Friday Chart Book

Waiting for CPI / Gold Tariff Impact / Preparing for Stagflation

A relatively uneventful week after last week’s payroll volatility has given me more room to ponder the bigger questions. After all, we had a 3-standard-deviation move in the US front-end (see details here), which had to consolidate as we are awaiting next week’s inflation print.

The market is clearly anticipating a bit of a stronger print, reluctant to push a September 25 bps cut to being fully priced.

Big level thought: Do we really think a 25 bps or even 50 bps cut would dramatically change the economy? I doubt that.

So what’s going on? I think we are in a decision paralysis, where conflicting data and economic models are not working correctly. There is reluctance not only from policymakers but also from markets to run with a theme. We have seen this film before. Recession plays have burned many macro traders before.

So we are all going to shrink our trading horizon and eagerly await September payrolls just to assess the next policy steps? That sounds logical, but doesn’t constitute proper macro perspectives.

Maybe this year’s Jackson Hole meeting from August 21-23 will give us more clues. After all, the title of the central banker symposium is “Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.". I wouldn’t hold my breath.

Meanwhile, the parody in the White House continues. The president appointed Miran to the Fed board on an interim basis. He is obviously going to push for a dovish agenda.

Not too long ago, however, he was advocating for the opposite stance. Monetary policy independence is an illusion.

Gold, once again, is possibly trying to tell us something. It’s not only a precursor for Dollar weakness, but ultimately a trust hedge. We are now seeing the top of the range for the 5th time this year (in futures).

Meanwhile, the trust asset is now also facing tariff concerns. I have asked a friend to summarise the implications on Gold, which you will find behind the paywalled section further below.

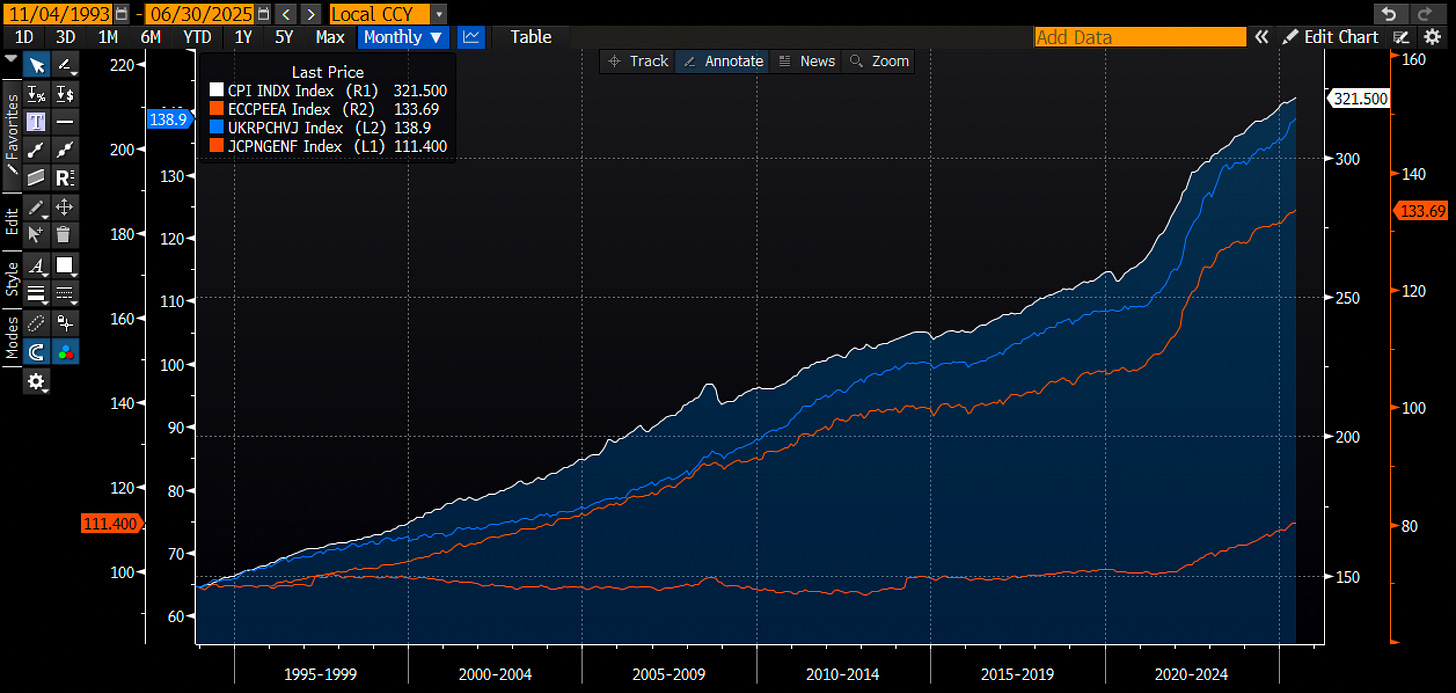

Policy makers are eagerly awaiting their mandated inflation rates to fall back in line, while debasement is still very much in play. Price levels give us a clearer picture, and I believe those levels are slowly but surely causing pain, regardless of whether y-o-y levels are coming down. Below are price levels for the US, EU, UK and Japan, where a stagnating price index over decades has now dramatically changed.

Stagflation is not something anyone of us has properly experienced, yet we are possibly already there or about to enter. The UK is a prime example where a mix of stubborn and accelerating inflation coupled with lower growth prospects is starting to manifest. What does the monetary policy framework look under those conditions? The BoE barely voted for rate cut on Thursday. Too much disagreement within the committee gives us maybe a clue where the FOMC is heading too. A “finely balanced” decision masks the small possibility that the bank’s rate cutting cycle is over. Welcome to the stagflationary world.

How do you invest under such conditions? Hard assets are part of the answer. Building robust portfolios that can deliver “real” returns is what we should strive for. That’s what the buy-and-hold portfolio for 2025 was build upon. It has deliverd 14% YTD in USD, beating US stock indices and inflation comfortably.

I am continuing to provide hedge-fund-like trading ideas to paying subscribers through my Substack notes and chat. I will present a few new trade ideas this weekend.

In addition, a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

If you are interested in exploring Paper Alfa’s full package, subscribe below.

Let’s now look at above mentioned impact of Gold tariffs on markets, read some of Macro D’s latest thoughts on the most prominent central banks, before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

Enjoy a fantastic weekend!