Friday Chart Book

Fed RMP / Cyclical Break-out? / Central Bank Watch / Full 250+ Chart Book

The FOMC wasn’t what people feared it would be. The expectation of a hawkish cut and possibly more dissenters, which would cloud any further path towards policy easing, was the prevailing narrative entering this week. This was accelerated, especially as bonds sold off and global front-end rates, even in Europe, were under pressure.

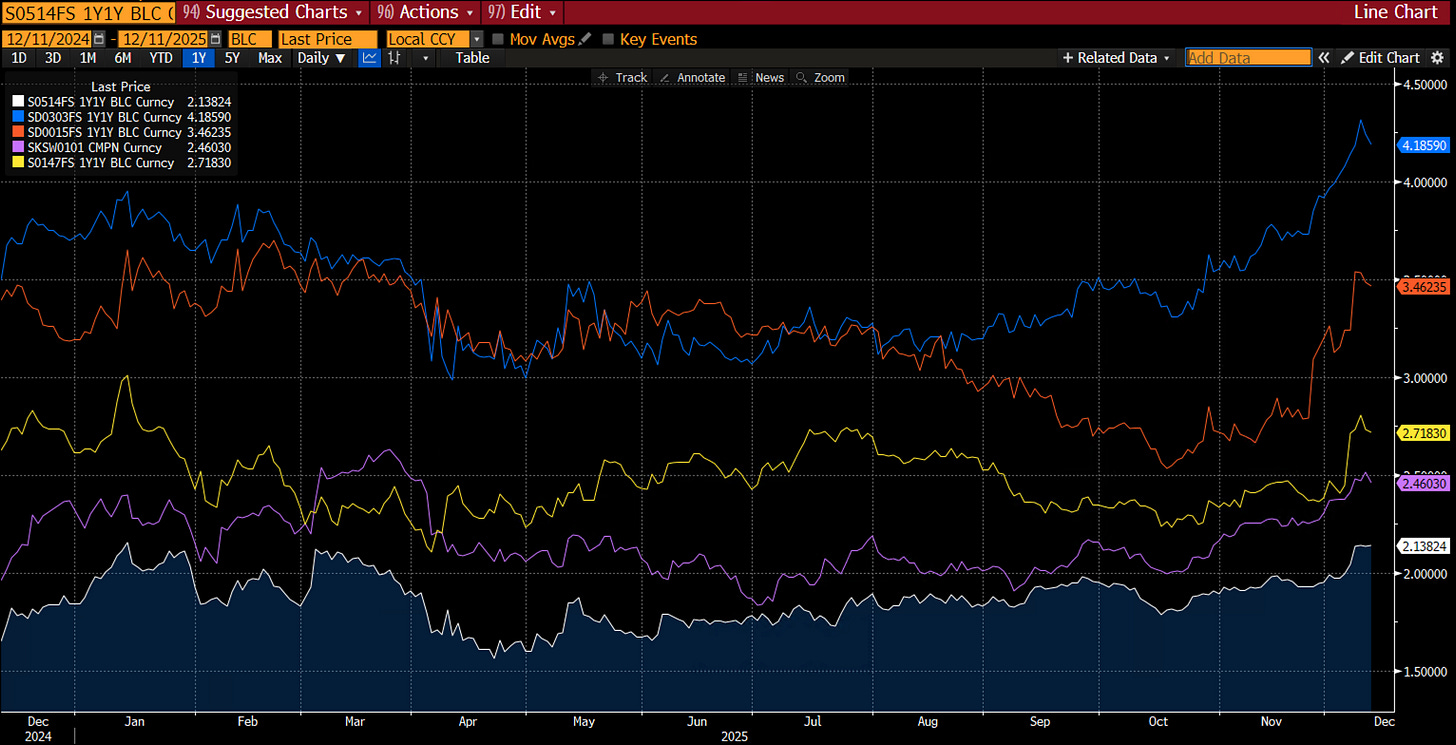

The chart below shows 1y1y forward rates in Europe, Australia, Sweden, Canada and New Zealand. Markets signalled that their easing cycles have ended and started pricing in hikes.

The equivalent USD 1y1y swap, meanwhile, has seen upward pressure since the end of November but has not experienced the severity of some of the market moves above. Much of the relative outperformance is due to the upcoming changes and the leadership change at the helm of the FOMC.

Powell sounded very dovish versus expectations and even surprised many by announcing an RMP (Reserve Management Purchases). According to their statement, the New York Fed’s trading desk plans to expand Treasury bill purchases—about USD 40 billion starting December 12—to keep reserves ample as demand for Fed liabilities increases seasonally. These RMPs, focused on T-bills and short Treasuries (≤3 years), will offset temporary liquidity drains such as tax payments. The pace will stay elevated into April, then slow as seasonal pressures fade, with amounts adjusted to market conditions.

Now, I know how this sounds to you, as I’m sure a certain two-letter word comes to mind. No, it’s not BS. I’m not in the game of dissecting whether this is QE or not. To me, the Fed reduced reserves through QT and is now in a position where front-end rates indicate reserves have reached their limit. Not too long ago (in 2019), we faced a similar “repo crisis”, which then resulted in the introduction of the standing repo facility (SRF) to create a permanent backstop for money markets. In essence, the SRF acts as a “ceiling” on short-term rates — complementing the overnight reverse repo facility (ON RRP), which serves as a floor—helping the Fed maintain stable control over short-term money market conditions. As always, read Conks and his excellent, in-depth analysis of anything related to financial plumbing.

