Friday Paper Charts

January 19, 2023

Finally, this was a week that can be characterised as interesting. Much to my content, my gut feeling proved right and wasn’t attributable to any Dry January side effect shenanigans.

Last week’s head-scratching post-CPI US front-end rally reversed during the week, as Waller’s comments trashed the view of any aggressive near-term easing path by the FOMC. Everything else moved in line with it, with the USD being the major benefactor given the extended short position that was established from the start of the year.

The voices from Davos kept a hawkish undertone, with Lagarde keeping her rhetoric, which was also echoed in the ECB minutes. Unsurprising, really, as they are known to be particularly well-versed in the game of fighting the last war.

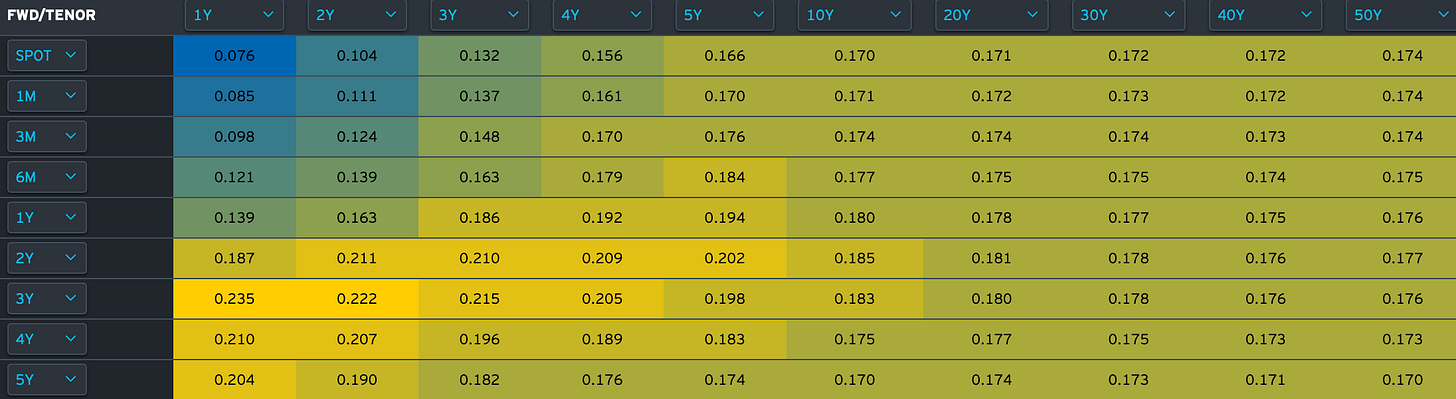

Over the week, we have seen US bonds sell off by roughly 15 bps on average, with a small steepening twist still in play.

Implied vols on 1-month options on 1-year (green), 10-year (light blue), and 30-year (teal) USD SOFR tenors still highlight the skew on front-end rates towards lower readings.

Let’s now focus on the charts, where quite a few developments have seen a shift change in our models. While side-stepping this week’s price action, a few interesting set-ups are developing, which should require our attention.

As a reminder to all new subscribers and those needing a refresher, check out a comprehensive full model guide here.

I am also working on making the models available for subscribers who are using the TradingView charting system.

Let’s now dive straight into the charting room.