Mid-Week Update

February 21, 2024

It was a more interesting start to what was expected to be a rather dull week. I have written a piece on a possible inflation return and what lies likey ahead. I’ve summarised the findings of an IMF study which analysed 100 inflation episodes over the past 50 years and concluded what those findings might indicate for markets ahead. I hope you enjoyed the tought piece.

The global inflation narrative saw another disinflationary marker yesterday, where we saw a large miss in Canadian CPI, which is in contrast to recent US data. Markets are reacted dovish, though sticky details within should deter the BoC from cutting rates too soon.

MoM inflation printed flat, missing consensus estimates of 0.4%, with headline slowing to 2.9% YoY (3.4% prior). However, details within paint a slightly more sticky inflation outlook. Core inflation remains the key measure and remains consistently above the BoC target of 2%.

Meanwhile, China lowered the 5y LPR rate by 25bps to 3.95%, the largest cut on record, above the 10bps expected and greater than any estimates in the Bloomberg survey. The further sign of support boosted HSI and Chinese equities. Remember that the January support package only allowed for a brief support, so let’s see how this one pans out.

Chinese A-shares are now back to the 200 ema line. The momentum model took us long a few weeks ago. Reversal zone is building, which means that we have possibly overshot in the current rally.

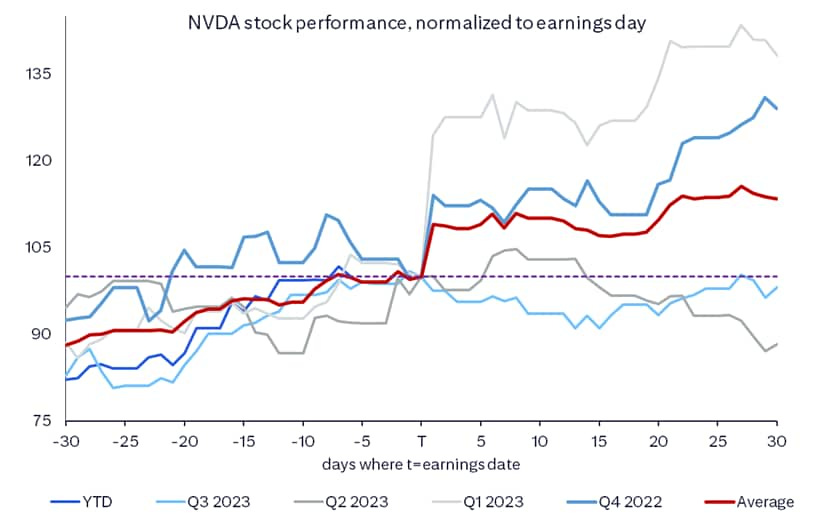

All eyes are on NVDA’s results today after market close. I’m not an equity analyst but you can tell from the charts that expectations are pretty damn high. Recent performance post earnings was around the 6% rally mark. With indices near ATH and vols relatively suppressed, do I really need to tell you how risk/reward looks in being long?

The stock has already adjusted lower, nearly touching the 20 ema resistance yesterday. Momentum is still indicating long. I’ll be watching for that support and whether it holds. Next support is down at 600 (50 ema).

Hedging activity, however, has already taken note of the upcoming risk events, with observable “kinks” in the vol structure on key dates ahead, including today’s NVDA results.

Let’s look at what other things have been flashing up on the charts.