Friday Chart Book

May 17, 2024

“In the impossibility of being able to see clearly, at least we see the darkness.”

- Sigmund Freud

by Macro D

You cannot stay in financial markets and turn your back on the Chinese dragon for more than a week; if you do, you will find yourself with doubts much bigger than the basket that should contain them, and this is never a good sight, especially if that basket is chock full of risks.

We are speaking of unknowns knocking at the front door of our Bloomberg platforms.

The miracle pump that China has used to inflate assets around the world has seemed to be running out of air lately. Or rather, the air is always there, but near the Chinese wall, someone began to wonder, "Has the wind changed?"

Let's delve into the situation. China, after expanding its influence across the globe, turned its attention to its own backyard. Despite rapid GDP growth, it became apparent that internal investments and family income were not keeping pace. This realization could have far-reaching implications for the global financial landscape.

Considering the current situation, one cannot help but ponder: Could a devaluation of the Yuan be a possible outcome? This question, if answered, could have significant implications for global financial markets.

It could, but if the big boss let stubbornness get the better of him again and put the export objective back at centre stage, well then...

What do I see?

I see that prices continue to be low, a sign that the economy is still weak. The acceleration seen in February appears to be an isolated event, and this reinvigorates fears of deflation, which, in turn, confirms weakness in the Chinese economy. The era of China's significant infrastructure build is over; for example, the steel sector faces enormous overproduction. China's steel production has increased rapidly in recent decades, becoming the world's largest producer and exporter. Yet, the prolonged downturn in the real estate market and the slowdown in infrastructure spending by some local governments to contain debt risks have left the industry with its back against the wall.

Prices have fallen sharply since 2021, and some steelmakers have called for limiting production, citing mounting losses and cash flow risks due to overcapacity. Even the possibility of using the foreign market (leveraging the practice of dumping) to unload excess steel is no longer a feasible hypothesis. In April, Biden said tariffs on Chinese steel and aluminium imports should be tripled.

In April, consumer prices increased for the third consecutive month by 0.1% compared to the previous month and by 0.3% compared to April 2023. This is a limited increase but still worth considering because it comes after a period in which prices have fallen.

Therefore, inflation has slowly returned to China (or something that closely resembles it), moderate and far from what has been seen in most of the developed world in the last three years: the April data indicate that Chinese consumption demand has returned to rise its head and put pressure on prices. This is a good sign for the Chinese economy, which has been struggling for some time.

The real estate sector is still in crisis, and we are not talking about just any industry but the one that has driven the economic context for years, pushing the country's growth. Youth unemployment is relatively high, and exports are no longer growing at the pace of the golden times.

Meanwhile, what wind is blowing around Washington?

On one side, the central bank continues to offer lifeblood to the unassailable project of wanting to cut rates. Conversely, it does not exclude the possibility that the risk may also arise that rates, rather than a cut, must be raised.

I don't feel comfortable in regard to rate increases. Therefore, I won't entertain this hypothesis. Powell is not ruling out that rates cannot be raised, which does not mean that there is a risk that rates will be raised in 2024; it means that interest rates could remain where they currently are.

Jay was still in his hotel room in Amsterdam when the US macro data pulled its head out of the sand.

But let's look at the charts before we come up with the numbers.

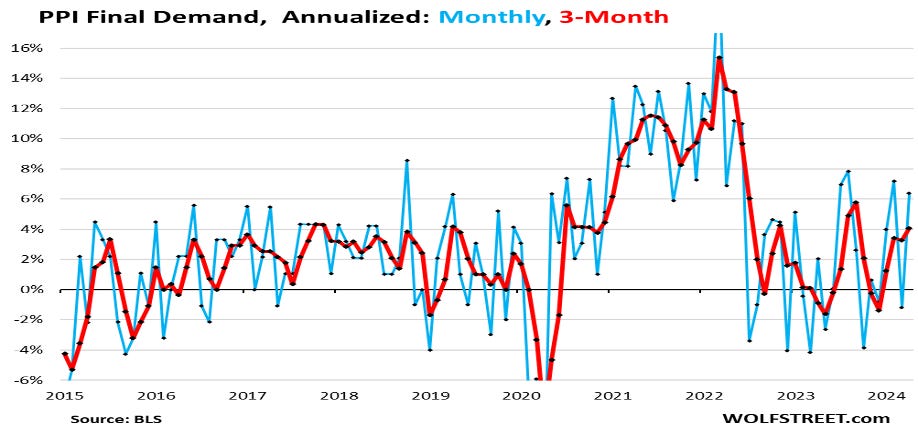

How can we translate this chart into concrete thoughts?

Let's delve into the economic cycle we're currently facing. It's characterized by an increase in prices, a challenge that not even an experienced bounty hunter would be able to eliminate without first suffering.

How did Jay react? He sketched, he took a nice walk through the canals of Amsterdam, and when the microphone popped up under his nose, he said he expected inflation to continue to decrease in 2024. Still, when it came to explaining the technicalities of this expectation, he turned up his nose and said that his confidence in this regard had diminished, considering that prices rose more than expected in the first quarter.

The journey ahead was never expected to be smooth. However, the recent inflation readings have been higher than anticipated, suggesting a need for patience and reliance on restrictive policy. This could mean maintaining the policy at the current rate for a longer period than initially projected.

I don't think it's likely, based on the data we have, that the next move we make will be to raise rates. It's more likely that we will be able to keep the policy rate at the current level.

"I expect inflation to come back down ... every month to levels more similar to the lowest readings we had last year," Powell said. "My confidence in this is not as high as before."

What does all this mean?

The sentences uttered by Powell mean that he has kept his mind on the path of monetary policy at this moment, which means stable rates and a natural inclination to want to cut them, even without making clear the modalities that will concern these cuts.

