Model Signal Alerts

August 16, 2023

Good morning. I will keep it brief today. Early indications show that bonds are attempting a small rebound, as indicated in the reversal model showing a higher bounce probability. Note that there is a 20-year JGB auction tomorrow. Last time, a strong 30-year auction set a bullish tone for bonds globally.

JPY-Futures are now in reversal mode, so naturally, there is a correlation with bonds there. Meanwhile, stocks still look vulnerable from here, although the selling is quite orderly.

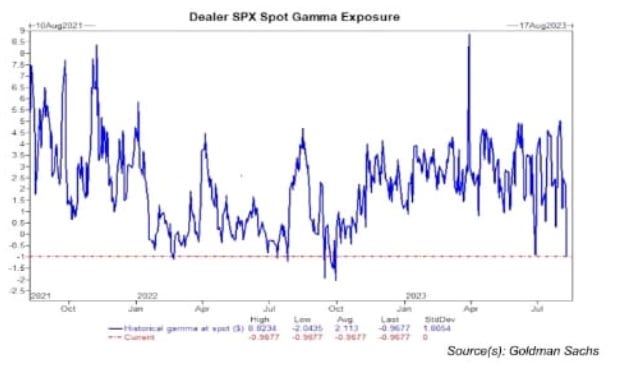

One reason for the low volatility grind higher in equity markets over the past few months has been the long gamma position held by dealers. This prevented outsized daily moves in the SPX. That gamma profile has now turned short, according to GS, which is adding to daily volatility.

UK CPI accelerates a touch more than expected, the third hawkish data print seen over the four days (GDP, wages). UK headline CPI rose 6.8% YoY in July (est. 6.7%) with core +6.9% (est. 6.8%). The MPC’s latest forecast is for headline CPI to average 6.9% in 2023 Q3 and 4.9% in Q4. With the market pricing in roughly 30 bps for the September meeting and 75 bps in further rate hikes, a lot of the hawkishness is already discounted, in my view, although that probability won’t move much until the next BoE meeting on September 21 (with next CPI a day before).

The RBNZ left rates unchanged at 5.50%. However, the accompanying forecasts were more hawkish because the OCR guidance was slightly revised higher, thanks to a surprising admission that long-run nominal neutral rates have risen by 25bps to 2.25%.

Now, let’s check on what else has been flashing overnight.