Fed Funds vs. general collateral rate below, showing recent spikes that have sparked the Fed’s intervention, especially as we approach year-end.

The market loved the announcement and the dovish tilt naturally. The RMP was greeted with a USD sell-off, and bonds rallied and curves bull-steepened. Commodities loved the “debasement” script and launched. Equities equally applauded the announcement until Oracle party-pooped the celebrations. Thursday saw a continuum of those moves, aside from ES and NQ (at the time of writing) still featuring red on my Bloomberg screen, while the Dow and Russell are up more than 1%. That’s one hell of a rotation, with the Russell breaking out to new ATHs. Crypto, however, doesn’t seem to have received the memo.

Cyclicals vs. Defensives have also broken out to new highs, in a straight-line move. This typically signals healthy returns ahead over the coming months and quarters. To me, it also suggests the US economy is performing better than many people realise.

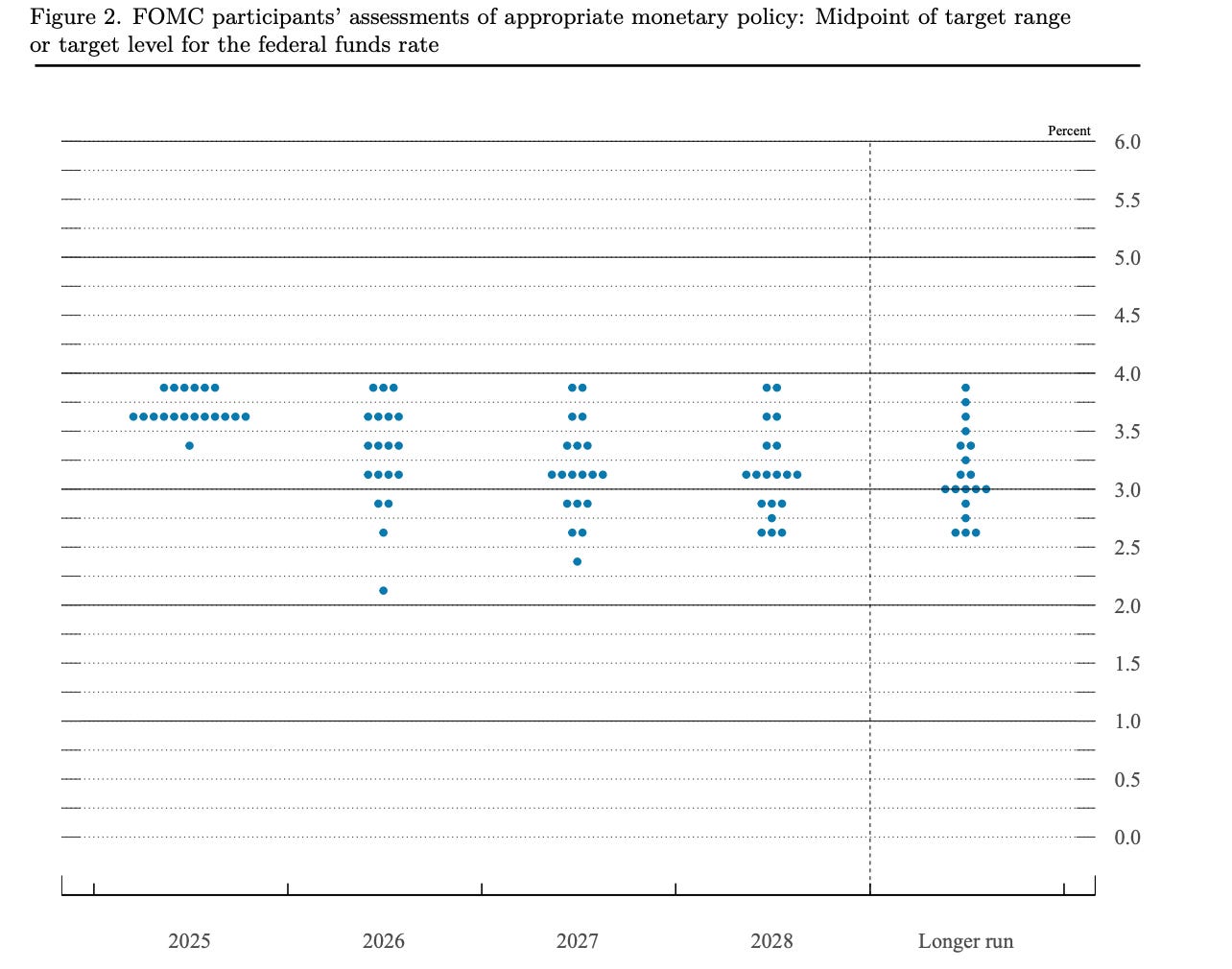

Yet, the committee still sees room to cut rates. As Powell noted, they aren’t considering hikes. As shown in the chart below, this is indeed the case and probably a fair assessment for 2026. For 2027 and 2028, however, I think those dots will evolve into something very different.

There are many moving parts in macro that it’s hard to keep an eye on them all. For that reason, I have my momentum and reversal models running and informing me daily and intraday which setups and signals are being triggered. There is much more to the offering, so why not join the pack and judge for yourself?

A reminder that you can now also use my trading models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read some of my friend Macro D’s detailed thoughts on the FOMC, RBA, BoC, SNB and more before we go through the entire chart book. Macro D will also be publishing a 3-part series of his visions for 2026, which will be an excellent year-end reading.

Have a blessed weekend, and a strong finish to the year!