small drawdowns and volatility exactly what a long-term portfolio should look like.

Now, what about 2024?