Mid-Week Update

July 16, 2024

The bond market wave has continued and we have caught this one nicely roughly 20 bps ago. What now? We have a reversal window now open and a 9 count buy setup (on yields), which will be interesting to see play out. Momentum, however, is still bullish and you can see the market’s reaction post a very strong retail sales print, which paused the rally just to resume its downtrend again.

Yield curve steepeners, however, came to a bit of a setback today, which saw the long-end outperform shorter dated maturities with vengeance. Luckily, my reversal model caught the conditions correctly and warned us in time about a possible pullback.

The narrative, at least for now, is unfolding nicely. Short term bonds can possibly rally a bit more. Further down the line we can stipulate, however, whether this rally will provide the basis for another leg higher in risk assets, which would strengthen financial conditions further and hence provide another economic boost until, well, it possibly then begs the inflation question again. Let’s see. We stand ready to pounce regardless of what will happen.

Let’s now hear Macro D’s thoughts.

by Macro D

Frankly, I do not feel like participating in the market party. I have nothing personal against those who want to celebrate, but I feel more comfortable with my hands in my pockets, and my head bowed rather than with a whistle in my mouth, a plastic smile on my face and a free ticket to the grand ball of the Venice Carnival. I will limit myself to one figure. The consumer prices of services net of the rent component show a vital metric the Federal Reserve uses to monitor the inflation trend. In the graph below, you can see how this component remains at a high annual growth rate of 4.8%, a sign of a lot of work still to be done by the monetary bodies to bring it back to sustainable levels.

Inflation of services net of the rental component

The stickiest part of inflation, namely services, showed the first slight sign of easing (which was enough to convince investors to celebrate), but as far as I'm concerned, the situation could be better. More confirmation is needed regarding the decline of the most stubborn components of inflation, so Thursday's is just an indication, and it isn't the straw that breaks the camel's back.

This week, it started with some data from China. China's gross domestic product rose between April and June at 4.7%, but the growth rate was also lower than the +5.3% year-on-year reported in the first three months of 2024. China's retail sales rose 2% in June, below the +3.3% growth expected by analysts' consensus. These data show how the Chinese government urgently needs to accelerate domestic consumption. Otherwise, the real risk is stagnation, which could be Japanese style.

Also on Monday, Eurostat released an update on the trend of industrial production, which, in May, showed a contraction of 0.6% monthly.

In any case, the most imposing voice rose in the air on Monday evening: it was Jay's voice.

Verbatim words:

“The last three inflation readings add to the confidence that the targets have been met and, therefore, a rate cut can be considered. “We will not give any signal today on any particular deadline; the decisions on the next rate cut by the Fed will be made on a meeting-by-meeting basis.”

The second-quarter economic data provided more basis for confidence that inflation is falling toward the central bank’s 2% target.

“We did not gain any additional confidence in the first quarter, but the three readings of the second quarter, including last week, add some confidence.”

“Inflation has now fallen, and the labour market is also providing comfort. There is a much better balance,” but “if we were to see an unexpected weakening in the labour market, that could also be a reason for us to react.”

A complex landing scenario for the United States “is not the most likely or likely scenario.”

A historical note: Up until about five years ago, inflation data (certainly more stable than today's) did not affect the stock and bond markets; today, the situation is different. July and the first part of August are often excessively bullish.

An innocent nod to the future: Things often change suddenly at the end of August and September. This year, with elections around the corner, anything can happen, and I tend to believe that this bull market that is staring us in the eye will have the strength to stay afloat. It will obviously change its appearance; in fact, I believe that it will compensate for the correction in the technology sector with a rise in other sectors.

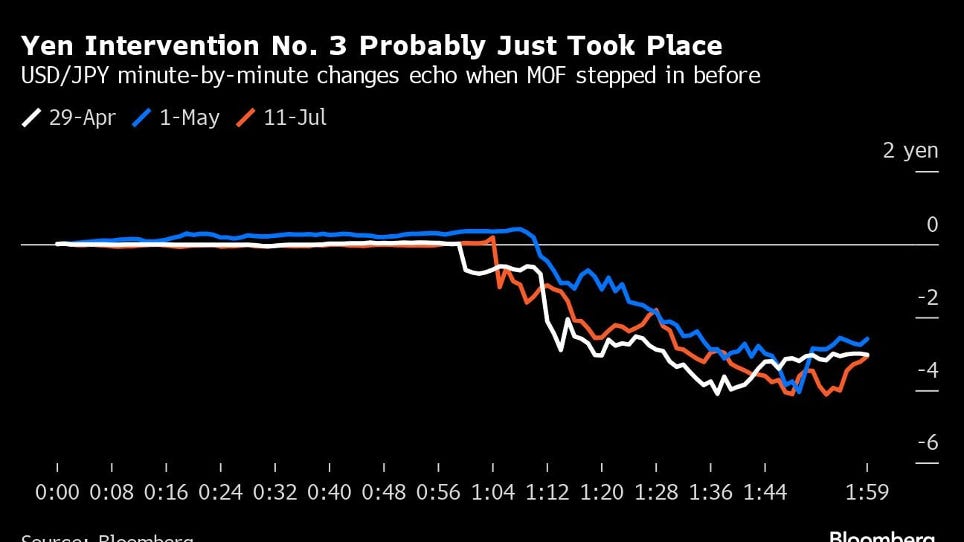

As I write, investors are carefully considering the consequences that a referendum in favour of Donald Trump in the next presidential elections could have for the world's fate and also on the nomination of J.D. Vance as Vice President in the event of a Republican victory. Meanwhile, Japan is slowing down its recovery after the monetary interventions coming from the Land of the Rising Sun.

Now, betting on Trump’s victory boils down to a rather essential comparative exercise: buy everything that is America and sell everything that is not. It seems like a direct emanation of the historic election catchphrase: Make America great again.

And now, pay attention to Thursday:

The ECB remains the absolute protagonist among the market movers this week. The Governing Council meeting and the announcement on the rates are expected on Thursday, July 18.

There will be no repeat of what happened in June. After the mini cut of 25 basis points, the ECB should thus confirm the status quo on July 18, leaving the rates on deposits, the interest rates on the main refinancing operations, and the interest rates on the marginal refinancing operations of the Eurozone at 3.75%, 4.25%, and 4.50%, respectively.

For now, let’s look at what the models are telling us.

Let’s dive straight in.