Friday Chart Book

BoJ - JPY "Carry" / Full 250+ Chart Deck

December started with quite a bang. Driven by what seemed like an all-but go-ahead for the BoJ’s December hike as Ueda delivered his speech in Nagoya. The Governor struck a quietly confident tone, arguing Japan’s recovery remains intact and inflation is evolving toward the 2% goal. The recent GDP dip was “temporary,” tariffs have hurt less than feared, and AI-driven demand is supporting exports. With core CPI near 3% but set to cool before rising again, Ueda signalled that rate hikes will continue “to ease off the accelerator, not hit the brakes.” Wage growth above 5% and tight labour markets strengthen his case for gradual normalisation — real rates, he noted, remain deeply accommodative.

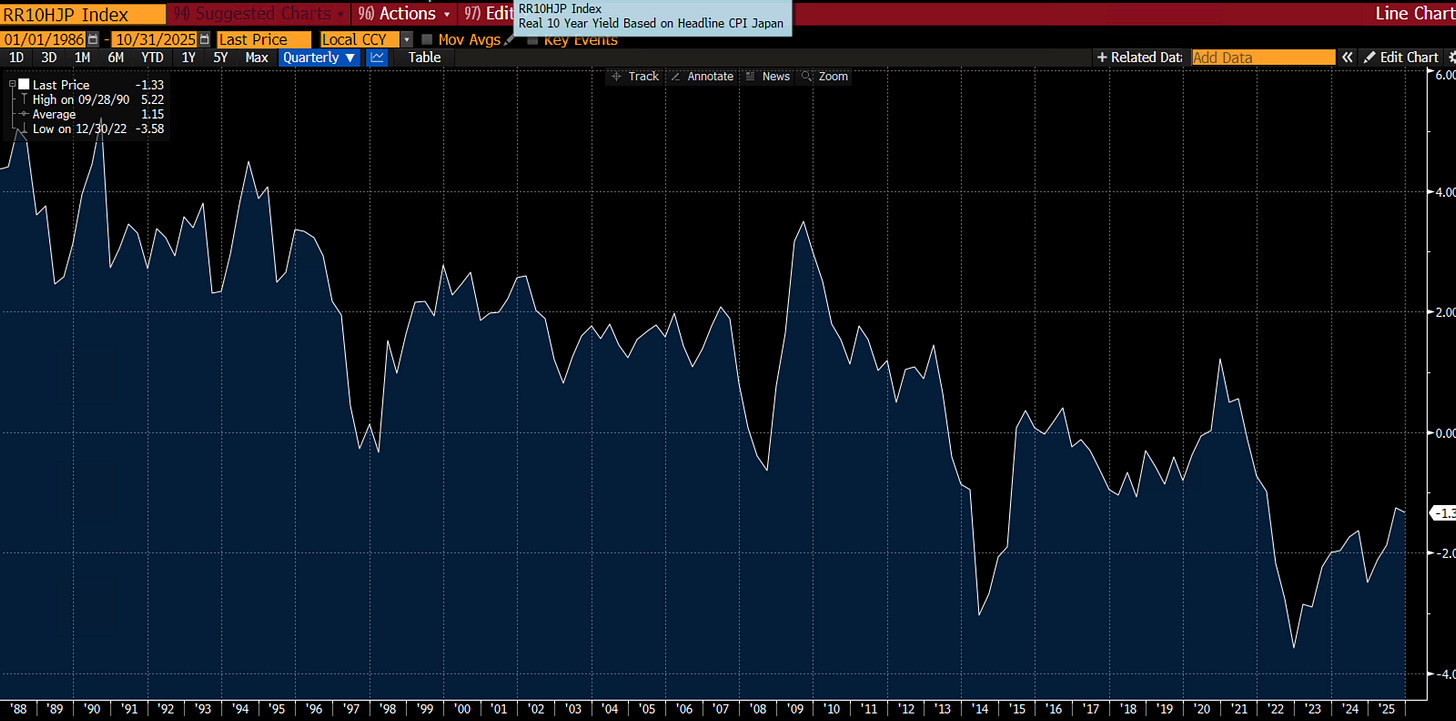

Many pundits argued that this caused some havoc in risk and bond markets on Monday. JGB yields have been rising steadily, with curves steepening as profoundly negative real yields are not enticing domestic demand to step up.

10-year real yields, as Ueda stipulated, are negative and offer healthy accommodation regardless of whether they would hike rates to 75 bps in a few weeks.

Any Taylor-rule approach would dictate rates to be much higher, with Bloomberg’s version pointing to closer to 5%, “only” 4% away. Make no mistake, there is no way the BoJ will ever get anywhere close to that. Real yields will likely remain negative.

As front-end rates can’t keep pace with inflation, the long end of the curve has to reflect those dynamics. As such, it’s interesting to see the 15y15y forward rate recently reach 5%.

