Friday Chart Book

May 16, 2025

It fascinates me how many people talk about Global Macro, and they talk well, but macro is not really about talking; it’s about doing. What’s the point if you can perfectly relay a view or trade idea but not act on it? It’s dead rhetoric. Nobody goes about playing sports by visualising and talking about how they will play a particular match; they go out there and do it.

I have always envisaged a creative aspect of anything, only to be valid if you give it life. Imagine the cloud storage of all possible ideas and things that never set off. The worst words in any investing endeavour are “should have” and “could have”. These terms are redundant and will not help you move on.

Why am I saying this? As much as I love writing about markets, I am much more interested in engaging with the beast itself and accumulating wealth in the process. The beauty of laying out my framework and tools to my readers here is that it helps me synthesise my thoughts onto paper. This is how my brain works. It is rare that I construct an idea in my head and trade on it without having given it life by either writing it down or talking with someone about it.

This is the power this community has given me, and I hope that my thought-to-paper (i.e., this blog) approach is also helping your journey. It’s a beautiful symbiosis and as such, anchored in the strength of our principles, which I have set in stone since day one. Long may it last. The growing subscriber base fuels my enthusiasm for learning and tackling what lies in front of us, and not what has been. Interested? Why not give it a go?

As my process of thinking and writing involves also acting on my thoughts, most of you following me should have hopefully benefited from my call to buy bonds a few days ago.

How did it happen? Nothing happens by accident at Paper Alfa. The buy signal came from our reversal model, which highlighted that bond markets will likely rally.

This is only one of many things, how my thoughts, ideas and tools combine to guide subscribers through the weeds of macro.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

My buy-and-hold portfolio, which I am presenting towards every year-end, has bounced from the depths of the April shock and is back at +8.71% YTD. It is comprised of my strongest conviction views, and expressed in long-only assets that I am happy to hold with a 12-month horizon. Read more about the holdings below.

What are my thoughts currently? I still very much like my macro blueprint, which helped me set a record month in April, although I have taken down a lot of risk on those trades based on the extreme levels we had reached. I am still in observation mode and acknowledge that cross-asset volatilities have retreated substantially.

Corporate credit and High yield spreads have fallen back to the mid-range of the previously very low 2024/25 range. The behaviour of the fall in spreads is synonymous with a crisis having been averted, similar to the episodes seen over the past 4 years.

