Have the Bond Models Switched?

Revisiting the allocation models

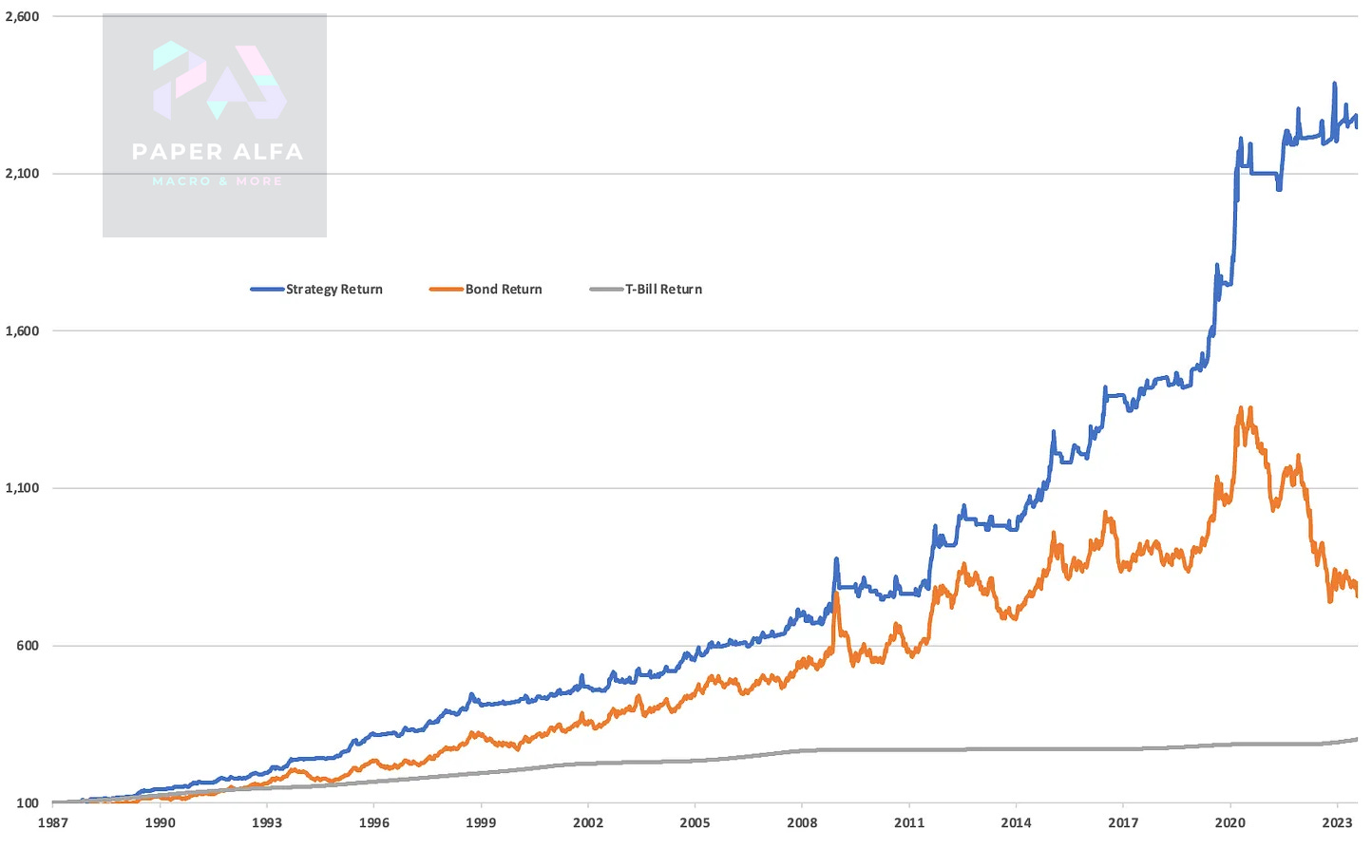

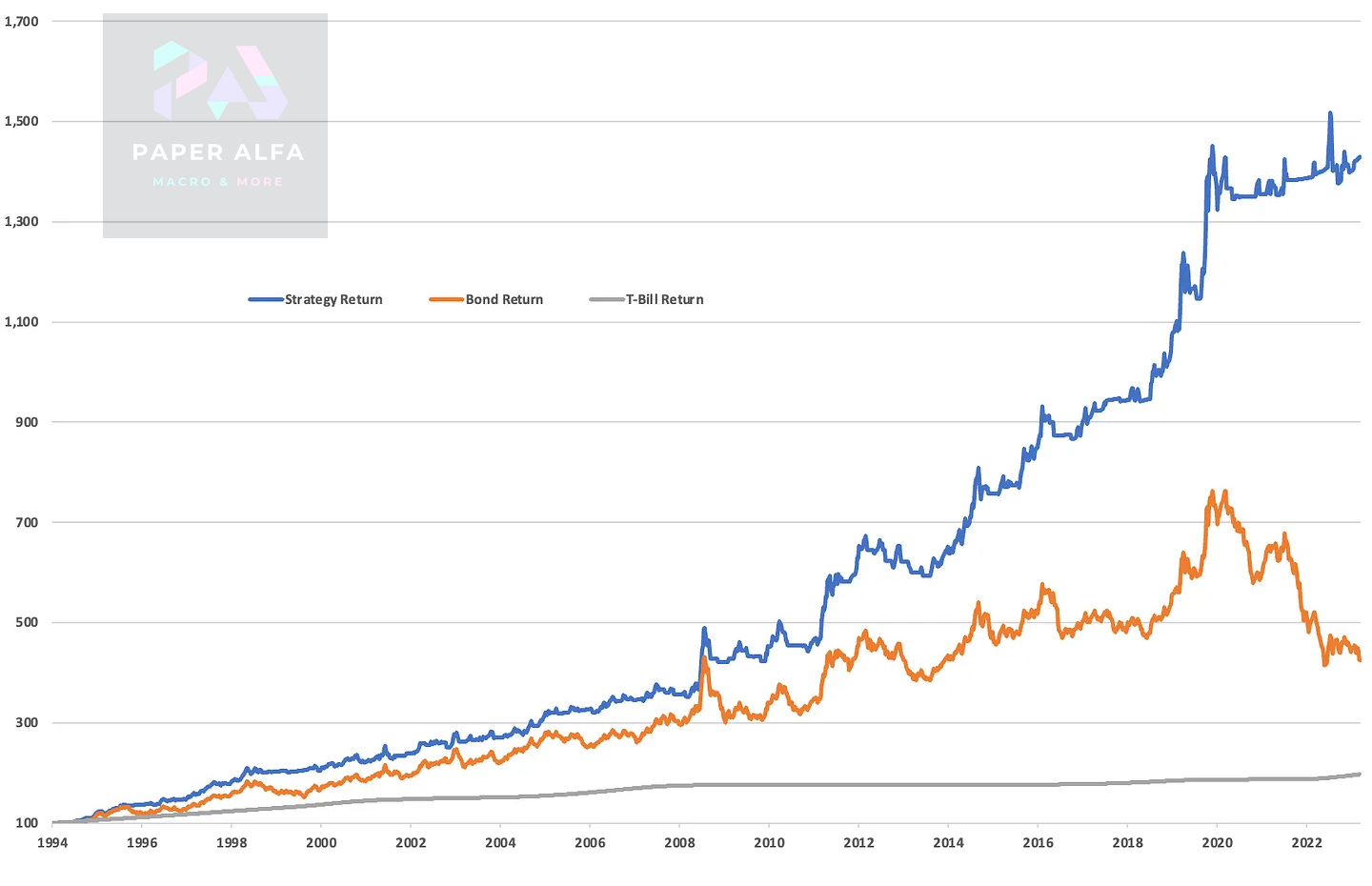

Back in August and September, I introduced two bond allocation models. Both are based on certain rules, allocating to either 100% bonds or 100% T-Bills, nothing in between. I used weekly data going back to the late 1980’s. As for bond total return indices, I used US Corporate bonds and 30-year total US treasury returns as a reference.

As a refresher, Model v1 side-stepped the steep drawdown of 2022 and reached new all-time highs (blue line) as it invested in T-Bills.

The outperformance is even more visible when using the 30-year US treasury total return index.

Model v2, meanwhile, performed even better, outperforming the US corporate total return index all the way through the rate-hiking cycle.

Again, using 30-year US treasury returns as the relevant bond index, the outperformance is even more staggering.

Needless to say, both models were still in T-Bills when I presented them in late summer.

Let’s explore whether they have since switched. The short answer is Yes, and they have done well.