Model Signal Alert

September 6, 2023

Good morning to all of you. A special welcome to my new subscribers. I’m honoured to have you join us here. This is the ad-hoc note whenever the momentum or reversal signal fires up an alert on the vast amount of securities we track. It isn’t unusual to have one or two of them a week. As of the close of business last night, we had a few interesting setups being flagged, so I thought I should give you a quick update on what has been going on.

Bonds have been struggling again with the large amount of corporate bond issuance, which is being put through the market this week. It is estimated that there is now roughly $ 50 bn to go through this week. This can usually put pressure on treasury bonds as “locking” and hedging flow occurs. This is usually the case as clients or dealers wish to hedge any residual duration risk when obtaining corporate bonds. From the issuing entity’s perspective, a rate lock may be used to hedge against changes in the level of the reference rate against which the new issue is priced. It is very common. I highlighted this on Monday’s ATW, which is worth revisiting if you haven’t already.

Treasuries remain under pressure, but ranges continue to hold for now. Curves (see chart below) are continuing their steepening trend.

Meanwhile, US 2-year yields found support at 4.97%, with next support at the 5.11% mid-August yield high.

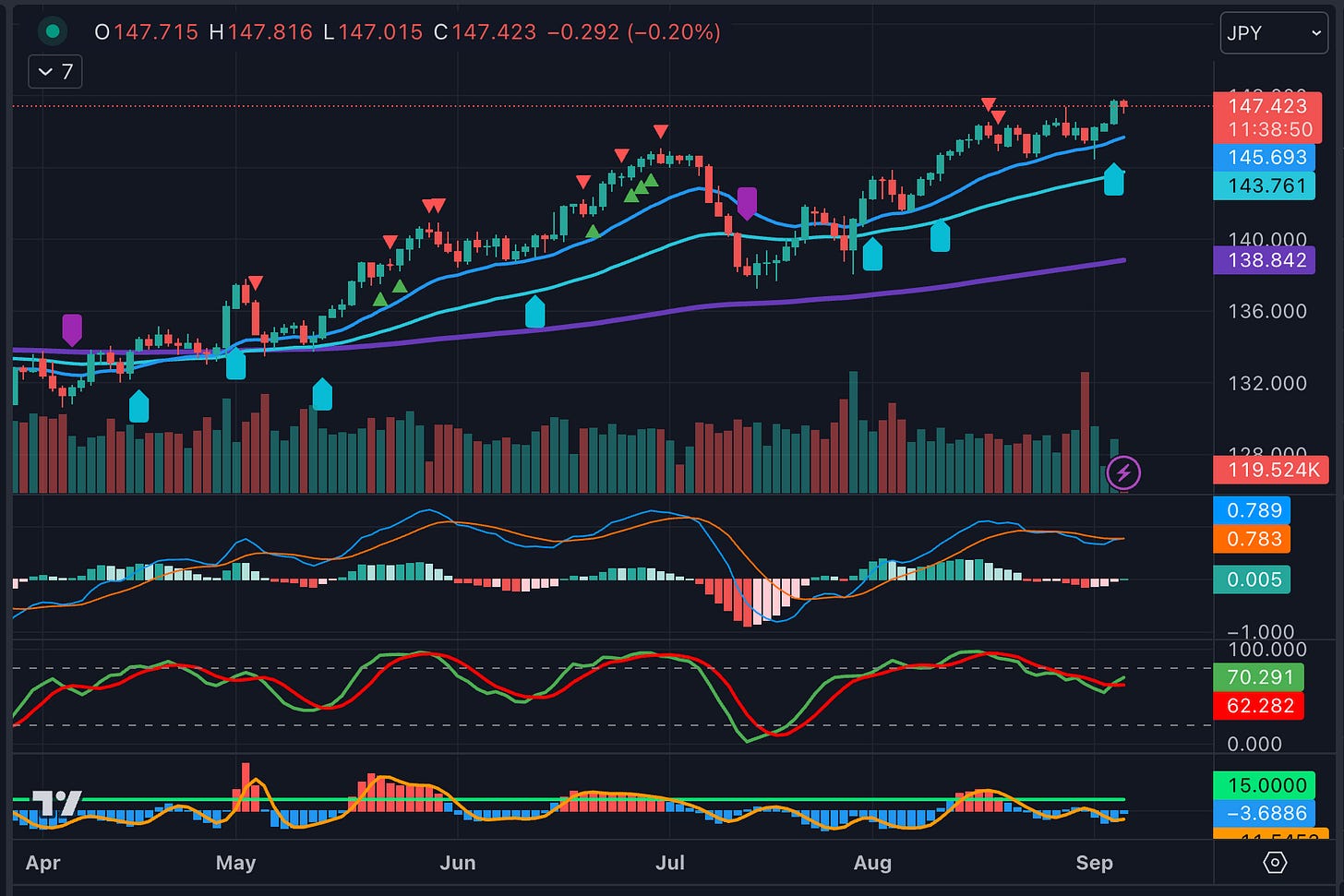

Japan's Vice Finance Minister for International Affairs (and top currency official) is pushing back against the recent JPY depreciation.

This is the first time speaking on FX since late July and comes after USDJPY hit the highest level since Nov. 2022 on Tuesday (147.73), rising as much as 0.9%. There have been comments from Fin Min Suzuki since mid-August on JPY, but today's language marks an escalation. This is indicating that we are moving closer to the pain point for authorities. However, fundamentals continue to suggest an upside for USDJPY. I wouldn’t expect intervention until >150 levels.

The momentum model likes continued Yen's weakness as it bought another clip just as we broke out from previous ranges.

Let’s see what else has been on offer from last night’s report.