Model Signal Alert

July 18th, 2023

Good evening to you all. Just a quick note on a few alerted situations the model is currently spitting out. Markets have continued the progression of the macro weeks and entrenched themselves into the much-talked-about Goldilocks scenario.

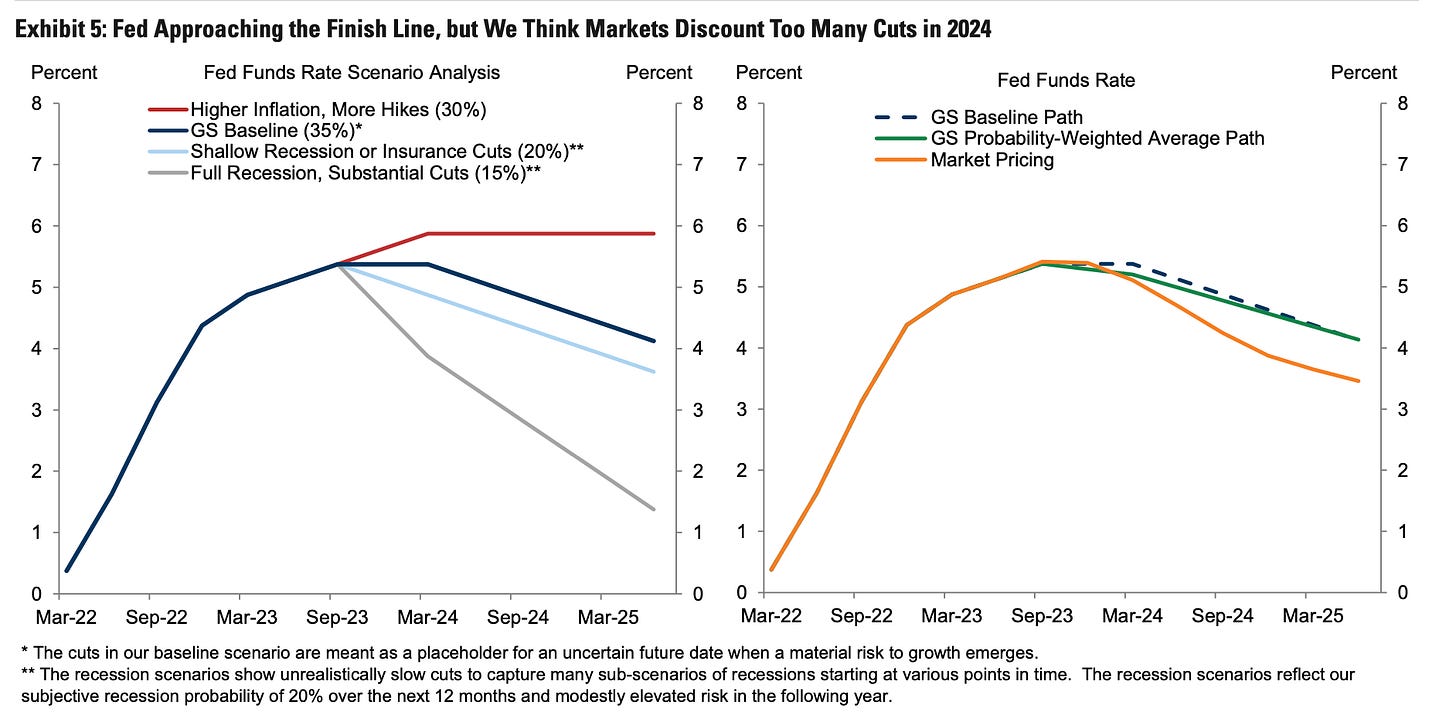

Meanwhile, banks and their esteemed strategists are all rolling over and declaring the recession to be over. As tweeted earlier today, Goldman GS 0.00%↑ is now also declaring a soft landing scenario as the most likely, cutting their recession probability to 20%.

Similar to my take earlier this week about the monetary policy hill top approaching, their research team led by Jan Hatzius also declares the end of the monetary tightening cycle, with a higher inflation scenario only moving Fed Funds up to 6%, which I think is rather low if such an outcome should arise.

All good, right? Time to load up on risk? Not so fast; let’s see what the model is flashing as of today …

ES, we have a first overbought condition flashing. You can see this in the bottom right corner, where we have a first bar flashing. The full reversal signal (red triangle) will then flash with the first weaker daily candle close.

NQ, the same but progressing in terms of red bar counts. This would indicate a retracing is ahead. So chasing higher here is, according to the model, not warranted.

DJI, the same patterns are flashing here as well.

With RTY, for now, being the exception.

This is only observable in the US equity space for the time being, suggesting that the recent euphoria will find some resistance and consolidation soon. This, however, does not imply a full reverse of the prevailing longer-term trend.

Elsewhere, we have some oversold conditions on Dollar crosses flashing. Interestingly, the recent correlation of the weakening Dollar amidst buoyant equity market performance is no longer in play.

GBP/USD has been noticeably struggling to pull higher, yet no big reversal has materialised as of yet.

The same can be observed for EUR/USD.

AUD/CAD, is another one of the tracked FX cross exhibiting upside exhaustion.

And lastly, USD/KRW, shows similar upcoming exhaustion.

Let’s see how those signals pan out for the remainder of this week. We will surely revisit it on Friday’s Paper Charts. I will, of course, highlight any other changes should they pop up.

Good Luck out there!

Paper Alfa

I would agree, it is probably a "sell the news" kind of thing. Probably pulling back tomorrow onward until mid-week (next week). Sounds reasonable?

Agree on DXY, particularly short EURUSD which has been pushing higher while EUR is falling verse the rest of the G7 currencies.