Friday Chart Book

Fed tempers mood / Central Bank Week / 250+ Chart Updates

In an otherwise quite boring macro week, the FOMC offered a bit more action than many had bargained for. With an overly dovish market pricing, the front-end was jolted by a committee that is caught between confidence and caution.

Powell’s post-meeting message was that a December rate cut is not a foregone conclusion, yet markets shouldn’t rule it out either. In fact, he brought back December pricing to a level more consistent with optionality. That’s really it. We are now pricing a 73% probability of another adjustment in December.

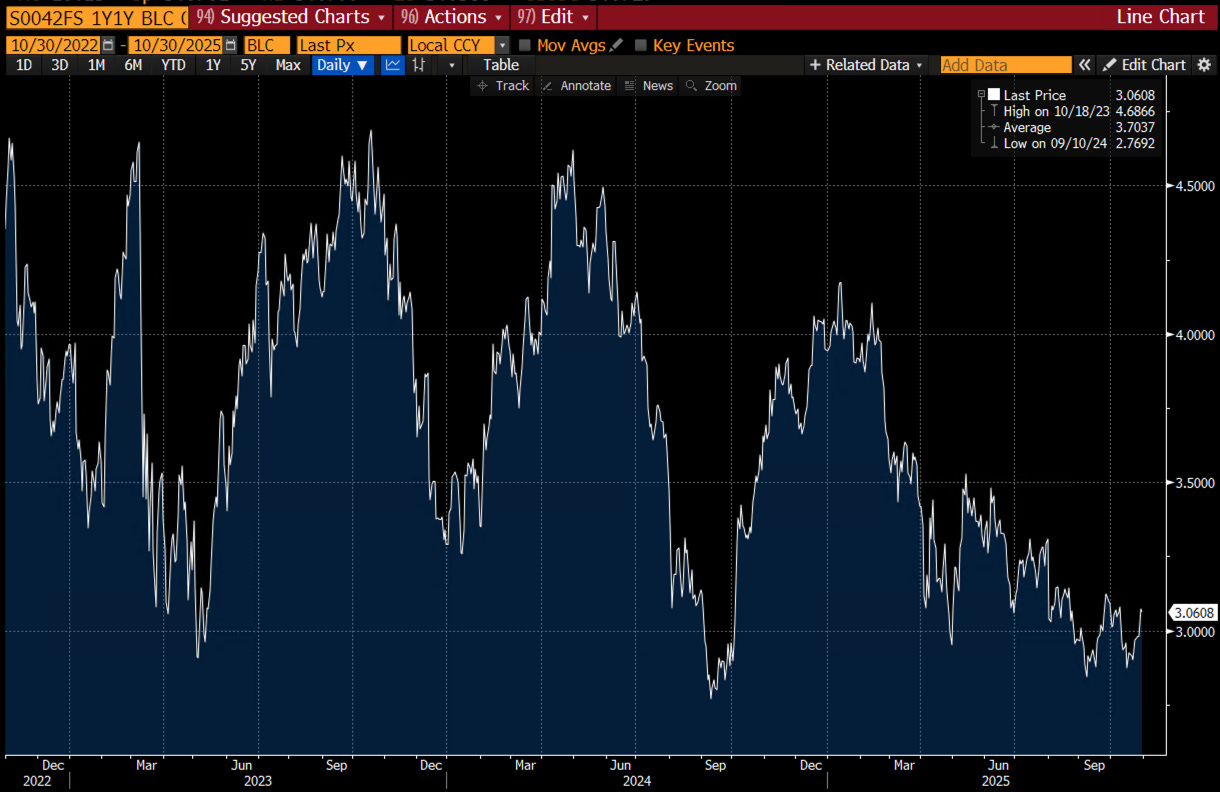

1y1y OIS has bounced back above 3%. This still looks a bit too richly priced, given what we have heard regarding their reluctance and division. I have an analogue. I am considering how this is going to play out. I will write a thought piece about it soon. The short story is that I think they are very likely done after a still likely December cut. Remember the talk about the political Fed next year? Not one mention in recent weeks.

The real issue facing the Fed isn’t conviction, it’s visibility — with patchy data and a government shutdown clouding the view, Powell likened policy-making to “driving in the fog”, which is fair.

Policy is now sitting at the upper end of neutral, and while most members still lean toward one final “insurance” cut, there’s a growing sense that the easing cycle is nearly done. Powell framed decisions through a risk-management lens — ensuring stability rather than signalling a need to rescue growth. Inflation, stripped of tariff effects, sits close to target, and the labour market shows gradual cooling but no cracks.

In tone, this wasn’t a dovish Fed. Jay’s language was careful, measured, and designed to prepare markets for a likely pause after December. Unless the shutdown drags on and data remain dark, the Fed appears ready to take its foot off the accelerator and watch how the economy absorbs the easing already in place.

