Friday Chart Book

November 22, 2024

Quite the week with plenty of fireworks around markets and, unfortunately, geopolitically. We saw big moves in the USD, with most eyes peeled by the underperformance of the EUR. Softer European data (aside from still resilient wages) led the currency lower with the climax reaching Friday morning, where EUR/USD traded all the way down to 1.0332 after the PMIs in very messy price action. This all seemed to be driven by option barriers, which got triggered.

These are exotic options, which I will cover another time, but in essence, someone most likely had a put or put-spread on the EUR/USD, trying to benefit from a falling EUR. All things are going well as the direction of travel is in place. To cheapen option premia, however, some punters engage in RKO (reverse knock-out) structures, whereby you still hold the put or put-spread, but it basically expires worthless if you hit the knock-out level which is further in the money. I have never engaged in such structures, and I think it’s the ultimate trading failure to bet in the right direction and be right but then lose all your upside because your trade went too much in the right direction.

Equities also exhibited quite interesting patterns in an otherwise quite macro data week. Below is the NQ intra-day 5-day range, where we chopped and turned several times, most notably around the US equity cash market opening. Despite NVDA’s stellar results, there seemed to be a bit of a rotation appearing.

This was especially evident on Thursday, when Russell leapt higher, spiking its ratio to NQ, which we observed over the summer in a bigger fashion. Below is the 5-day RTY/NQ ratio.

Meanwhile, bonds saw more stability, with curves generally flattening. I wrote about it last week, but with the Fed now really uncertain about its December moves, the highly positioned curve steepening trades could get unwound as we approach year-end. Negative carry is eating up the position, which hasn’t moved or is flatter over the past several weeks. See US 2-10s below.

As for bond yields outright, I am plotting the below (very rough) channel merely as food for thought. It shows the US 10-year yield, and I’m hypothesizing about whether another rally is in the works here. Our momentum model is still short from around 3.75%, but it’s worth thinking about how the next leg in macro is going to play out.

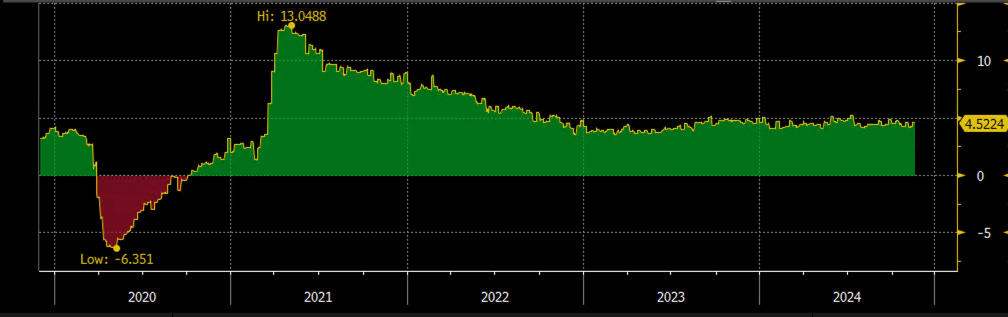

Do you know what not one research piece talks about? A US slowdown. While my nominal GDP tracker (see below) is still nicely trending at 4.5%, this possibility still looks rather remote.

However, Macro is not about analyzing the past. It still strikes me that Trump’s landslide win was brought upon an unhappy average US citizen who might see his paycheck rise a little but otherwise still struggles under a higher price level, regardless of whether inflation mathematically is coming down. Meanwhile, BTC and other crypto assets showcase a 2021 vibe, indicating a high degree of speculation as market liquidity still looks ample. Is the Fed too easy or too tight? We have been pondering this question for a while now, but I am starting to believe that behaviourly risk-taking is in its final phases of ascendency. After all, we had someone pay over 6 million US Dollars for a banana duct-taped to a wall. Go figure. Now, imagine if US stocks, for whatever reason, start their descent. Imagine what this would inflict on those speculating at current levels. Imagine what firms would do under such a scenario. Will there be hiring? Absolutely not. People would be shown the door. This self-fulfilling cycle would crater demand suddenly and forcefully. The Fed wouldn’t be able to inflict much of a boost with rate cuts as those natural reflexive processes need clearing out. This happens over and over again, yet nobody seems to believe that it can occur again.

While not my base case, I do think about those possibilities. This thinking, alongside my loyal friend Macro D’s invaluable insight, presents the backbone of Paper Alfa’s offering. In addition, our models guide us through the near-term noise, and they have provided us with outstanding assistance in any market environment. I often think I should increase the price of my offering as I believe it’s worth a good multiple more. But then, I appreciate that many of you would be priced out. After all, number one of our core principles is to help others on their journey. We are now more than 4’000 strong and growing, and that’s what matters most. If you are ready to be part of this community, I’d be thrilled if you are able to join. For those curious enough, I have enabled a free 7-day trial, where you can explore the full range of our offerings. Don’t hesitate as it won’t be open for too long.

For paying subscribers, Macro D presented his thesis on the GBP and why he is short in a post this week. This trade has worked magic as UK data came in softer, resulting in a fall of Sterling to 1.25 to the US Dollar. This is one of many ways this place adds value for our readers.

By now, most of you will be familiar with the models and their signals. If not, please study the guide I have published. I would highly recommend you go through these notes and guides if you are new to the pack. I am also in the process of making an intra-day model available soon. It’s in the works.

Further below, the full book of 250+ charts covers the whole asset spectrum from equities, bonds, commodities, FX, and Crypto to give you the most extensive view. On average, it will generally provide a good 5-10 set-ups on a weekly basis.

This is a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions. It’s taking time to set everyone up so I will limit the amount of users going forward.

Let’s also read my friend Macro D’s recent thoughts on markets before engaging our scanning eyes across the multitude of charts that I have updated for you below.