Mid-Week Update

November 20, 2024

There are only a few trading sessions left for the remainder of the month. Tuesday brought a bit of volatility following Ukraine's long-range missiles hitting Russian soil. Ukraine's reportedly first strike using Western-supplied rockets and Putin approving an updated nuclear doctrine came as a one-two punch in early European markets trading. I honestly don’t know what to make of this. It almost feels like the outgoing administration wants to ensure this war escalates to the point where the new president has no other option but to be drawn into a heightened conflict. It’s lunacy, and it doesn’t make me overly confident that this will resolve itself quickly. Now, Putin certainly knows of those intentions and will hopefully be cool-headed in ordering a hasty response. I don’t think he will and will try and wait it out until Trump comes in. Maybe that’s the read equity markets took after returning into green territory after initial losses. We shall see.

Another question I am pondering is what monetary policy rate moves we are going to see in the final stretches of the year.

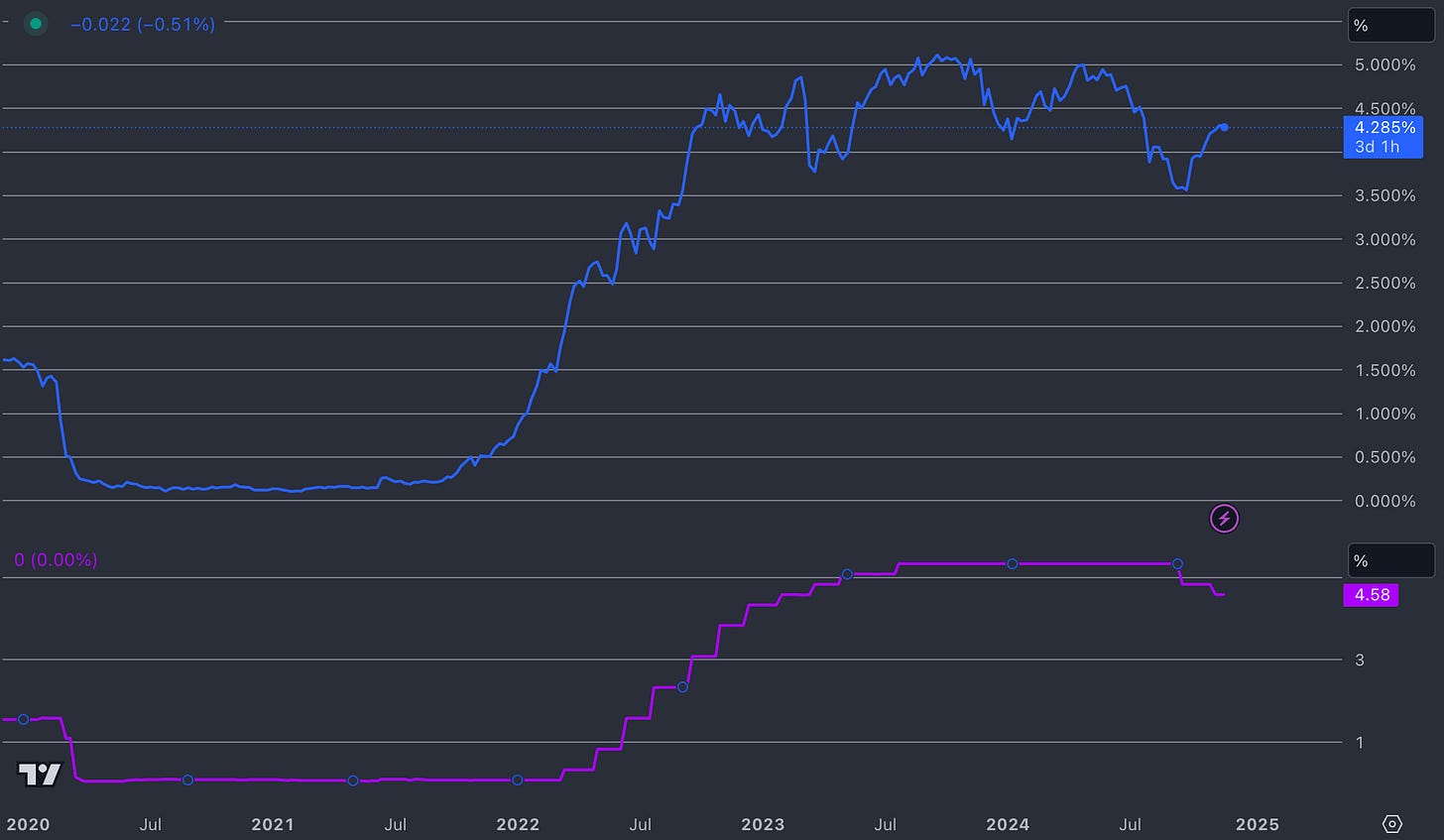

Powell has famously put the December decision into a fine balance. Of course, it’s going to be data dependent, but given the post-election relief, I wouldn’t exclude that the 20 bps currently priced will likely not materialise. The front-end (US 2-year yields) are already much higher compared to a month ago and could feel more pain. If the market sniffs out that a pause is imminent, I wouldn’t be surprised to see US 2-year yields (blue line below) closer to where effective Fed funds are (pink line). This implies another roughly 30 bps sell-off from here, which would likely flatten curves and lift the Dollar. Equities would likely do ok in such a scenario as the long end would most likely welcome the pause.

Plenty of things that can move in the last few weeks, so it is ever more important we end the year with a maximum attention before we can ponder about what trades we should consider in the new year.

Let’s now hear Macro D’s latest thoughts before we look at some updated charts & setups. If you have missed Macro D’s trade corner post, please see below, where he discusses the GBP.