Mid-Week Update

The Circus Continues / FX Trade Updates

A quick update with some thoughts before I’m heading for a 10-day holiday break, where I’m just going to sit on the beach and try not to look at markets too often as I’m recharging my batteries. There are no immediate fat pitches that I can see or I’m engaging in. There are, however, plenty of questions I am asking myself.

There are increasingly nuanced market disagreements in the narrative carousel we are finding ourselves in. Like, how can the USD suffer when the US long-end blows out, but the same isn’t true for Japan, for example? Or how can the ECB be that dovish, but cyclical sectors like European Banks are breaking new highs?

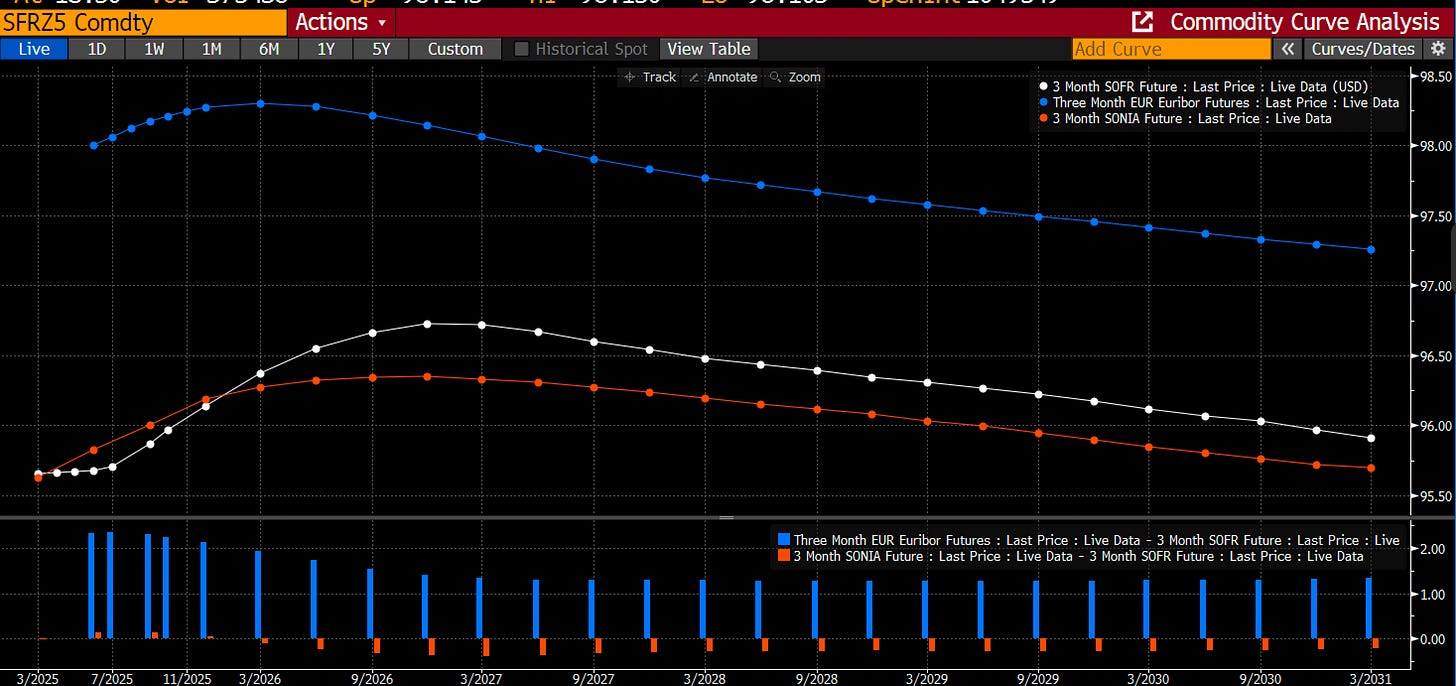

Meanwhile, I’m looking at what is priced in and struggle to see how those forward curves actually materialise. The Fed is expected to cut in 2026, while the ECB is normalising again? Everything is possible, of course, but I would find such a scenario hard to imagine.

SFRZ5Z6 has been on an aggressive flattening trend since the start of the year. Compared to Z4Z5, however, we can go much lower should there be another economic soft patch coming up. Amazingly, though, this spread has traded both bullish and bearish, with the market seemingly content to push out rate cuts in 2026.

Is that realistic, though? If we are saying that a few or no rate cuts are coming this year, as a recession has been averted, and tariff-related noise will keep the Fed on hold, how can we be sure that next year will see a backdrop where rates can be adjusted lower? Much, of course, has to do with Powell’s term ending in May 2026, with a new, possibly dovish chair taking over. There are, however, 11 other voting members who can make voting a much more contentious process next year.

The more I look at front-ends, I think that’s where possibly the big moves will happen while everyone is focused on longer-dated Treasuries, especially the very long-end, which has seen some stabilisation over the last 24 hours as the BoJ and the BoE have taken steps to stabilise the market.

This economic cycle is unlike any that has come before. We saw a large market drop and wealth destruction in 2022, without leaving a recession in its trail, boosted by excess cash from fiscal impulses post-COVID, which has then been transferred from consumers into profits at corporations. Since then, inflation has markedly slowed, giving the Fed the opportunity to cut rates to adjust real rates lower. Equity markets have continued adding wealth, which in turn is boosting consumption, supporting economic expansion, with employment still running at very strong levels. Trump has come in and is trying to rebalance global trade and bring manufacturing back to the US shores. He started off badly but has since walked back the worst of his threats. This might hurt confidence, but will unlikely leave a bad mark on a still very resilient economy. What happens next? I shall mull that very question from the beach. Rest assured, this place will leave no stone or marker unturned to provide answers and hopefully profitable trade ideas for the pack. By the way, I have made the 7-day trial period available if you're interested in exploring our full offering.

While away, I will still post the Friday Chart Pack and Attack the Week (ATW) publications as normal, but in a shorter and more concise format. Macro D will continue providing thoughts from his vantage point. He has led the way this year with great FX trade calls and is providing an update and important changes to some of his calls below (taking profit on USDJPY, for example). In addition, he is providing his views on what’s likely ahead.

Enjoy!