Friday Chart Book

Narrative Carousel

This is a long weekend (UK bank holiday Monday) and I am travelling into the wild to spend time in nature walking, pub crawling my way across Hampshire.

Markets have found a new gear this week as we are seemingly spinning the narrative once again. My focus on the long-end and the link to the fiscal discipline bond markets are seeking from the new administration has given way to renewed fears as Trump threatened new hefty tariffs on the EU amidst slow trade talks progress. If observing the EU over decades has taught me anything, it is that they are not fast mover. You are negotiating not with one country but with 27 individual interests. Markets reacted, although bonds have unwound initial strength, and stocks rebounded, while the US Dollar is taking most of the brunt.

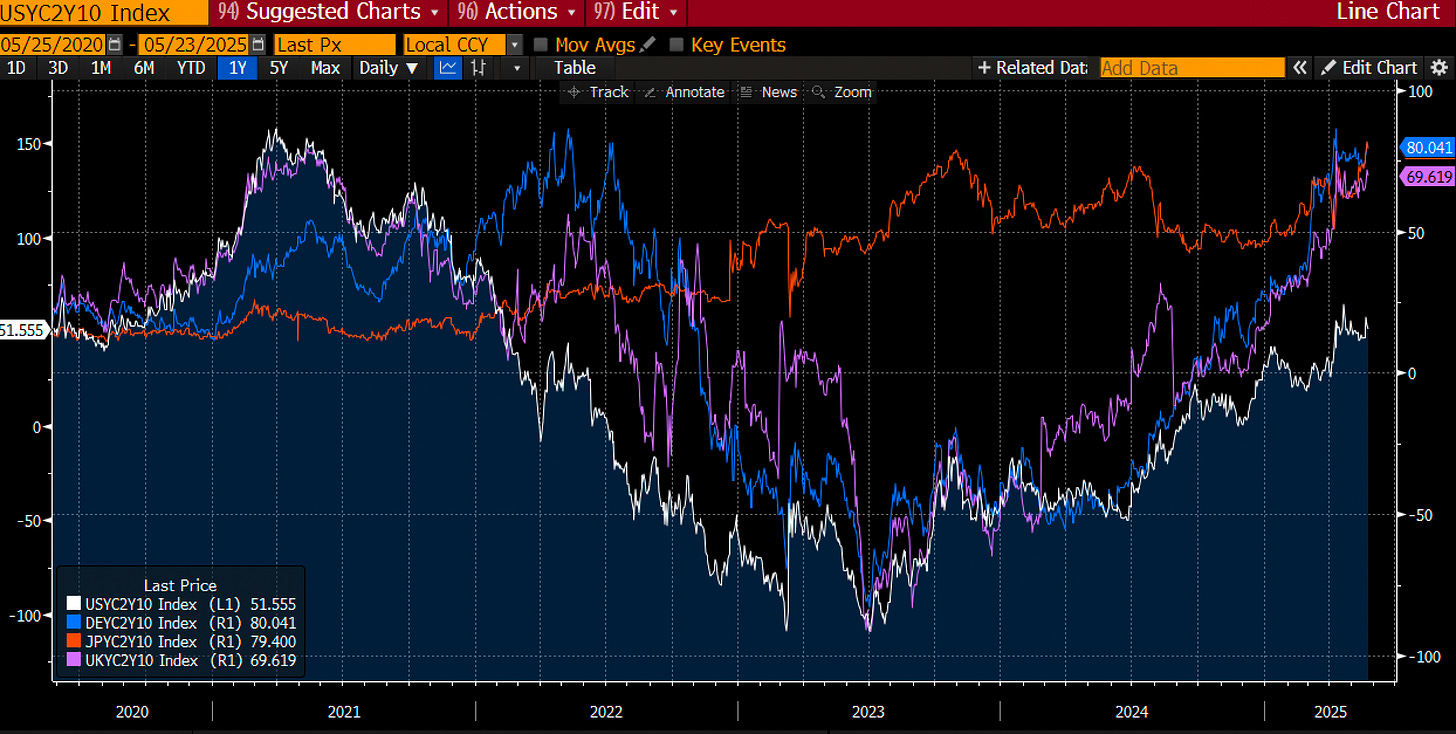

The recent steepening of global yield curves has caught much attention. Looking at the comparative curves for some countries would reveal that only Japan really stands out as to how steep the very long-end is trading, while the curvature in other countries is not too dissimilar from the 20-year point out. For a more detailed discussion on yield curves and convexity, please explore my educational series on Trading Yield Curves.

The global expansion of term premia is the result of markets adjusting for a macro view that, in a world of heightened tariff uncertainty and renewed focus on domestic policy, spending will increase in order to support domestic demand. After all, if the world ultimately needs to consume all those US manufactured goods, real wages will need to be increased sufficiently high in order to create the necessary demand.

Gold and Bitcoin are already moving to reflect this macro vision.

The US Dollar has notably printed new lows in May when looking at the equally weighted currency index from Bloomberg below.

This reinforces my view that my macro roadmap is still very much intact. The resulting investment implications continue to be the same.

The US Dollar continues to weaken

US Stocks on an index level will likely re-rate lower

I don’t call the end of US exceptionalism. For it to end, you need an alternative. I don’t see exceptionalism elsewhere. US companies are still the best in the world.

Rotation might continue, but the bulk of non-US equity outperformance is behind us

Lower trade deficits and still elevated budget deficits mean steeper US yield curves

Inflationary pressures might persist in the short-to-medium term. US Treasuries might not offer you the same diversification in a stagflationary environment unless we enter a recession

Real assets, like precious metals, should continue to do relatively well

Stay nimble; markets are going to be volatile

Paper Alfa’s buy-and-hold portfolio is up close to 9% YTD, with the latest wobble leaving no marks on performance.

Our trading models have done a remarkable job, as shifting narratives and lower volatility induce risk-taking in shorter time horizons. CTAs, meanwhile, are having a dreadful time (see SG CTA index below), as the narrative carousel is chopping up their performance. As we are in this regime, I would envisage momentum trades to be more challenging compared to trend reversals.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

If you are interested in exploring Paper Alfa’s full package, why not go for a 7-day trial?

Let’s now read some of Macro D’s latest thoughts on the US, China, Europe and the potential policy dilemma of the BoJ before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

As its a bank holiday / US holiday on Monday, Attack the Week will be published on Monday evening / Tuesday morning.

Have a blessed weekend, everyone!