As Jay shook hands and prepared for the return journey, what happened? The leading US indices showed they wanted to be an example of promiscuity for the rest of the day. The S&P 500 index closed up 0.4%, and the small-cap Russell 2000 gained 1%.

At this point, I said to myself:

“Give up; you're in for a sleepless night”.

I had already set my thoughts towards the horizon of the next day when the inflation data would come out. To which I thought:

If Jay had spoken that way before, exposing himself in that way (he didn't lay himself completely bare, but he came close). He already knew the data that would be published the next day; therefore, what he declared perfectly reflected the numbers and graphs he already had at his disposal.

I said to myself: “Tomorrow we won't have any big surprises”.

Meanwhile, I was mulling over the following: due to the drop in consumption, the US economy is slowing down, but if reason isn't playing a trick on me, then the drop in consumption should, in turn, generate a drop in inflation. Something didn't add up, so I picked up a book that I loved during my university studies (Being and Time, by Martin Heidegger), and I inevitably remembered all the rents I paid in those years of crazy and desperate study.[1].

"Yes, the rent!". I thought.

The biggest obstacle to disinflation in the USA seems to me to be the growth of rental shelters (currently around 6%). Since housing constitutes 36% of the index, the gears must step on the brakes if we hope to reach the much-desired target of 2%.

Before closing my eyes for a few hours, I thought that if the next day brought any surprises, it would come from the rental data.

The night passed between a nightmare called subprime and two ghosts: Fannie Mae and her competitor, Freddie Mac, who accused each other of unspeakable misdeeds.

It wasn't easy, and at dawn, I arrived with my fingers ready to give myself a screen that showed me how the eastern markets were doing—very little stuff.

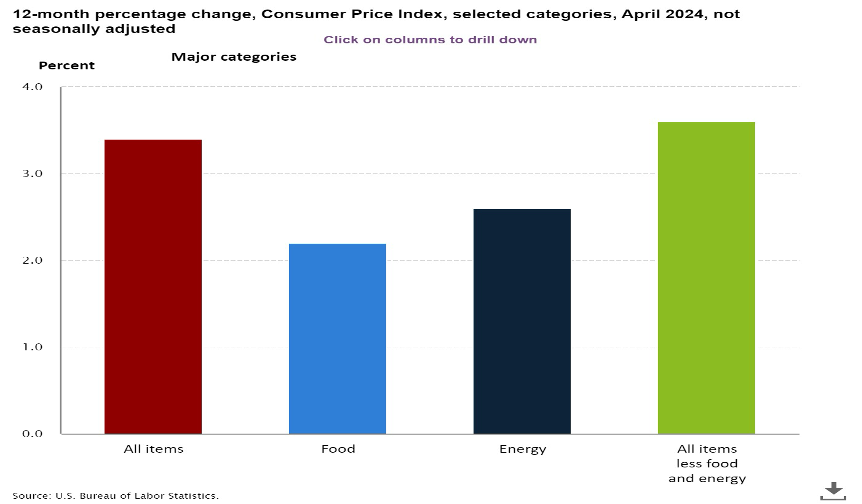

And then, the long-awaited moment arrived: the one who took these two charts.

What do these charts mean?

They mean that the trend figure for US inflation is growing but in line with expectations at 3.4% in April. The economic data is especially worth keeping an eye on, with the cost of living rising to 0.3% in April, less than what the experts expected (+0.4%). Core inflation, which excludes food and energy, was 0.3% monthly and 3.6% annualized, both expected by consensus.

At this point, I tried to deepen my gaze. Although these data align with market expectations, the US consumer price index remains above the warning level, i.e. beyond the area that would suggest an imminent cut in interest rates.

Result?. This suggestion is not there; therefore, there is no intention of offering Powell a brand-new pair of scissors in the near future.

So, I put it in writing.

That 3.6% and the 3.4% got me thinking. At first glance, it might make some members of the FOMC smile. That's the lowest increase since April 2021.

Still, I was raised following a very specific and never out-of-fashion saying: one swallow does not make a summer. Much more solid evidence is needed before putting aside the hat and scarf and bringing out the bermuda shorts and T-shirts.

Most of the data that gives me food for thought are those on real estate. In the consumer price index, real estate costs continued to rise faster than before the pandemic, which continued into April. There wasn't much cooling, but there was very slight moderation. The primary residence rent index calculated by the Bureau of Labor Statistics increased 0.4% in April compared to March. The pace of increase is visibly slower than last year, but reversing the trend of housing inflation is a task that takes time to accomplish. This mission requires patience. Does the Biden administration have the time it takes?

But then, can these data represent a step forward or not?

They are neither a step forward nor a step back. Still, I expect the message from Jay in the next few weeks to be a message that makes the markets understand whether there will be cuts this year, not a message that makes me know how many cuts there will be.

In short, Powell will soon tell us whether he will offer us ice cream, but he will certainly not say anything about the flavours of the ice cream he intends to provide.

If the price data had been higher, he would probably have ended the rate cut talk once and for all, and the markets would have bet on a rate hike.

We close with another question.

Will the Fed be able to keep inflation under control without slowing down the economy and, consequently, safeguard the people at the highest risk of losing their jobs?

Bets are accepted.

In the meantime, Employment growth was slow in April, while the unemployment rate accelerated.

One final consideration.

For once, economic forecasts did a good job.

Let’s now turn our attention to the charts. By now, most of you will be familiar with the models and their signals. If not, please study the guide I have published. I have now also recorded a brief video tutorial, which you will find further below.

The full book of 250+ charts covers the whole asset spectrum from equities, bonds, commodities, FX and Crypto to give you the most extensive view. On average, it will generally provide a good 5-10 set-ups on a weekly basis.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts for a fee. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.