Model Signal Alert

August 10, 2023

Another day of action has resulted in the model flagging a few alerts, which I will discuss further below.

As expected, there is a relatively muted session ahead of today’s CPI and weekly claims. The Fed’s Bostic is also going to be on the tapes, which will be interesting to see whether they are trying to direct the market as they see pricing misaligned with their current assessment. I guess the Jackson Hole meetings later this month will be more revealing in this regard.

Talking to my network reveals a large degree (2/3) of views anticipating a somewhat softer CPI print relative to expectations.

Elsewhere on the inflation map Norway just had its first CPI miss in four months (5.4% vs 5.9% YoY expected).

USD/NOK is still seemingly a sell for the model and offers good r/r as we have had a nice reversal.

Oil is on a mission. The model is firing another long.

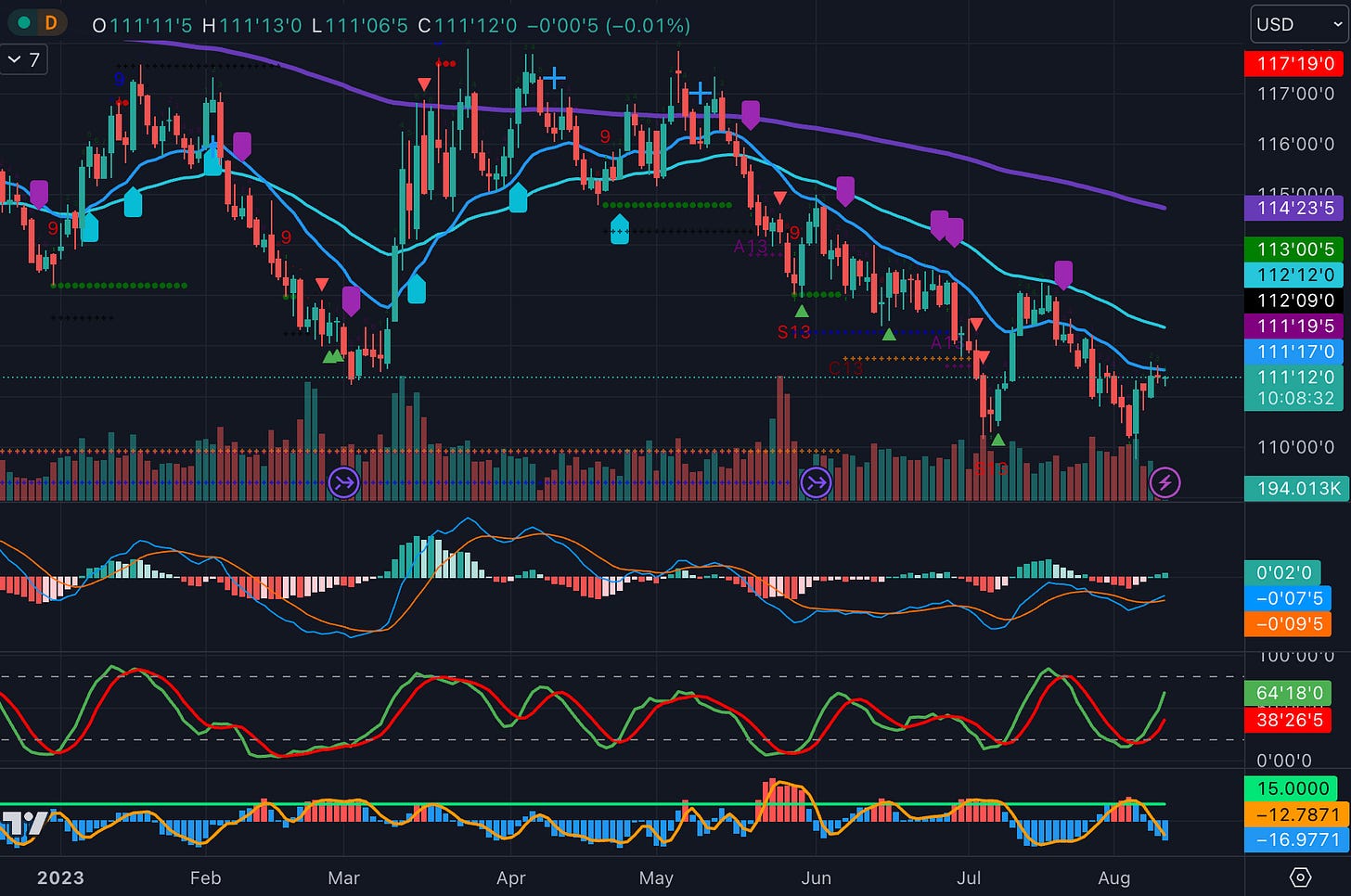

ZN has had a nice bounce, now struggling to break through the 20 ema. If broken, we have a window to rally another point (roughly 12 bps in yield).

Now to the rest of yesterday’s alerts …