Model Signal Alert

July 26th, 2023

FOMC day. As mentioned in my Monday ATW, I am not overly fussed about market action ahead of this week’s central bank meetings.

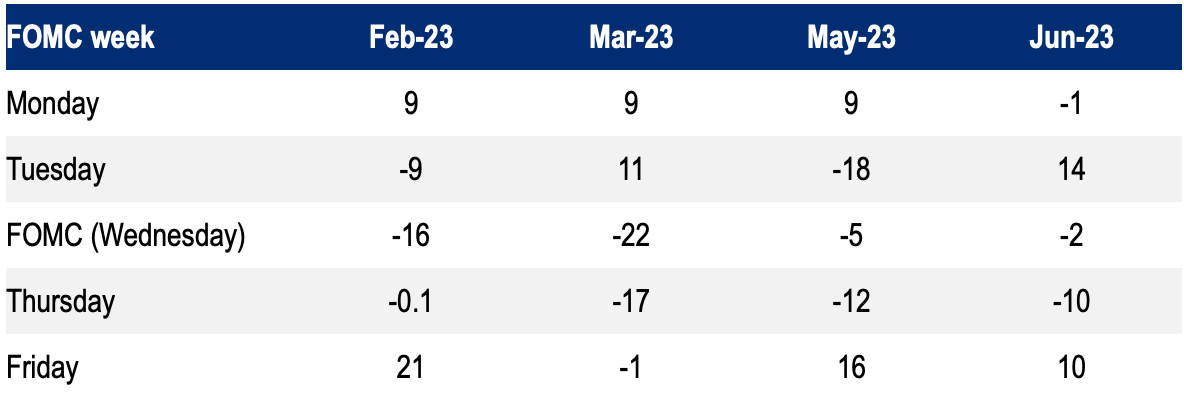

A few things, however, are worth highlighting, which I didn’t include in Monday’s thoughts. First off, we had a sizeable backup in front-end yields. Despite general hawkishness, FOMC meetings this year have generally been bullish events for US front-end treasuries (see table chart). Energy prices have risen, with Crude nearly up 6% over the past week, which was the main driver for the track higher in yields.

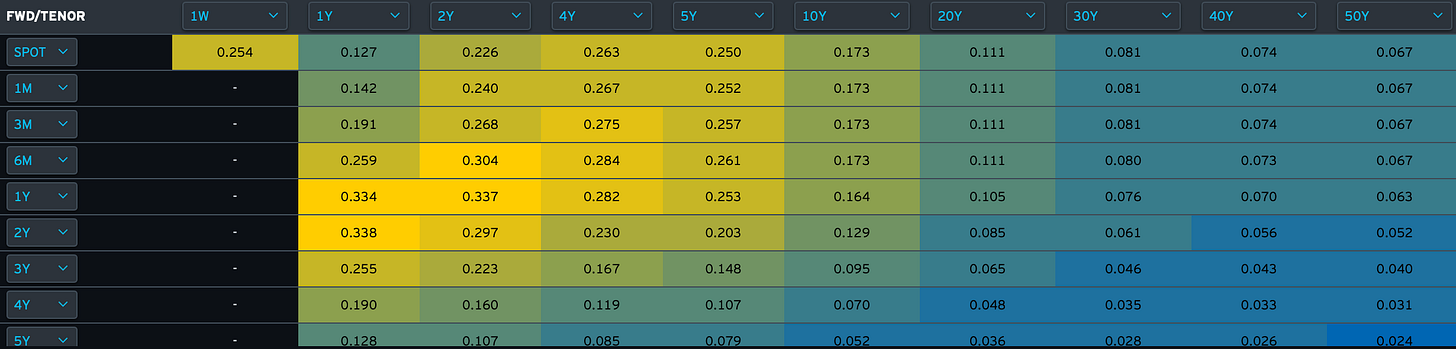

The quite sizeable sell-off in the 2-5 year treasury spot curve and in 1-year forwards somewhat skewed risk-reward towards taking some profit on recent shorts (Model caught that one nicely too).

This also makes sense when just looking at the chart where ZT is approaching previous lows.

The model has also been flashing other signals as of the close of business yesterday. Let’s see what’s been coming up on the radar.