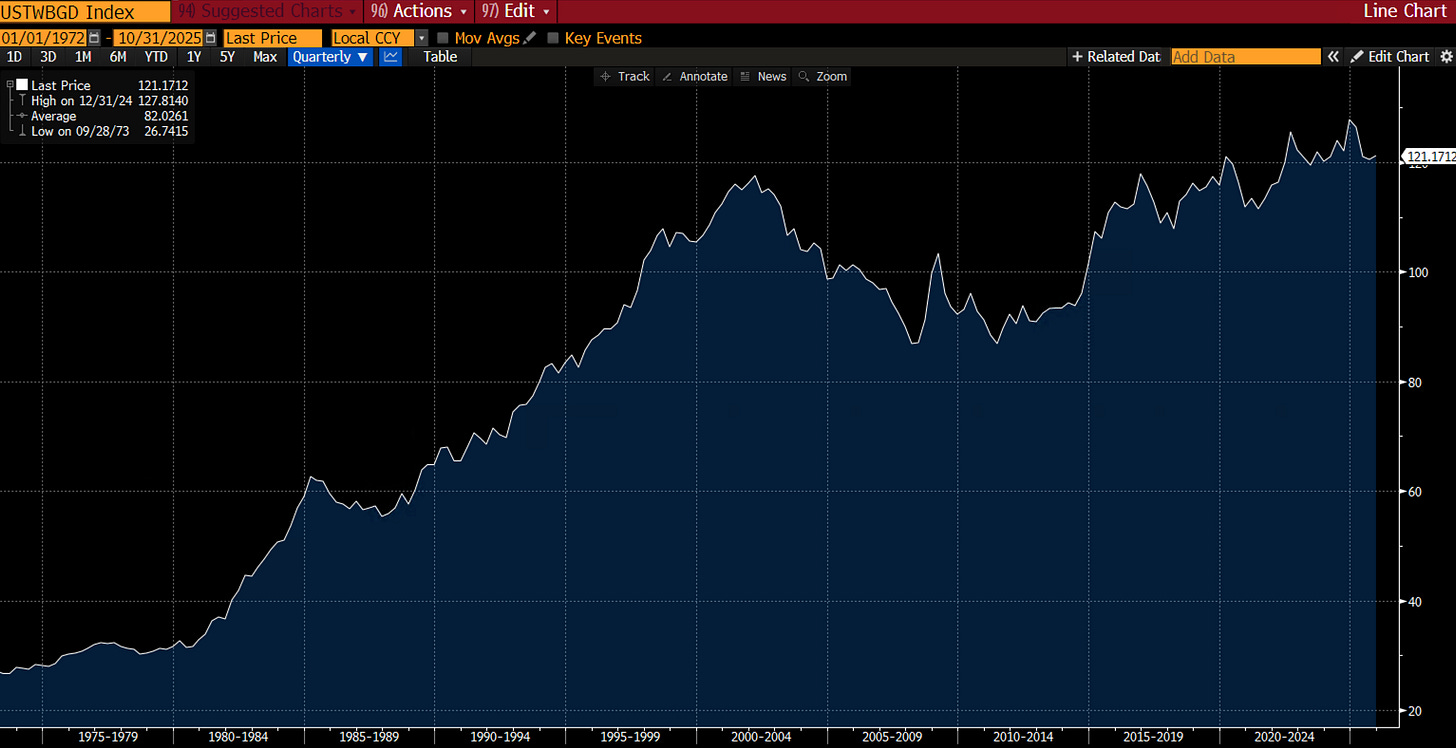

Much has been said about the BoJ’s reluctance and the cooperative nature between the government and the central bank to support their domestic aspirations, while maintaining highly accommodative policies. The Yen, therefore, has been a frustrating trade this year, failing to gather momentum, as no credible monetary policy strategy was being followed, resulting in the currency being used as a funder for global macro FX punters. Who can blame them?

Japan’s net international investment position stands at around 3.5 trillion USD. That’s how many assets the Japanese hold vs the rest of the world holding Japanese assets. It’s a staggering 100% of GDP, which is often referred to as the big carry trade. That’s, however, misleading as a large chunk of those assets is being hedged back into the domestic currency, which is costly.

As a large holder of US Treasuries, for example, the US 10-year Treasury yield is currently lower than an equivalent JGB, despite the sell-off in Japanese government bonds, by 20 bps, which isn’t small change.

All that is going on is that JGBs are trying to find a level where domestic allocators step in. Is it here? It doesn’t look like it. Is there a convex moment happening when capital flies back onto Japanese shores, strengthening the Yen in the process? For sure, the trade-weighted JPY is at record lows. Will this have consequences elsewhere? Absolutely. There is a beautiful macro trade brewing just in front of your eyes.

Lucky for subscribers, Macro D has outlined his thoughts on the central bank and new government in a three-part series. See the links below.

Is this driving the US Dollar lower currently? Sure, this is a desired government policy that still targets a weaker Dollar as well as a high chance of a very dovish Fed chair, which are all factors, driving the greenback weaker. Global rebalancing on trade and push for national mercantilism doesn’t happen overnight; it's a long process, but therefore a prime candidate for a thematic macro trade that can play out over years. The recent commodity surge is, in this regard, telling us something.

Our global macro buy-and-hold portfolio for 2025 is up 24% YTD in USD terms, and I am already working on the allocation for 2026, which, as I alluded to, won’t be a year many are expecting. Rate cuts, fiscal, capex spend, it’s all good news for risk as I’m reading some of the already published outlooks for next year. Macro never follows the obvious path, what normally transpires is sometimes what people least expect.

A reminder that you can now also use my trading models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read some of my friend Macro D’s thoughts on Japan, European Inflation, the SNB and more before we go through the entire chart book.

Have a blessed weekend, and a great start to December!