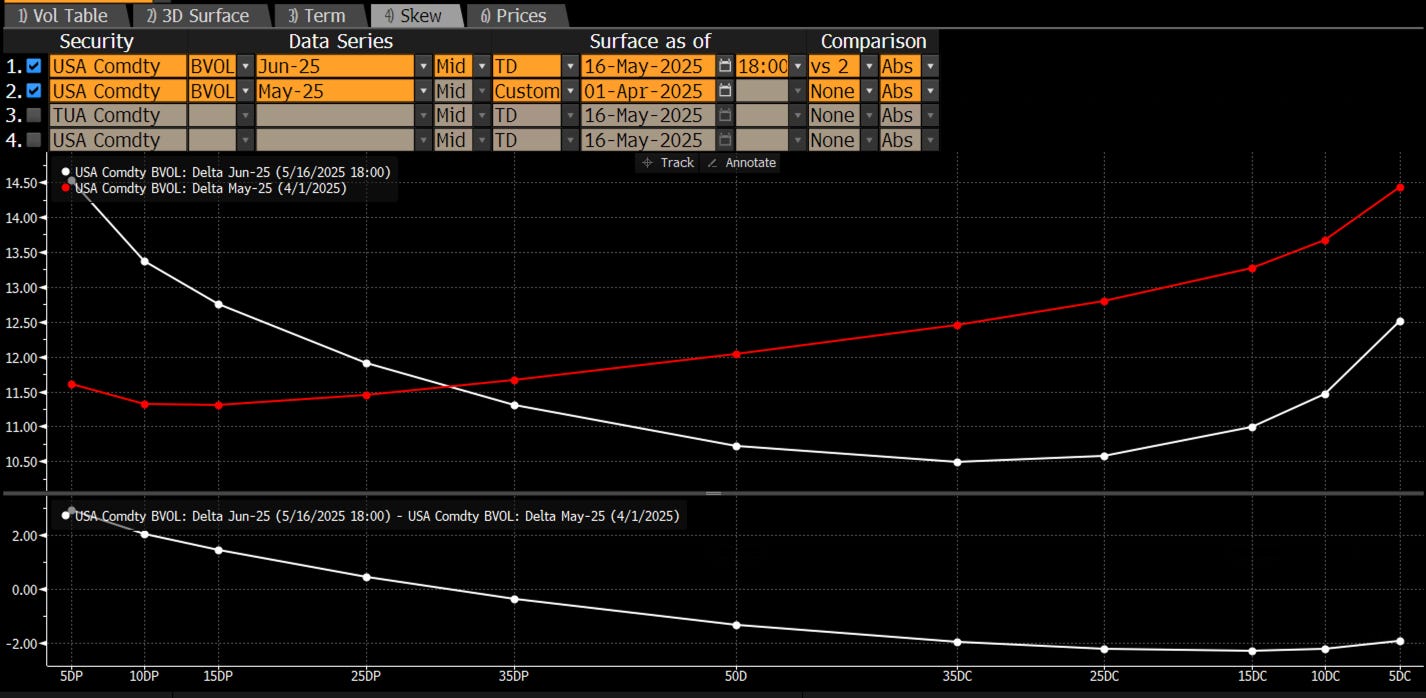

As such, the market is really just behaving like any other past stress scenario. This time around, however, I think some of the ultimate tails can still materialise. The US long-end is one that is deep in my macro thinking. We weren’t too far from touching 5% yields in 30-year this week, nothing ordinarily crazy about that thought as nominal GDP is tracking around that number. But what if fiscal worries resurface once again? The volatility skew in the relevant futures is telling us clearly that option markets still see risks tilted to the upside as far as long-duration assets are concerned. The red line is the skew before liberation day, vs the white line being now.

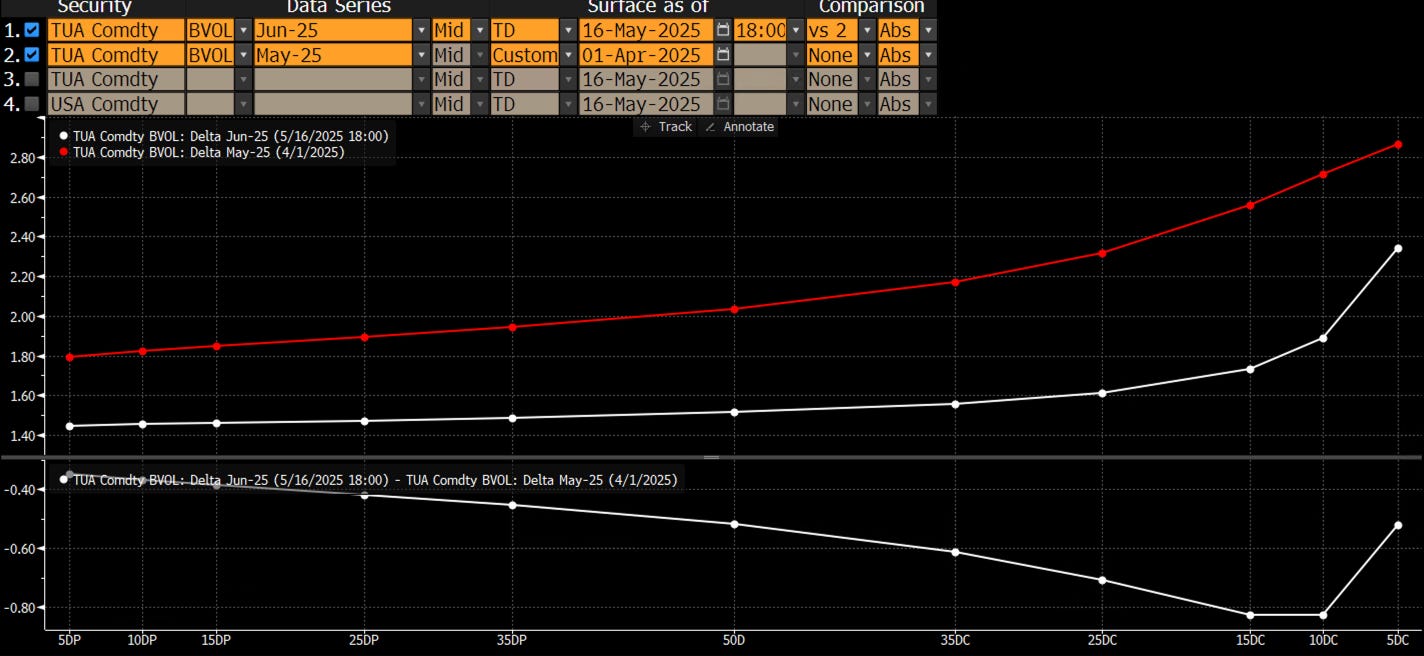

The short-end skew, meanwhile, hasn’t materially changed, and the premium clearly leans towards materially lower short-end rates from here on out.

This, of course, is the underpinning of the yield-curve steepening move we have been witnessing, US 2-30s showing below.

Structurally, the trade makes sense, but a lot of the dynamics are already priced while the position is carrying -60 bps over a one-year horizon. Going forward, the macro observation should firmly focus on the dynamics of this spread, with a particular focus on how the US long-end behaves.

Let’s now read some of Macro D’s latest thoughts before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

Enjoy the read and have a wonderful weekend ahead.