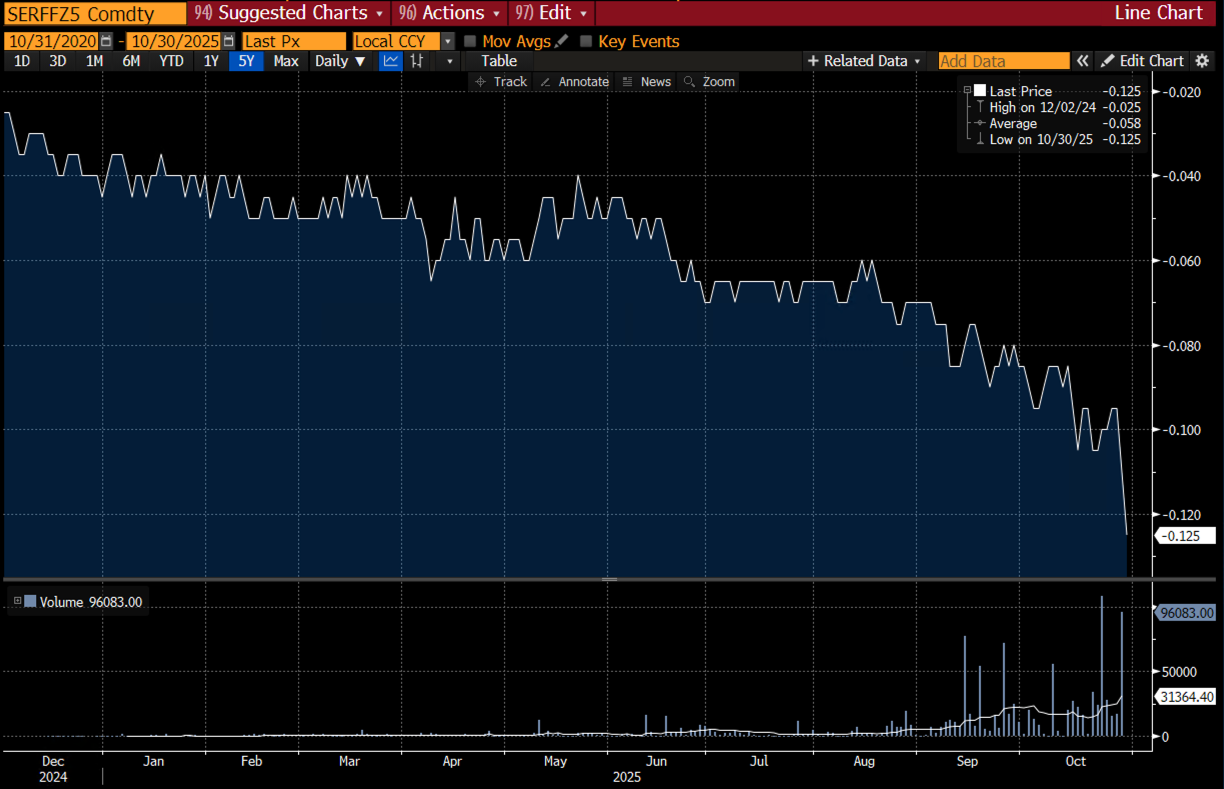

Also, Powell referred to the FOMC hawks as “they” in the press conference, using this word more often than in any other 2025 press conference and twice as much as in September. This suggests that he is willing to tolerate the risk of inflationary entrenchment, but “they” are not. This shows a clear division, which is healthy but makes decisive policy-making a bit more complicated, especially when you are faced with a lack of data. The QT announcement was pretty much expected with the start on December 1st, seeing mortgage-backed redemptions being reinvested into Bills. This will add around 15-20 billion USD in buying demand. There is some tension around funding spreads, with SOFR-Fed Funds for December collapsing to new lows. A lot of it has to do with year-end “turns”, which sees a bit of liquidity tightness. When in doubt, I always read my friend Conks for his excellent publication on everything plumbing-related - financial only.

I’m watching the below EUR/USD chart and wonder whether this is just setting us up for a swift downmove in the coming weeks.

The BoJ decided not to increase rates. I’m losing patience with the only monetary authority, which is not following its mandate appropriately. We all know they don’t want to hike for political and market stability reasons. The consequences are clear in one chart. USDJPY has broken the previous highs, now looking to take out the 155 marker soon.

Gold had a tough start to the week but is holding in relatively well. We are now at the bottom of the trend channel, which is holding. A break, however, would see us retest the 3800 level, with eyes on the breakout area from the end of August at 3500.

For now, some reversals are flashing in a few market segments. See the chart pack below, which captures my long-standing trading models.

A reminder that you can now also use my trading models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Paper Alfa will be 3 this weekend. As a sign of gratitude, I am running a 20% discount for life on new subscriptions. Please use the link below.

Let’s now read Macro D’s thoughts and roundup on this week’s central meetings. In addition, you will find the updated chart pack of all 250+ charts across the global macro universe.

Have a fantastic weekend!