Friday Chart Book

February 7, 2025

NFP day, hooray! I am writing this before the print, and it seems the market is ready to buy bonds on any backup. Remember, these days offer more noise than signal. There is uncertainty around the weather and LA wildfires, plus the usual January seasonal adjustments, which have resulted in higher prints since the pandemic. We shall see. We are only a few weeks away from a possibly significant overall downward adjustment, so people are eyeing the forward-looking components with heightened interest.

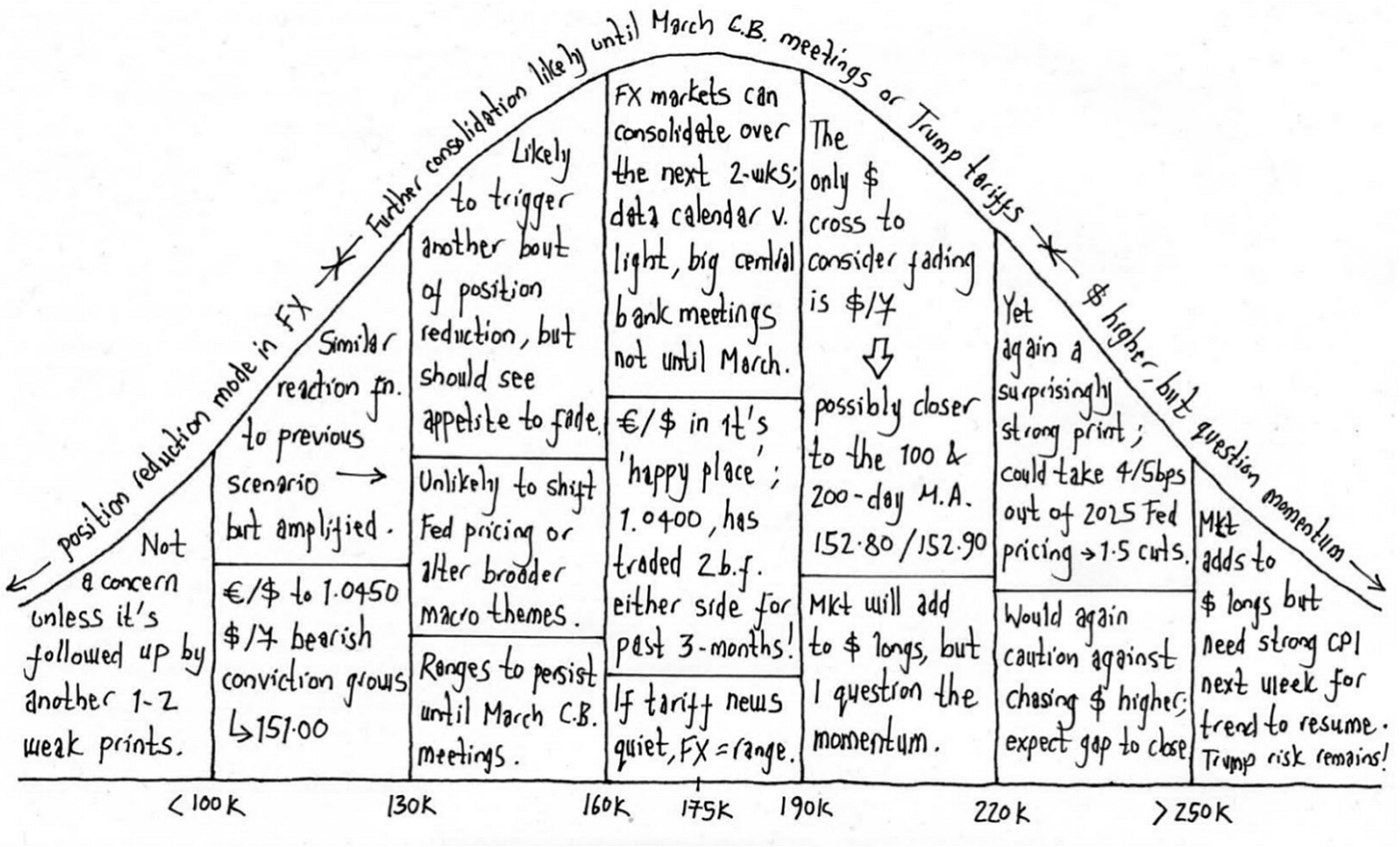

DB puts together a great distribution chart for NFP days and likely moves. Have a look at it and then compare it to what has actually unfolded.

There are a ton of moving parts with tariffs still in play, what a possible solution for Ukraine would look like, and what the impacts would be. These are the thoughts that are currently occupying my strategic thinking. I will follow up on those thoughts in another post.

Apollo’s Torsten Slok always provides interesting charts. The one below got me thinking. While not my base case at all, this cycle has been very unusual. So what if, indeed, we are at the stage where the last cut in December has been delivered? The shortest time was 7 months, and the median was 16. The Fed could be on hold for the entire year. What would be the implications?

The technical signals worked like a dream this week. Readers were alerted on Wednesday’s Mid-Week Update of a rally in JPY and Bonds, and the models nailed this move.

If you are curious about what Paper Alfa has to offer, I still have the 7-day trial for you unlocked. We offer timely insights and systematic allocation models which have proven us well over time. There are also our momentum and reversal models scanning all liquid global macro markets daily for any shifts and break-outs. Further, our goal is to enhance our reader’s understanding of how the macro world works and offer free educational pieces. The year has started very well for us. The Long-term 2025 portfolio is up over 5% (+1% in February so far) and doesn’t hold any position in US stocks. Rather than shooting darts at the board, we are all about the process.

This is a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost. I am also in the process of making one of my intra-day models available. This will come at no additional cost to existing users, but new admissions will see a price increase.

Here is a little preview. These are 15 min bars for the ES (mini-SPX future). This is still in refinement mode but the results so far are encouraging. I’m trying to incorporate volume into the mix as well, which should be interesting.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read what my friend Macro D has in store for us. We then scan the multitude of charts I have updated below.

Let’s go.