Friday Paper Charts

February 2, 2024

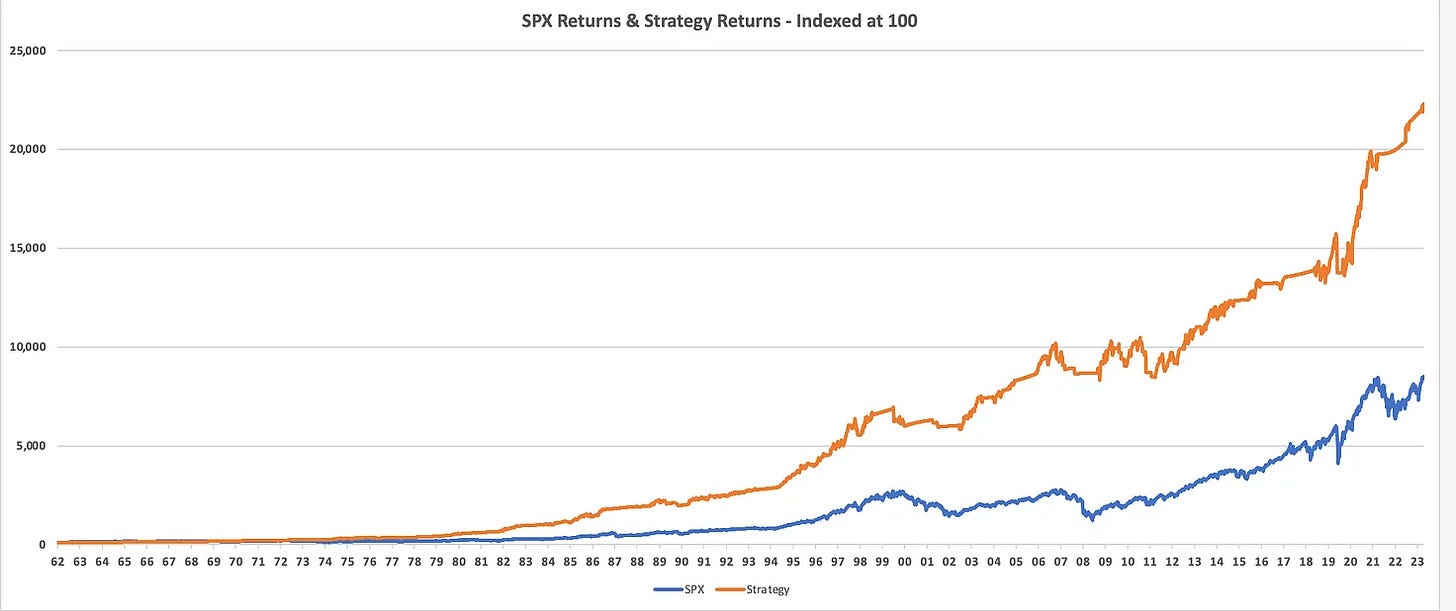

February, here we go. I added my first Macroscope post yesterday, presenting a strategy that times the buying of the S&P 500 by analysing certain liquidity impulses.

Rather than tracking liquidity directly, I am stipulating the hypothesis to identify where liquidity shows up first in a very simple liquidity cycle model. The results are very encouraging as the produced strategy offers higher risk-adjusted returns by sidestepping liquidity withdrawal cycles, where equities typically underperperform. See the chart below (orange line - strategy).

Good news for those interested in obtaining the models via a script for the TradingView setup: I have finally found time to get this working. If you are interested, please get in touch with me.

Before we dive into the numerous chart updates, I wanted to also opine quickly about Wednesday’s FOMC meeting and any meaningful signal that might have come out of it.

Let’s go.

Fed Thoughts

In my view, the Fed really didn’t throw up that many surprises. It rattled market expectations of a continued dovish impulse, but Jay would have had to sound even more dovish to have a similar impact as the December meeting.

Sure, it was feasible, but he would have had to throw a big nudge to cement an almost certain cut in the upcoming March meeting. It’s still possible, though, as data dependency is now again back in focus. He will also give a Humphrey-Hawkins speech in late February / beginning of March, where he could guide markets.

Every point he commented on can not objectively be refuted. I am happy to see that he corrected some overly dovishness in December. Inflation has slowed, but the economy remained too strong for the Fed to be able to ease soon.

“Based on the meeting today, I would tell you that I don't think it is likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that, [i.e. cut rates] … it is probably not the most likely case, or what we would call the base case”.

Let’s dig a bit deeper …